United Miles Transfer Partners — How to Move Points In (and Out)

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

Want more from your MileagePlus balance? United Miles Transfer Partners make it possible. From United Airlines credit card transfer partners like Chase and Bilt to hotel programs and a broad United Airlines partnerships list (international) through Star Alliance and beyond, you have multiple ways to move value where you need it.

This guide explains every practical path to transfer to and from United MileagePlus—which programs work, how ratios and timing play out, and smart strategies for beginners and pros. If you’ve ever wondered when to use bank points, when to tap hotel points, or how partner links affect redemptions, you’re in the right place.

Understanding United’s Partnerships vs. Transfer Partners

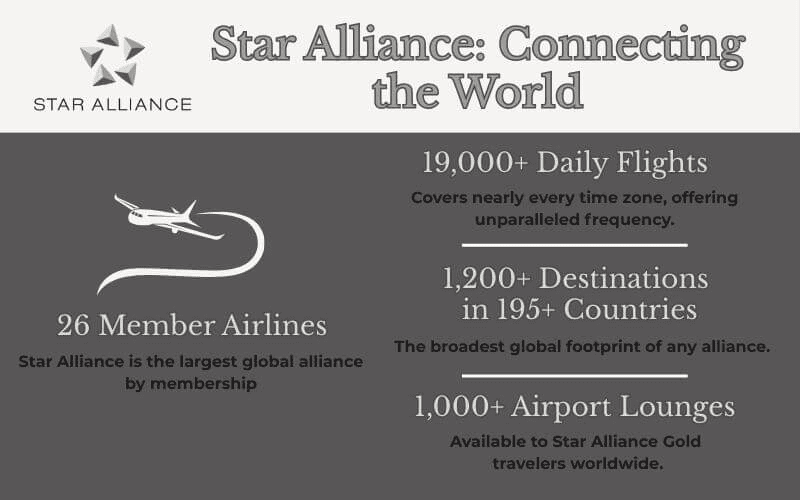

United is a founding member of the Star Alliance, which means it has over 40 international airline partners where you can earn and redeem MileagePlus miles. This includes 25 Star Alliance member airlines (like Lufthansa, ANA, Air Canada, etc.) and additional global partners such as Aer Lingus, Emirates, Hawaiian Airlines and more.

However, it’s important to distinguish between redeeming miles on partner flights and transferring miles between programs.

- Redeeming on partners: As a MileagePlus member, you can use your United miles to book award flights on any of these partner airlines (and earn miles when flying them). For example, you could redeem United miles for a Lufthansa or ANA flight. But this is not the same as moving miles into another airline’s loyalty account – your miles stay in your United account and are simply used to ticket a partner flight.

- Transferring miles between programs: This refers to converting points or miles from one loyalty program into United miles, or vice versa. These “transfer partner” relationships are much more limited. You generally cannot directly convert United miles into another airline’s miles (and vice versa). Instead, United’s transfer partnerships are mostly with bank rewards and hotel programs that allow point conversions.

United’s extensive airline partnerships make it easy to use your miles on flights worldwide, but when it comes to transferring miles in or out of United, you’ll mostly be dealing with credit card points and hotel points. Next, we’ll explore all the programs that let you transfer points to United MileagePlus – and the few options to transfer United miles out to other programs.

Transferring Points TO United MileagePlus

One of the best ways to boost your United miles balance is by transferring points from partner programs into your MileagePlus account. This can help top off your miles for an award or make use of points you’ve earned elsewhere. We’ll cover both credit card transfer partners and hotel/loyalty point transfers that convert into United miles.

Credit Card Transfer Partners for United MileagePlus

United MileagePlus is a popular transfer option for certain flexible bank-point programs. In fact, United has two major credit card rewards partners that allow one-to-one transfers of points into MileagePlus miles:

Chase Ultimate Rewards

If you hold Chase cards like the Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred, you can transfer Chase Ultimate Rewards points to United at a 1:1 ratio. For every 1,000 Chase points, you get 1,000 United miles. Transfers from Chase to United are usually instant, letting you quickly move points when you’re ready to book an award.

