Maximizing Travel with Hilton Honors Amex Cards + Limited Time Offers August 13, 2025

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

Offer Ends: Expired

The Hilton Honors American Express series of credit cards represents a strategic partnership between Hilton Hotels and American Express. It is designed to reward loyal customers and frequent travelers with a range of benefits that enhance their travel experiences. These cards come with varying levels of rewards and perks, tailored to suit different needs, from casual tourists to business travelers and luxury seekers. Understanding the unique features and benefits of each card can help you maximize your travel rewards and make informed decisions about which card best suits your lifestyle and travel habits.

Overview of Hilton Honors American Express Credit Cards

Hilton and American Express offer a variety of credit cards that cater to different types of travelers. Each card comes with specific benefits designed to enhance the Hilton hotel experience, ranging from basic points earning to luxurious travel perks. All cards in the lineup allow cardholders to earn Hilton Honors points on everyday purchases, which can be redeemed for hotel stays, shopping, dining, and more.

Detailed Comparison of Hilton Credit Cards

Hilton Honors American Express Card

The entry-level option, Hilton Honors American Express Card is ideal for those new to travel rewards. It offers generous point earnings on Hilton stays and everyday purchases with no annual fee. Benefits include complimentary Hilton Honors Silver status and access to standard Hilton perks such as late check-out.

Hilton Honors American Express Surpass Card

A step up from the entry-level card, the Hilton Honors American Express Surpass Card offers higher point earnings and complimentary Gold status, which includes room upgrades and breakfast at Hilton hotels. The card has a moderate annual fee but offers substantial value for frequent travelers.

Hilton Honors American Express Aspire Card

The premium card in the lineup, Hilton Honors American Express Aspire Card, offers top-tier benefits, including complimentary Diamond status, annual free night rewards, and substantial credits for airline incidental fees and Hilton resort expenses. Its higher annual fee is justified by the luxury benefits and extensive travel protections it offers.

Hilton Honors American Express Business Card

Tailored for business owners who travel, Hilton Honors American Express Business Card mirrors many benefits of the Surpass but adds bonus categories tailored for business expenses. It offers travel protections and points on common business purchases, making it a valuable tool for managing business travel costs.

Comparison of Hilton Credit Cards

| aa | Hilton Honors Card | Hilton Honors Surpass | Hilton Honors Aspire | Hilton Honors Business |

|---|---|---|---|---|

| Annual Fee | No | $0 annual fee for the first year, then $150 (through August 13, 2025) | $550 | $195 |

| Sign up bonus | ||||

| Sign up bonus (Limit time offer through August 13, 2025) | Earn 100,000 Bonus Points and a $100 Statement Credit (after spending $2,000 in the first 6 months) | Earn 130,000 Points (after spending $3,000 in the first 6 months) | Earn 175,000 Points after spending $6,000 in the first 6 months | Earn 150,000 Points after spending $8,000 in the first 6 months + 25,000 Bonus Points (after additional spending $2,000 in the first 6 months) |

| Earn Hilton Honors Points | 7X Points on eligible Hilton purchases; 5X Points at U.S. restaurants, U.S. gas stations, and U.S. supermarkets 3X Points on all other eligible purchases | 12X Points on eligible Hilton purchases; 6X Points at U.S. restaurants, U.S. gas stations, and U.S. supermarkets 4X Points on U.S. online retail purchases 3X Points on all other eligible purchases | 14X Points on eligible Hilton purchases; 7X Points on flights booked directly with airlines or Amex Travel, on car rentals booked directly from select companies, and at U.S. restaurants; 3X Points on all other eligible purchases | 12X Points on eligible Hilton purchases 5X Points on other purchases made using your Card on the first $100,000 in purchases each calendar year; 3X Points thereafter |

| Free Night Reward | 1 Free Night Reward each year after spending $15,000 in purchases | 1 Free Night Reward each year + 1 Free Night Reward from Hilton after you spend $30,000 in purchases + 1 Free Night Reward from Hilton after you spend $60,000 in purchases | ||

| Complimentary elite status of Hilton Honors | Silver status + Gold status (after spending $20,000 on purchases) | Gold status | Diamond status | Gold status + Diamond status (after spending $40,000 on purchases) |

