Review of Southwest Rapid Rewards Business Credit Cards

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

Business travel is an essential part of many industries, and companies are increasingly seeking ways to maximize their travel budgets through rewards programs. With rising airfare costs and an increasing number of small businesses looking for financial flexibility, business travel credit cards have become an indispensable tool for entrepreneurs. Southwest Airlines offers two primary business credit cards, the Southwest Rapid Rewards Premier Business Credit Card and the Southwest Rapid Rewards Performance Business Credit Card, which cater to different needs but share the goal of maximizing travel rewards for business owners.

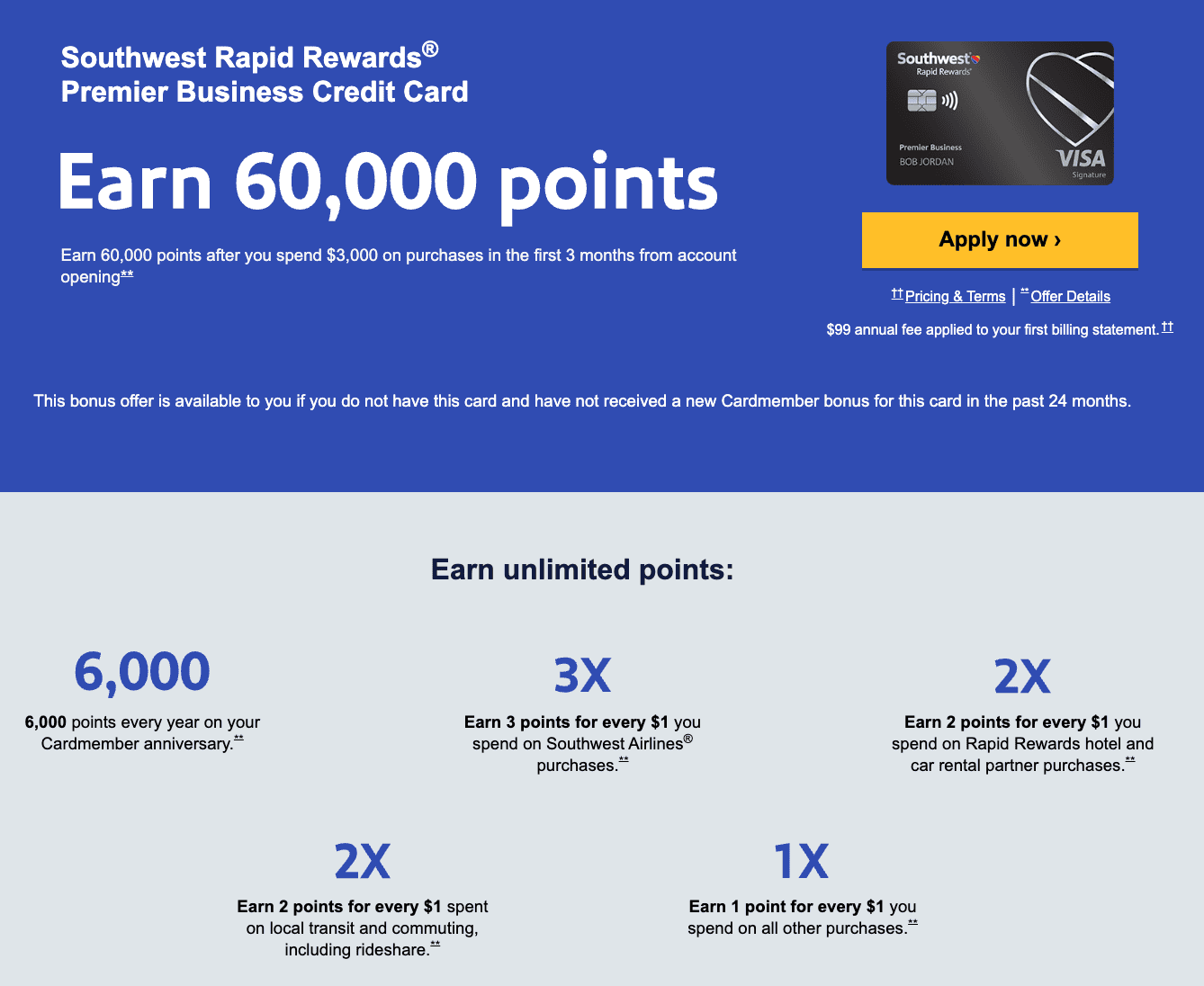

Southwest Rapid Rewards Premier Business Credit Card

Key Features and Benefits:

- Welcome Offer: Earn 60,000 points after spending $3,000 on purchases within the first three months.