Many travelers accumulate Chase points for their flexibility – you can transfer to 14 different airline/hotel programs – and then convert to United miles when you find a great flight award.

Bilt Rewards

Bilt is an innovative U.S. loyalty program that lets you earn points on rent payments and other spending via the Bilt Mastercard. Bilt has partnered with United to allow 1:1 transfers to MileagePlus as well. This means 1,000 Bilt points = 1,000 United miles. Transfers require a minimum of 2,000 points and are done through the Bilt app. For renters who earn Bilt points, this is a valuable way to build your United balance without flying. (Bilt also partners with other airlines like American and Air Canada, but United gives Star Alliance coverage for your points.)

Chase Ultimate Rewards allows instant transfers of points to United MileagePlus at a 1:1 ratio. Simply select United as the transfer partner and enter your MileagePlus account details to convert your credit card points into miles.

Do other credit card programs transfer to United?

Hotel Loyalty Programs – Converting Points to United Miles

Many hotel programs allow you to convert hotel points into airline miles, including United MileagePlus. In general, these conversions tend to have worse ratios than credit card transfers, but they can be useful if you have excess hotel points or need to top off your United miles. Let’s look at United’s hotel point transfer partners:

Marriott Bonvoy

Marriott points transfer to United at a base 3:1 ratio, meaning 3,000 Marriott Bonvoy points become 1,000 United miles. Uniquely, thanks to a Marriott-United partnership (RewardsPlus), you get a 10,000-mile bonus for every 60,000 Marriott points transferred to United.

In practice, 60,000 Bonvoy points = 30,000 United miles (instead of 20k at a standard 3:1, this includes the special 10k bonus). This is a better bonus than Marriott offers with other airlines, making United one of the best Bonvoy transfer options.

Tip: You can initiate Marriott transfers on the Marriott website; transfers typically take ~2 days to post. Many travelers use Marriott points (earned via hotel stays or Marriott credit cards) to boost their United miles for an upcoming trip. (Later, we’ll also discuss converting United miles to Marriott points — available for elite members.)

World of Hyatt

Hyatt points convert to United miles at a 2.5:1 ratio. You must transfer in increments of 1,250 (with a 5,000 point minimum), which yields 2,000 miles per 5,000 Hyatt points. Additionally, Hyatt awards a 5,000-mile bonus for every 50,000 points transferred (effectively 50k Hyatt = 20k + 5k bonus = 25k United miles). While Hyatt points are quite valuable for hotel stays, this option exists if you need to convert for a mileage redemption.

Hilton Honors

Hilton points transfer to United at a 10:1 ratio. In other words, a hefty 10,000 Hilton points nets just 1,000 United miles. This poor rate means you lose a lot of value (Hilton points are generally worth ~0.5¢ each, whereas United miles are ~1.1¢ each, so 10k Hilton ≈$50 value -> 1k United ≈$11 value). Thus, converting Hilton to United is usually not recommended except to keep miles from expiring or in very specific scenarios.

IHG One Rewards

IHG points (from IHG Hotels like Holiday Inn, InterContinental) transfer at 5:1. 10,000 IHG points = 2,000 United miles. Like Hilton, this yields low value (IHG points are worth ~0.5¢ each, so 10k IHG ~$50 for 2k United ~$22). Use only if you have IHG points you can’t use on hotels.

Choice Privileges

Choice Hotels points convert at 5:1 as well . For example, 5,000 Choice points -> 1,000 miles. Again, this is a last-resort type of transfer given the value loss.

Wyndham Rewards

Wyndham points convert to United at 5:1 (5,000 Wyndham = 1,000 miles). Wyndham’s partnership allows earning miles on stays or converting points, but the same warning about value applies.

Accor Live Limitless (ALL)

Accor’s program (covering brands like Sofitel, Novotel, Fairmont, etc.) lets you convert points to United at a 2:1 ratio . Accor points are roughly €0.02 in hotel value each, so 2:1 is a significant devaluation unless you have no hotel use for them.