| Foreign transaction fees | No | No | No | No |

| Statement credits | Get up to $50 in statement credits each quarter for purchases made directly with a property in the Hilton portfolio (up to $200 per year); Up to $50 per quarter, up to a total of $200 per year, for airline purchases made directly with the airline or through AmexTravel.com | Get up to $200 in statement credits semi-annually for eligible purchases made directly with participating Hilton Resorts (up to $400 per year); Up to $50 per quarter, up to a total of $200 per year, for airline purchases made directly with the airline or through AmexTravel.com | Get up to $240 back each year on eligible Hilton purchases, with up to $60 in statement credits per quarter | |

| Other benefits | Enjoy complimentary National Car Rental Emerald Club Executive status. Enrollment in the complimentary Emerald Club program is required | Receive up to $189 in statement credits per calendar year after you sign up and pay for a CLEAR Plus Membership (subject to auto-renewal); Enjoy complimentary National Car Rental Emerald Club Executive status. Enrollment in the complimentary Emerald Club program is required | Enjoy complimentary National Car Rental Emerald Club Executive status, including perks like Executive Area Access (for full-size reservations and above) in the USA and Canada |

Pre-Approval Process for Hilton Credit Cards

Prospective cardholders can check their pre-approval status online, which helps them apply for the card that best suits their credit profile without impacting their credit score.

Access your account and go to the “Check for Pre-qualified Credit Card Offers” section. Enter your information there, and you will be able to see any preapproved credit cards that are available to you.

User Experience and Accessibility

Hilton Honors Credit Card Login and Account Management

Managing your Hilton Honors credit card account online is straightforward. Cardholders can access their account to check their points balance, redeem points, and review transaction history. American Express also provides a mobile app that makes it easy to manage your account on the go, ensuring you can always keep tabs on your rewards and card benefits.

Customer Service

American Express is renowned for its high standard of customer service. Hilton Honors cardholders can benefit from 24/7 customer support, providing assistance with everything from billing inquiries to emergency card replacement. The customer service team is also helpful in maximizing benefits and navigating reward options.

Stay Up-To-Date With the Latest Offers

It’s crucial for potential cardholders to stay informed about the latest offers for each credit card, as they can change based on various promotional periods and availability. These offers are often seasonal or tied to specific marketing goals, and they can vary significantly from one card issuer to another.

- Check the Card Issuer’s Website: Regularly visiting the credit card issuer’s website is the most direct way to stay updated on the current promotions.

- Sign up for Notifications: Many issuers allow you to sign up for promotional emails or alerts that notify you of new deals, ensuring you never miss out on an advantageous offer.

- Comparison Sites: Utilizing credit card comparison websites can also help in quickly viewing promotions across multiple cards and issuers, making it easier to find the best deal available at any given time.

By taking advantage of these sign-up offers and promotions, new cardholders can maximize the benefits received from their credit cards right from the outset.