- Earning Rates: 3 points per $1 spent on Southwest purchases; 2 points per $1 on Rapid Rewards hotel and car rental partner purchases; 1 point per $1 on all other purchases.

- Annual Perks: Cardholders receive 6,000 bonus points every year on the cardmember anniversary.

- Travel Benefits: Includes two EarlyBird Check-Ins per year, no foreign transaction fees, and the potential to earn the Southwest Companion Pass.

Fees:

- Annual Fee: $99.

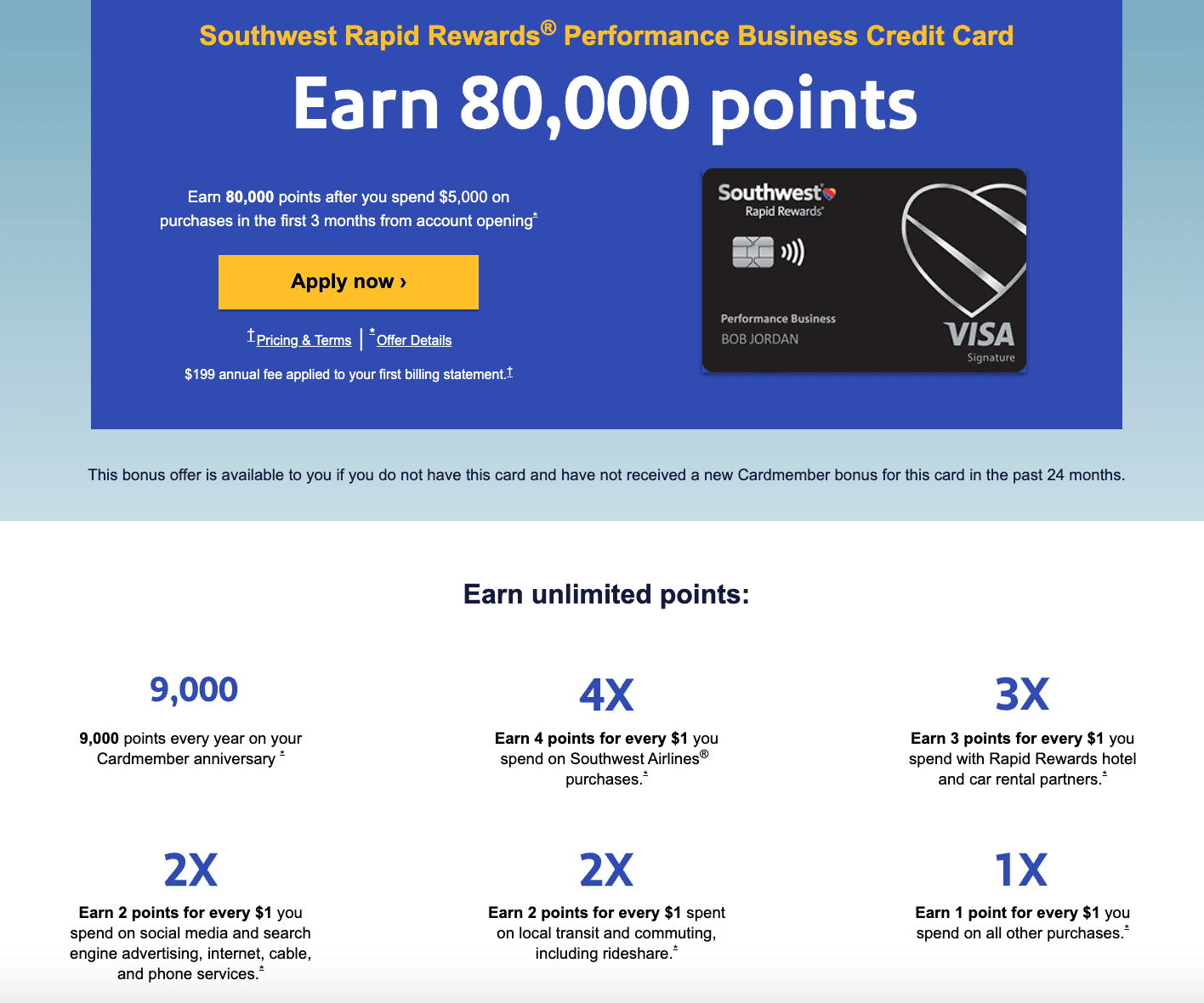

Southwest Rapid Rewards Performance Business Credit Card

Key Features and Benefits:

- Welcome Offer: Earn 80,000 points after spending $5,000 on purchases within the first three months.

