New Limited-Time Offers: United Business and United Club Business Cards Now Come with 100,000 Miles + PQP

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

Offer Ends: Expired

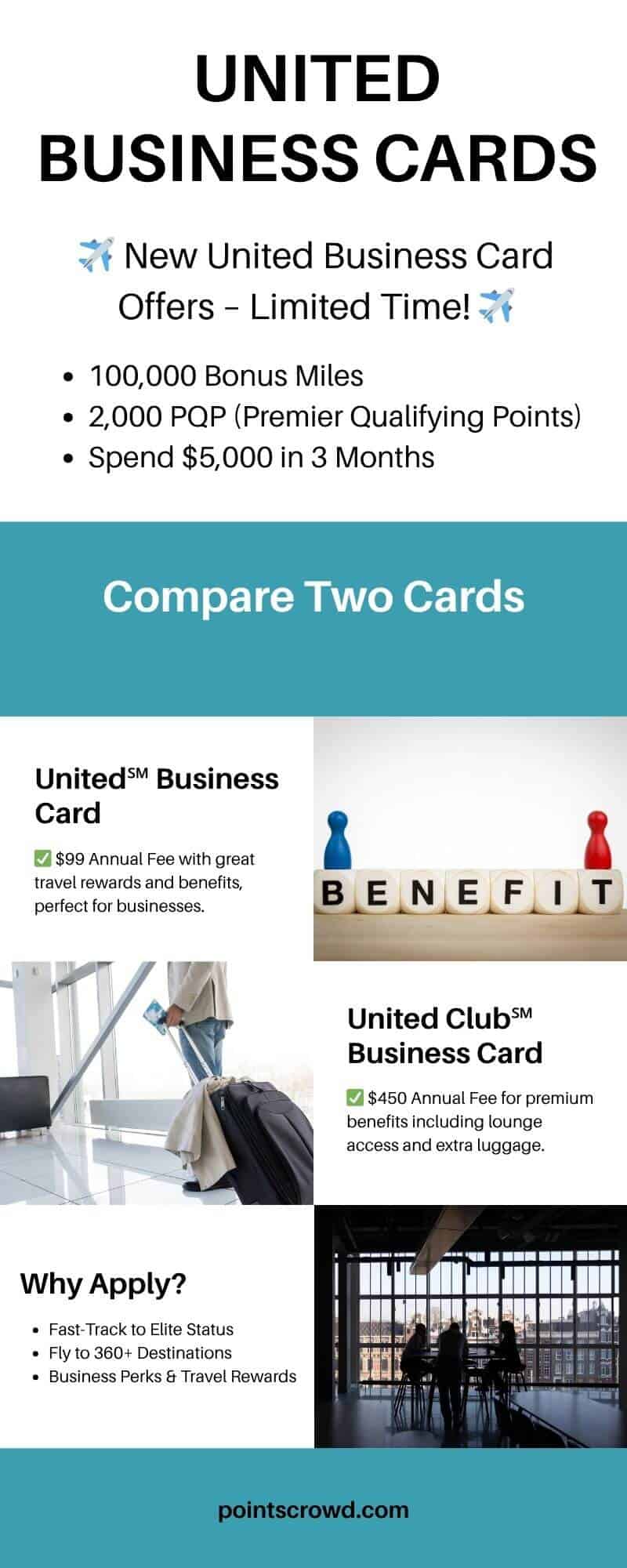

Small business owners and frequent flyers, take note: United Airlines and Chase have just launched enhanced welcome bonuses on two of their best business credit cards – the United℠ Business Card and the United Club℠ Business Card.

For a limited time, both cards are offering 100,000 United MileagePlus bonus miles plus 2,000 premium qualifying points (PQPs) for spending $5,000 within the first three months. These new offers make both cards one of the most attractive business airline credit cards on the market in 2025.

Let’s take a closer look at the details.