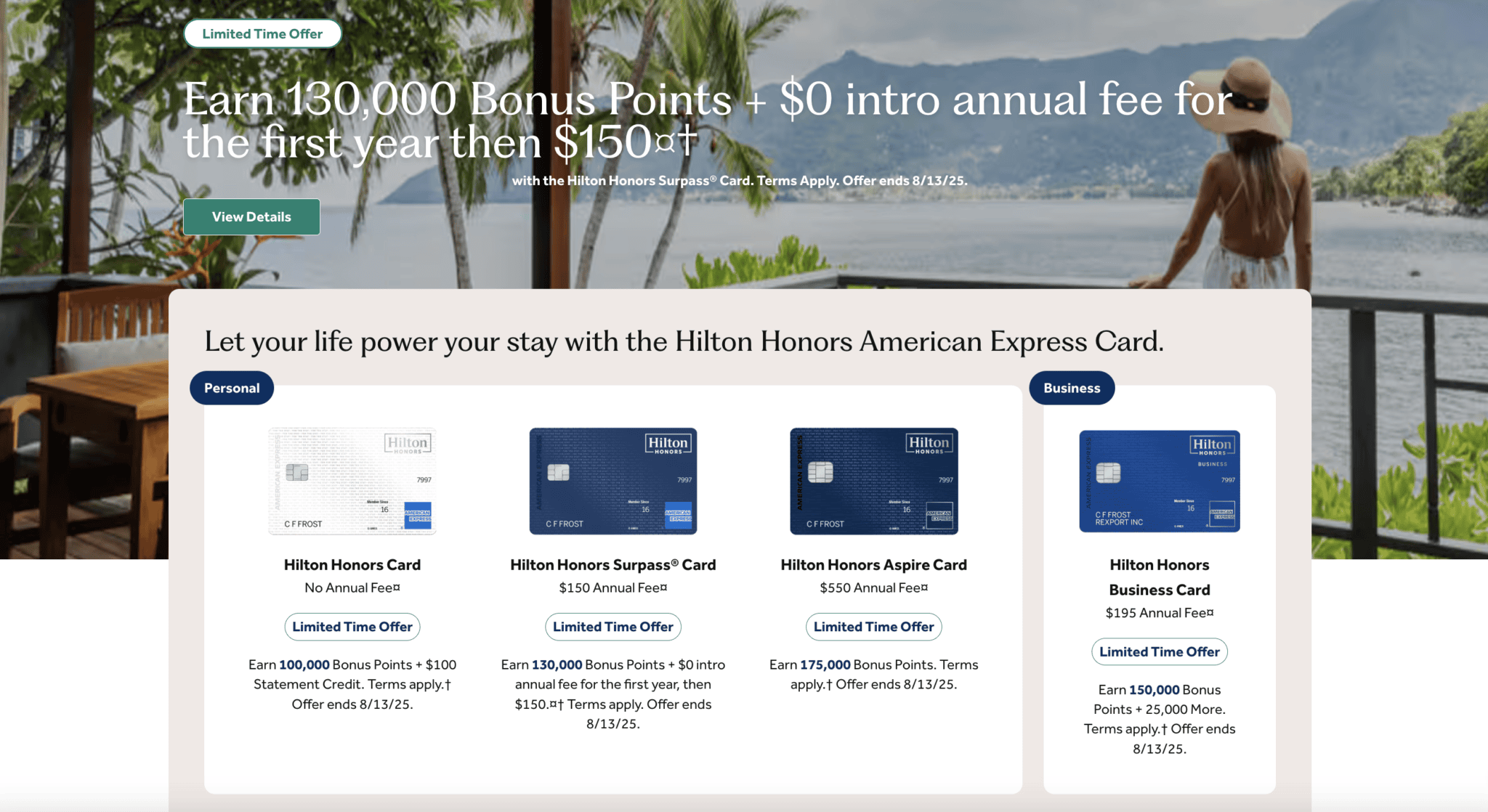

Current Promotional Hilton Honors Limited Time Amex Offers (valid until 08.13.25)

Hilton and Amex have launched a limited-time offer for co-branded Honors cards until August 13, 2025.

These offers for new Hilton cardholders are not bad, but when compared to previous offers that also offered free night certificates, these offers are less significant, especially considering the recent devaluation of Hilton points.

| Details | Hilton Honors Card | Hilton Honors Surpass | Hilton Honors Aspire | Hilton Honors Business |

|---|---|---|---|---|

| Annual Fee | No | $0 annual fee for the first year, then $150 | $550 | $195 |

| Limit time sign-up bonus offer through August 13, 2025 | Earn 100,000 Bonus Points and a $100 Statement Credit (after spending $2,000 in the first 6 months) | Earn 130,000 Points (after spending $3,000 in the first 6 months) | Earn 175,000 Points after spending $6,000 in the first 6 months | Earn 150,000 Points after spending $8,000 in the first 6 months + 25,000 Bonus Points (after additional spending $2,000 in the first 6 months) |

Is the Hilton Honors Credit Card Worth It?

Determining whether a Hilton Honors credit card is worth it largely depends on your travel habits and preferences. For frequent travelers who often stay at Hilton properties, the higher-tier cards like the Hilton Honors Aspire Card offer exceptional value that easily offsets the annual fee through room upgrades, free breakfasts, and other perks. For more occasional travelers, the no-annual-fee Hilton Honors American Express Card may be more appropriate, still offering an excellent return on spend without the commitment of a fee.

Conclusion: What Is the Best Hilton Credit Card

The Hilton Honors credit card lineup from American Express has something for every type of traveler – from the once-a-year vacationer to the full-time traveler. These cards offer some of the best perks in the hotel credit card business, thanks to generous point earnings, substantial travel perks, and solid backing by American Express customer service. Choose wisely among cards based on your travel frequency and likes because they will contribute significantly to improving your travel experience while at the same time benefiting from being a loyal customer to Hilton.

So, whether you want a no-annual-fee card or a card that offers access to luxury travel benefits, there is likely an option from the Hilton Honors American Express series for you. As you consider your choices, weigh the benefits against the costs and consider how you travel—doing so will help you select the perfect card that not only meets your expectations but also exceeds them, making every journey more rewarding.