Updated Overview of United Business Credit Cards for 2026

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

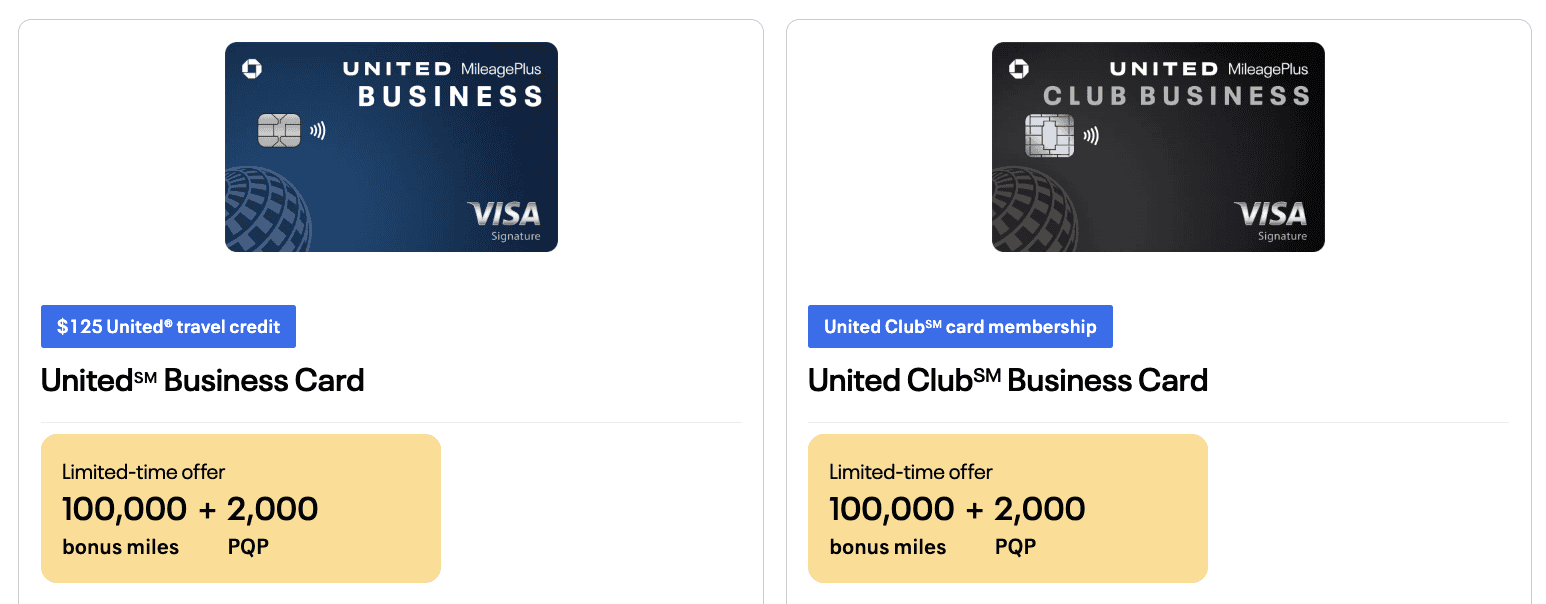

As a small-business owner who values smooth travel, United’s co-branded business cards from Chase and United Airlines can be very compelling — largely because the newest versions layer in meaningful statement credits and faster paths to Premier status. Below you’ll find what changed, what each perk really does for you, and who each card fits best, based on today’s terms.

Is the United Business Card Right for You?

The Chase United Business Card is particularly advantageous for small business entrepreneurs who frequently fly with United Airlines. The annual fee is $150, and the welcome offer is currently 100,000 bonus miles + 2,000 PQP after $5,000 in 3 months (many targeted paths also add +10,000 miles when you add an employee card and make a first purchase). This is a limited offer that ends on 5/20/26. For instance, if your business requires you or your employees to check baggage at least four times a year, the savings from the free first checked bag benefit alone can cover the annual fee.

Moreover, the card provides two one-time passes to United Club lounges after account opening and on each anniversary, along with a 25% discount on United inflight purchases, and a surprisingly deep roster of annual partner credits (rideshare, Instacart, Fee Credit for FareLock, United Hotels, Avis/Budget, JSX, CLEAR, Restaurants United, and more) that can easily exceed the annual fee if you’ll actually use them. These benefits are invaluable, not only for frequent fliers but also for those who fly occasionally.

The current welcome offer & annual fee

- AF: $150.

- Offer (ends 5/20/26): 100,000 miles + 2,000 PQP after $5,000 in 3 months (and many targeted journeys add +10,000 miles for adding an employee card and first purchase).

Moreover, Chase’s unpublicized 5/24 rule might impact your application. If you’ve activated five or more credit cards within the previous 24 months, your approval might be on the line.

Key Features and United Business Credit Card Benefits

Designed with small business proprietors in mind, the United Business Card comes packed with exclusive perks, especially if you don’t already have elite status with United or the Star Alliance network. Some highlighted features include:

Streamlined Travel with United (Free First Checked Bag and Priority Boarding)

When flying United, both you and a travel buddy can check your first bags for free, provided you book with your United Business Card. And with priority boarding, evade the hassles of basic economy.

United Club Access

The business card includes two (2) one-time passes to the United Club each year.

Regardless of your travel frequency, access to United Club lounges can be a lifesaver, especially during flight disruptions. A list of all United Club locations and United Polaris lounges can be found here.

Additional incentives of the United Business Card

- Over $600 in potential annual partner credits – United lists rideshare, Instacart, Restaurants United, CLEAR, United Hotels, Avis/Budget, JSX, FareLock, and more. Use even a few and you’re ahead of the fee. Exact categories/amounts are posted on United’s benefit hub.