The Welcome Offers (Limited-Time)

| Card Name | Bonus Miles | Premier Qualifying Points (PQP) | Minimum Spend Requirement | Offer Ends |

|---|---|---|---|---|

| United℠ Business Card | 100,000 | 2,000 PQP | $5,000 in the first 3 months | Limited-time |

| United Club℠ Business Card | 100,000 | 2,000 PQP | $5,000 in the first 3 months | Limited-time |

Both offers are identical in bonus miles and PQP, but the cards differ significantly in their long-term perks and annual fees.

Why This Offer Matters

These are some of the richest bonuses United has ever offered for its business cards—especially since the PQP component helps you fast-track to Premier elite status with United MileagePlus.

To put this in perspective:

- 100,000 miles can cover:

- Multiple round-trip economy flights in the U.S.

- A round-trip business class ticket to Europe on a United partner

- One-way Polaris Business Class to Asia with partner airlines

- 2,000 PQP is 20% of the requirement for Premier Silver, or 10% of Premier Gold, giving you a meaningful head start toward 2025 status.

Overview: United Business vs. United Club Business Card

Here’s how the two business cards compare:

| Feature | United℠ Business Card | United Club℠ Business Card |

|---|---|---|

| Annual Fee | $150 | $695 |

| Welcome Offer | 100k miles + 2k PQP (spend $5k/3 mo) + 10k miles for adding AU | 100k miles + 2k PQP (spend $5k/3 mo) + 10k miles AU |

| United Club Access | 2 one-time passes/year | Full Club membership + 4 one-time passes after anniversary |

| Earning Rates | 7× United flights; 5× United hotels; 2× gas, dining, transit, office supplies, United purchases; 1× others | 7× United flights; 5× Renowned Hotels; 2× United purchases; 1.5× others |

| Free Checked Bags | 1st bag free for you + one companion | 1st and 2nd bag free for you + companion |

| Priority Boarding | Yes | Yes + Premier Access (expedited services) |

| Travel Protections | Standard: trip delay, lost luggage, rental insurance | Enhanced protections |

| Annual Credits | ~ $600+ in credits: $125 United flights, $100 hotel, $100 rideshare, $50 car, $120 Instacart, $100 JSX, $25 FareLock | ~ $925+: $200 Renowned Hotels, $150 rideshare, $100 car, $240 Instacart, $200 JSX, $50 FareLock |

| PQPs From Spend | 1 PQP per $20 up to 4k PQP/year | 1 PQP per $15 up to 28k PQP/year |

New Benefits in 2025

The enhanced benefits for the United℠ Business Card and United Club℠ Business Card went live on March 24, 2025 for all new and existing cardholders, as part of United and Chase’s wide-ranging credit card refresh that introduced elevated perks, annual credits, and updated PQP-earning structures.

United℠ Business Card

- $125 United TravelBank Credit

- Earned after five United flight purchases of $100+ each in a calendar year.

- Delivered as TravelBank cash, usable only toward United‑ or United Express‑operated flights (including taxes/fees), expires 12 months after issuance, and cannot be combined with miles, vouchers, or transferred.

- Up to $100 United Hotels Statement Credits

- $50 back on each of your first two prepaid United Hotel stays per anniversary year.

- Up to $100 Rideshare Statement Credits

- Enroll to receive $8/month January–November, and $12 in December—annually up to $100.

- Up to $50 TravelBank Car Rental Credit

- $25 each on your first two Avis/Budget rentals booked via cars.united.com—received as TravelBank cash.

- Up to $120 Instacart Credits

- $10 monthly Instacart credit, plus a 3‑month free Instacart+ membership (through 12/31/2027).

- Up to $100 JSX Flight Statement Credit

- Applied to bookings directly with JSX—up to $100 per anniversary year.

- Up to $25 FareLock Statement Credit

- Covers FareLock purchases per anniversary year.