- Earning Rates: 4 points per $1 spent on Southwest purchases; 3 points per $1 on Rapid Rewards hotel and car rental partner purchases; 2 points per $1 on social media and search engine advertising, internet, cable, and phone services; 1 point per $1 on all other purchases.

- Annual Perks: Cardholders receive 9,000 bonus points every year on the cardmember anniversary.

- Travel Benefits: Includes four upgraded boardings per year, in-flight Wi-Fi credits, and no foreign transaction fees.

Fees:

- Annual Fee: $199.

How to Qualify for Southwest Business Credit Cards

To qualify for either of the Southwest business credit cards, applicants typically need to demonstrate good to excellent credit. This is in line with the general Southwest business credit card requirements. Potential cardholders should also ensure their business expenses align well with the earning structures of the cards to maximize benefits.

| Feature/Benefit | Premier Business Card | Performance Business Card |

|---|---|---|

| Annual Fee | $99 | $199 |

| Welcome Offer (Limited time until September 16, 2024) | 60,000 points after spending $3,000 in the first 3 month + an additional 60,000 points when you spend $15,000 in 9 months | 80,000 points after spending $5,000 in the first 3 month + an additional 40,000 points when you spend $15,000 in 9 months |

| Points on Southwest Purchases | 3X | 4X |

| Points on Southwest and Rapid Rewards hotel and car rental partner purchases | 2X | 3X |

| Points on social media and search engine advertising, internet, cable and phone services. | None | 2X |

| Points on local transit and commuting, including rideshare | 2X | 2X |

| Points on all other purchases | 1X | 1X |

| Anniversary Points | 6,000 | 9,000 |

| EarlyBird Check-Ins | 2 per year | None |

| Companion Pass qualifying points every year | 10,000 | 10,000 |

| Inflight purchase discount | 25% | None |

| $500 fee credit for points transfers per year | Yes | Yes |

| Employee cards (earn points on employee expenses) | Yes | Yes |

| Foreign Transaction Fees | None | None |

| Up to 365 Inflight Internet credits per year | None | Yes |

| Global Entry or TSA Pre✓® application fee credit up to $100 | None | Yes |

| 4 Upgraded Boardings per yearwhen available | None | Yes |

| Earn 1,500 TQP on your way to A-List status for every $5,000 you spend | Yes | Yes |

| Bags fly free | Yes | Yes |

What Is Earlybird Check-in On Southwest?

EarlyBird Check-In is a service offered by Southwest Airlines to enhance the passenger experience when boarding an airplane. With EarlyBird Check-In, you receive automatic check-in 36 hours before departure. This is 12 hours before the standard 24-hour check-in window for other passengers opens. The main benefits of EarlyBird Check-In include

- The best seat in the cabin: By checking in early, you are likely to get a better seat in the cabin. This means you’ll have earlier access to overhead bins and a better selection of seats, as Southwest doesn’t have assigned seats.

- Earlier access to the plane: With a better seat, you’ll be able to get on board faster, which is especially beneficial on crowded flights or during peak travel seasons.

- Convenience: Eliminates the need to remember to check in exactly 24 hours in advance, providing peace of mind, especially for travelers who may not have access to the internet or do not want to manage the check-in process themselves.

EarlyBird Check-In can be especially useful for those who do not have elite status on Southwest flights, which would provide similar boarding benefits. It is available for a fee, which varies depending on the route and the popularity of EarlyBird Check-In among passengers on the flight.

Privileges and Hidden Benefits for Travelers

Beyond earning rewards, Southwest business credit cards offer valuable perks that enhance the travel experience.

No Foreign Transaction Fees Both Southwest business credit cards waive foreign transaction fees, making them ideal for international business travel. This means you can make purchases abroad without worrying about extra charges, which can add up significantly over time.

Maximizing In-Flight Wi-Fi Credits The Southwest Rapid Rewards Performance Business Credit Card includes up to 365 in-flight Wi-Fi credits per year—essentially offering free Wi-Fi on every Southwest flight. Frequent flyers can take advantage of this perk to stay productive in the air.

Lesser-Known Benefits: Purchase Protection & Extended Warranty

- Purchase Protection: Covers eligible new purchases against damage or theft for up to 120 days.