Shangri-La Circle

Shangri-La (Asia-Pacific luxury hotel group) allows transfers to United 1:1 . You need a minimum of 2,500 Shangri-La points to convert, yielding 2,500 United miles. This is one of the rare parity transfers, but Shangri-La points themselves are quite niche unless you’re a regular guest.

With most hotel transfers, patience is required – they are not instant. It can take a few days (or even a week or more) for hotel -> United conversions to process. Plan ahead if you intend to use hotel points for an award booking. And remember, transferring hotel points to airlines typically offers lower value , so consider other uses first. Only convert points if you really need those United miles or if the points are otherwise going unused.

Transferring Miles FROM United to Other Programs

What if you have a stash of United miles – can you transfer them out to another loyalty program? In general, airline miles (including United’s) are a one-way street, and you cannot freely move them to other airlines or programs. United miles are meant to be redeemed within MileagePlus (for flights, upgrades, etc.) or on United’s travel partners, but not converted into another currency. However, there are a couple of special options and exceptions:

Converting United Miles to Hotel Points (Marriott RewardsPlus)

The primary way to “transfer” United miles out is through United’s partnership with Marriott Bonvoy, known as RewardsPlus. If you have United Premier elite status (Silver or higher), you are eligible to convert MileagePlus miles into Marriott Bonvoy points on a limited basis. Key details of this benefit:

- The conversion rate is 1 United mile = 1 Marriott Bonvoy point. This is an excellent ratio (full parity) – for example, converting 10,000 United miles gives you 10,000 Marriott points.

- Elite status is required. You must be at least Premier Silver in MileagePlus to use this perk. (Premier Silver is achieved by flying 25,000 miles or earning 5,000 Premier Qualifying Points in a year, for instance.)

- There is an annual cap. You can convert up to 100,000 United miles per calendar year into Marriott points. (Earlier versions of the program had caps of 50k; as of 2025 it’s 100k for eligible members.)

- Conversions are done via the RewardsPlus portal. You log in, choose “Convert Miles to Points,” and specify the amount (in 500-mile increments, minimum 500 miles). The miles will be deducted from your United account and the equivalent Marriott points will be added to your Bonvoy account.

While a 1:1 transfer sounds great, consider the value trade-off before moving large chunks of miles. On average, United miles are worth ~1.1¢ each, whereas Marriott points are worth ~0.8¢ each. That means 10,000 miles ($110 value) -> 10,000 points ($80 value). You lose roughly 25-30% of value in the exchange. Therefore, this conversion is best used for small top-ups – for example, if you’re a few thousand points short of a Marriott hotel redemption, it can make sense to transfer some miles. It’s not usually wise to dump 100k miles just to stockpile Marriott points, since you’d likely get more travel value using those miles for flights.

Other hotel programs: Currently, Marriott is the only hotel partner with a direct MileagePlus conversion feature. United’s website mentions partnerships with other hotel brands (like Hilton, Hyatt, IHG, etc.) where you can earn United miles for hotel stays or redeem miles for hotel bookings, but no direct mile-to-point transfer exists for those. (For instance, you cannot convert United miles to Hyatt or Hilton points – you could only redeem United miles to book hotel nights through United’s awards portal, which is generally poor value.)

Can You Transfer United Miles to Other Airlines?

No, you generally can’t transfer United miles to another airline’s loyalty program. There are no partner airlines or alliances where you can convert your United MileagePlus balance into, say, Lufthansa Miles&More or Air Canada Aeroplan points. Even though they are partners for earning and redeeming, each airline’s miles stay in its own program. MileagePlus miles must be used within MileagePlus or via award redemptions on partners, but you can’t turn them into a different airline’s currency.

Transfer United Miles to Another Person

United lets you transfer miles to another MileagePlus account, but it’s poor value. You’ll pay a hefty fee (currently $7.50 per 500 miles plus a $30 processing fee per transaction), which quickly wipes out a lot of the miles’ worth.