- PQP from spend: Earn 1 PQP per $20, up to 4,000 PQP annually

- Other perks:

- Free first checked bag for you + companion

- Priority boarding

- Two Economy Plus upgrades after $25,000 spend annually

- 25% back on inflight purchases

- Exclusive award flight pricing under “Cardmembers save”

United Club℠ Business Card

- Up to $100 TravelBank Car Rental Credit

- $50 each on your first two Avis/Budget rentals via cars.united.com—issued as TravelBank cash.

- Up to $200 Renowned Hotels Statement Credits

- Credits on prepaid stays booked through Renowned Hotels—up to $200 annually.

- Up to $150 Rideshare Statement Credits

- Must enroll. Up to $12/month January–November, and $18 in December—totaling $150/year.

- Up to $240 Instacart Credits

- $10 twice per month ($20 total) for purchases on Instacart—up to $240 annually.

- Up to $200 JSX Flight Statement Credit

- Applied to bookings with JSX—up to $200 annually.

- Up to $50 FareLock Statement Credit

- For FareLock hold purchases—up to $50 per year.

- PQP from spend: Earn 1 PQP per $15, up to 28,000 PQP per year

- Other perks:

- Free first and second checked bags

- Premier Access (priority check-in, security, boarding, baggage)

- Two global Economy Plus upgrades after $40,000 annual spend

- Special award pricing via “Cardmembers save”

Who Should Get These Cards?

Choose the United℠ Business Card if:

- You want a lower annual fee ($99).

- You still want essential United perks like a free checked bag, priority boarding, and access to exclusive award discounts.

- You value bonus categories like dining, gas, transit, and office supply stores.

Choose the United Club℠ Business Card if:

- You frequently travel for business and want full United Club lounge membership (normally worth $650/year).

- You value more travel protections, two free checked bags, and 1.5x miles on all other spending.

- You want top-tier perks bundled into your business travel experience.

How These Offers Stack Up

Compared to other airline business cards, this is a very competitive offer:

| Card | Welcome Bonus | Elite Status Boost? | Annual Fee |

|---|---|---|---|

| United Business | 100,000 miles + 2,000 PQP | ✓ | $99 |

| United Club Business | 100,000 miles + 2,000 PQP | ✓ | $450 |

| Delta Business Reserve | 110,000 SkyMiles + 1 MQD Boost | Partial | $650 |

| American AAdvantage Business | 75,000 miles | ✗ | $99 |

| Alaska Business Visa | 50,000 miles + Companion Fare | ✗ | $95 |

How to Apply

You can apply directly on the United Business Cards page or through Chase. The application process typically requires:

- Good to excellent credit

- Proof of business ownership (this can include sole proprietors, freelancers, or LLCs)

- A U.S. business address

Approval decisions are usually fast, but Chase’s 5/24 rule may apply (if you’ve opened 5+ credit cards in the last 24 months, you may be ineligible).

Final Thoughts

The United Business and United Club Business Cards are currently offering some of the best airline business card bonuses of 2025. If you’re a frequent flyer with United or a small business owner looking to offset travel costs, these offers are worth serious consideration.

Between the 100,000 miles, 2,000 PQP, and enhanced travel perks, there’s never been a better time to apply.

This is misinformation: “Airline credits: The United℠ Business Card now includes a $100 United TravelBank credit each year.”

and: “United Club Access ✗”

Reality: “Two (2) United ClubSM one-time passes” and $0 in United TravelBank credit”. I have this card and read from the United website.

Thank you for your interest! We have updated the information to reflect the most current data.

Starting March 24, 2025, the United℠ Business Card offers a $125 TravelBank credit that can be redeemed after five United ticket purchases of $100 or more in a calendar year. The credit is provided in TravelBank cash and can be used to reduce the cost of a flight, not as a statement credit.

The United Club℠ Business Card includes up to $100 in TravelBank credits for Avis/Budget car rentals, offering $50 for the first and second rentals each calendar year.

We appreciate you bringing this to our attention!