- PQP from spend (meaningful for status) – Earn 1 PQP per $20 in purchases, up to 4,000 PQP per calendar year—on top of the 2,000 PQP from the welcome offer. This can materially bridge the gap to Premier Silver/Gold/Platinum (and even 1K when paired with flying).

- “Better Together” 5,000-mile anniversary bonus – Hold this card and a personal United card? You’ll get +5,000 miles each anniversary.

- 2 Economy Plus® seat upgrades after $25,000 spend in a calendar year (continental U.S.). Handy for taller travelers.

- Earning categories – 2x miles on United purchases, restaurants, gas stations, local transit/commuting, and office supply stores; 1x all else. That mix maps well to typical small-business spend.

- Award-ticket upgrades for elites – If you (or staff) hold Premier status, United now allows complimentary Premier upgrades even on award tickets for United credit cardmembers — a meaningful comfort boost on work trips booked with miles.

- Expanded award availability for primary cardmembers on United-operated flights can make last-minute award bookings actually bookable.

- No foreign transaction fees and free employee cards with custom limits.

Mileage Earnings and Redemption

For every dollar spent on various purchases like United services, gas stations, and restaurants, including eligible delivery services, at gas stations, at office supply stores, and on local transit and commuting, including ride share services, taxicabs, train tickets, tolls and mass transit you receive 2 United miles. And for all other eligible transactions, you earn 1 mile per dollar.

When it’s time to redeem, using your miles for airline tickets usually yields the best value.

When You Want the Works: United Club℠ Business Card

If you or your team are always at the airport, the United Club℠ Business Card is a solid choice. You’re basically paying for a United Club membership, which saves you time and makes your travels comfier. Including full United Club membership, providing unlimited access to United Club locations and participating Star Alliance affiliated lounges worldwide Plus, you get PQP points faster when you spend. The sign-up offer changes, but it’s often around 80,000 miles + 2,000 PQP after you spend $5,000 in 3 months. Be sure to check the current offer. The yearly fee is $695.

What makes it special:

- You get a full United Club membership (not just passes) and Premier Access (priority check-in, security, boarding, and baggage). It’s great if you’re often at big airports or have travel issues.

- You earn PQP points quicker: 1 PQP for every $15 you spend, up to 28,000 PQP a year. That’s enough to get you to Premier 1K status just by spending and flying. This is the best PQP earning rate for United cards for both personal and business use.

- You can also stack credits from partners like Instacart (up to $240), JSX (up to $200), FareLock (up to $50), Avis/Budget through cars.united.com (up to $100), and more. If you use these, they make the $695 fee more manageable.

- You get two global Economy Plus upgrades after spending $40,000 each year.

- The card also offers 25% back on in-flight purchases, no foreign transaction fees, free employee cards, and the cardmember can also get complimentary Premier upgrades on award tickets if you have status.

Who is it for? Business owners or teams who travel a lot, will use the United Club weekly, and want to earn PQP points fast. If you’ll visit the lounge often, value the PQP points, and can use the credits, it’s worth it. But if you won’t use the lounge much, the regular United Business Card is a better deal.

Comparison and Conclusion

Comparing United’s business credit cards, it’s clear that each card caters to different business travel needs and preferences. The United Business Card offers a balanced mix of benefits for a moderate annual fee, making it an excellent choice for small business entrepreneurs who fly United occasionally to frequently. Meanwhile, the United Club Business Card, with its comprehensive lounge access and premium benefits, is ideal for those who travel extensively and value comfort and convenience.

For small business individuals who frequently fly United, the suite of perks offered by United business credit cards, especially the Chase United Business Card, delivers substantial value. With benefits ranging from free checked bags and priority boarding to exceptional travel protections, choosing a United business credit card can significantly enhance your travel experience while providing valuable rewards for your business spending.

| Feature | UnitedSM Business Card | United ClubSM Business Card |

|---|---|---|

| Annual Fee | $150 | $695 |

| Welcome Bonus (public) | 100,000 miles + 2,000 PQP after $5,000 spend in 3 months | 100,000 miles + 2,000 PQP after $5,000 spend in 3 months |

| Earning Rates | 2× miles on eligible United purchases; 2× on dining (incl. delivery), gas stations, office-supply stores, local transit & commuting; 1× all other purchases | 2× miles on airline tickets and other eligible purchases made from United; 1.5× on all other purchases |

| Free Checked Bags | 1st checked bag free for primary cardmember + 1 companion on the same reservation (United/United Express) | 1st & 2nd checked bags free for primary cardmember + 1 companion on the same reservation (United/United Express) |

| Airport Perks | Priority boarding | Premier Access® (priority check-in, security, boarding & baggage handling) |

| Lounge Access | Two United Club one-time passes per year | United Club membership included |

| Annual Credits | $125 United TravelBank (after five United purchases of ≥$100 each); up to $100 United Hotels (prepaid); up to $100 rideshare; up to $50 Avis/Budget; up to $120 Instacart; up to $100 JSX; up to $25 FareLock | Up to $150 rideshare; up to $100 Avis/Budget; up to $240 Instacart; up to $200 JSX; up to $50 FareLock; “Renowned Hotels and Resorts” statement credits |

| Inflight/Club Savings | 25% back on United inflight purchases | 25% back on United inflight purchases and Club premium drinks |

| Global Entry / TSA PreCheck® Credit | Not listed | Not listed |

| PQP From Card Spend | 1 PQP per $20 spent; up to 4,000 PQP per calendar year | 1 PQP per $15 spent; up to 28,000 PQP per calendar year |

| Foreign Transaction Fees | None | None |