A better move is to use your miles to book an award ticket in your companion’s name directly from your account. United allows you to issue awards for anyone, and there’s no fee to “gift” an award this way. You keep control of the booking, avoid transfer charges, and everyone flies on the same itinerary.

United now allows you to pool miles with family or friends for free, so you can combine balances to book a single premium ticket from a shared pool—with no transfer fees and no need to be related. One adult (18+) creates the pool and can invite up to four other members (maximum of 5 people in total).

There are a few things to know before adding miles:

- You can only belong to one pool at a time, and the manager controls who can use miles from the pool.

- New members must wait 72 hours after joining before they can make contributions or use miles.

- Once someone contributes miles, there is a 24-hour waiting period before those miles can be used — so plan ahead (or use FareLock if you are protecting a seat for an award ticket).

- If you later leave the pool, the miles you contributed will remain in the pool; if the leader dissolves the pool, the remaining miles will be distributed equally among the members.

- Miles from the pool can only be used to book United/United Express award flights, not partner award flights, upgrades, seat assignments, or ancillary services. If you plan to use miles with partners (Lufthansa, ANA, etc.), leave those miles out of the pool.

The best option is to combine only what you need when you need it for a specific United flight and leave the rest in your individual accounts.

If you have flexible Chase Ultimate Rewards or Bilt points in different accounts, first transfer them to one account, then transfer them to United at a 1:1 ratio. Now you can use them to book award flights with United and Star Alliance partners (Lufthansa, ANA, etc.).

JetBlue–United “Blue Sky” Collaboration (What it is, What it isn’t)

United and JetBlue announced Blue Sky on May 29, 2025, a loyalty collaboration that lets members earn and redeem on each other’s flights, with priority-style perks (priority check-in/boarding, access to preferred and extra-legroom seats, same-day changes/standby) when flying the partner airline. The deal is an interline (not codeshare) tie-up, with each carrier still selling and operating its own flights; you’ll also see cross-shopping/booking on both websites and apps.

Key point for “transfer partners” seekers: Blue Sky does not create a new bank transfer path into United. You still can’t move Citi/Amex/CapOne points into MileagePlus via JetBlue. It’s reciprocal earning and redemption, not a points-pooling or miles-transfer merger.

Tips for Maximizing Transfers and Miles

Now that we’ve covered all the ins and outs of United’s transfer partners, here are some final tips to help you get the most value:

- Earn flexible points when possible: For many, the optimal strategy is to accumulate flexible bank points (like Chase Ultimate Rewards) rather than miles tied to one airline. Points give you options – you can transfer to United when you find a good award, or choose a different partner if United’s award prices are high.

- Transfer with a goal in mind: Whether moving Chase points to United or United miles to Marriott, do it with a specific redemption in mind (a flight or hotel you want to book now). Don’t transfer speculatively just because you can – points and miles can devalue over time, and transfers are often one-way. For example, if you move 60k Chase points to United, be ready to book that award flight. If you convert 20k United miles to Marriott, have a hotel in mind. This ensures you actually get the reward you want and mitigates the risk of devaluation.

- Take advantage of promos: Occasionally, there are transfer bonus promotions. For instance, Marriott Bonvoy sometimes offers a limited-time bonus when converting points to airlines – or Chase/Bilt might offer bonuses for transferring to certain partners. Keep an eye out; a 30% transfer bonus to United (hypothetically) could make a Marriott or Chase transfer far more lucrative. Also, United’s own mileage sales or partner promos (like hotel stay bonuses) might help you accumulate miles without needing to transfer as many points.

Conclusion

United MileagePlus offers a world of possibilities through its transfer partners. By knowing which credit card and hotel programs can funnel points into United – and understanding the few ways to convert United miles out to other uses – you’ll have full control over your miles. Beginners can quickly earn a free flight by leveraging a Chase Sapphire signup bonus or Marriott points, and seasoned points collectors can strategically move rewards to unlock that dream trip. Remember to keep an eye on the math (transfer ratios and value) and enjoy the flexibility these partnerships provide.

Here’s to maximizing your United miles and flying farther for less!