- Extended Warranty: Adds an additional year to manufacturer warranties on eligible purchases, making this card valuable beyond just travel perks.

Application and Approval Process

Understanding the eligibility criteria and application process can improve your chances of approval for a Southwest business credit card.

Who Qualifies as a Business?

Chase, the issuer of Southwest business credit cards, considers various business structures, including sole proprietors, LLCs, corporations, and even freelancers. If you generate income from any side business, such as consulting, reselling goods, or freelance work, you may qualify as a business owner.

How to Improve Your Chances of Approval

- Credit Score: A good to excellent credit score (typically 700+) significantly increases approval odds.

- Income Reporting: Even if you have a small business or side hustle, accurately reporting revenue and expenses can strengthen your application.

- Existing Chase Relationship: Having a personal banking or credit relationship with Chase can sometimes improve your chances of getting approved.

FAQ: Common Approval Concerns

- Does the 5/24 rule apply? Yes, Chase’s 5/24 rule (which limits approvals if you have opened five or more credit cards in the past 24 months) applies to these business credit cards.

- Can I get both Southwest business cards? Yes, but Chase may require a strong business revenue history and credit profile.

- Where can I apply? You can apply directly through the official Chase application page to maximize your chances of approval.

Target Business Profile for Southwest Rapid Rewards Business Credit Cards

Premier Business Credit Card

The Southwest Rapid Rewards Premier Business Credit Card is best suited for small to mid-sized businesses whose employees frequently travel with Southwest. This card is ideal for those looking to balance a moderate annual fee with valuable travel perks like annual bonus points and anniversary points, which offset the cost of travel expenses over time.

Performance Business Credit Card

The Southwest Rapid Rewards Performance Business Credit Card targets larger businesses or those with higher travel and operational expenses, especially in digital marketing and telecommunications, given its bonus categories. This card is more suitable for businesses that will leverage the higher rewards earning rate on Southwest purchases and the added benefits like upgraded boardings and in-flight WiFi credits, justifying the higher annual fee.

Break-Even Analysis: Flights Per Year Needed

To determine how many flights are necessary for each card to pay off, we’ll consider the value of the points earned and the annual benefits provided by each card. The break-even point is reached when the value of these rewards equals or exceeds the annual fee. Here, we’ll use a conservative estimate that Southwest points are worth about 1.5 cents each (according to NerdWallet).

Notice: This analysis and subsequent comparisons focus on the standard welcome bonus offer, without additional promotional offers that may be

Premier Business Credit Card

- Annual Fee: $99

- Anniversary Bonus: 6,000 points

- Value: 6,000 points x $0.015/point = $90

- Rewards from Spending:

- Assuming most expenses are on Southwest flights, earning 3X points:

- To cover the remaining $9 ($99 – $90), you’d need to spend $300 on Southwest flights (earning 900 points, worth $13.50).

- Assuming most expenses are on Southwest flights, earning 3X points:

Performance Business Credit Card

- Annual Fee: $199

- Anniversary Bonus: 9,000 points

- Value: 9,000 points x $0.015/point = $135

- Rewards from Spending:

- Assuming most expenses are on Southwest flights, earning 4X points:

- To cover the remaining $64 ($199 – $135), you’d need to spend $1,600 on Southwest flights (earning 6,400 points, worth $96).

- Assuming most expenses are on Southwest flights, earning 4X points:

For the Premier Business Credit Card, even minimal travel (1-2 flights) could potentially offset the annual fee through the combination of the anniversary bonus and rewards on spending. For the Performance Business Credit Card, more frequent travel (possibly 4-6 flights) is needed to justify the higher annual fee, but for businesses with significant spending in the bonus categories, this card can offer exceptional value much more quickly.

These cards are both excellent choices for businesses that regularly utilize Southwest for travel, with the selection depending on the scale of travel and type of expenditures the business incurs.

Final Thoughts: Is a Southwest Business Credit Card Right for You?

For businesses that frequently fly Southwest, these credit cards offer compelling value. The Southwest Rapid Rewards Premier Business Credit Card is best for moderate travelers looking for a lower annual fee, while the Southwest Rapid Rewards Performance Business Credit Card is ideal for high-frequency travelers who will benefit from Wi-Fi credits and enhanced perks.

By choosing the right card and strategically using its benefits, business owners can optimize their travel experience while earning valuable rewards. To explore your options and apply, visit the official Chase application page.