Updated Overview of United Business Credit Cards for 2024

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

As a small business entrepreneur who values efficiency and convenience while traveling, choosing the right business credit card is pivotal. Among the plethora of options, United business credit cards, specifically those offered in partnership with Chase, stand out for their comprehensive benefits tailored to frequent travelers. This article delves into the unique features, benefits, and comparisons of the United Business Card and other United business credit cards, ensuring you make an informed decision that aligns with your business requirements.

Is the United Business Card Right for You?

The Chase United Business Card is particularly advantageous for small business entrepreneurs who frequently fly with United Airlines. With a reasonable $99 annual fee, this card offers a suite of perks that can easily outweigh its cost. For instance, if your business requires you or your employees to check baggage at least four times a year, the savings from the free first checked bag benefit alone can cover the annual fee.

Moreover, the card provides two one-time passes to United Club lounges after account opening and on each anniversary, along with a 25% discount on United inflight purchases. These benefits are invaluable, not only for frequent fliers but also for those who fly occasionally. The United Business Card also offers extended warranty, purchase protection, and travel protections, catering to the diverse needs of a small business.

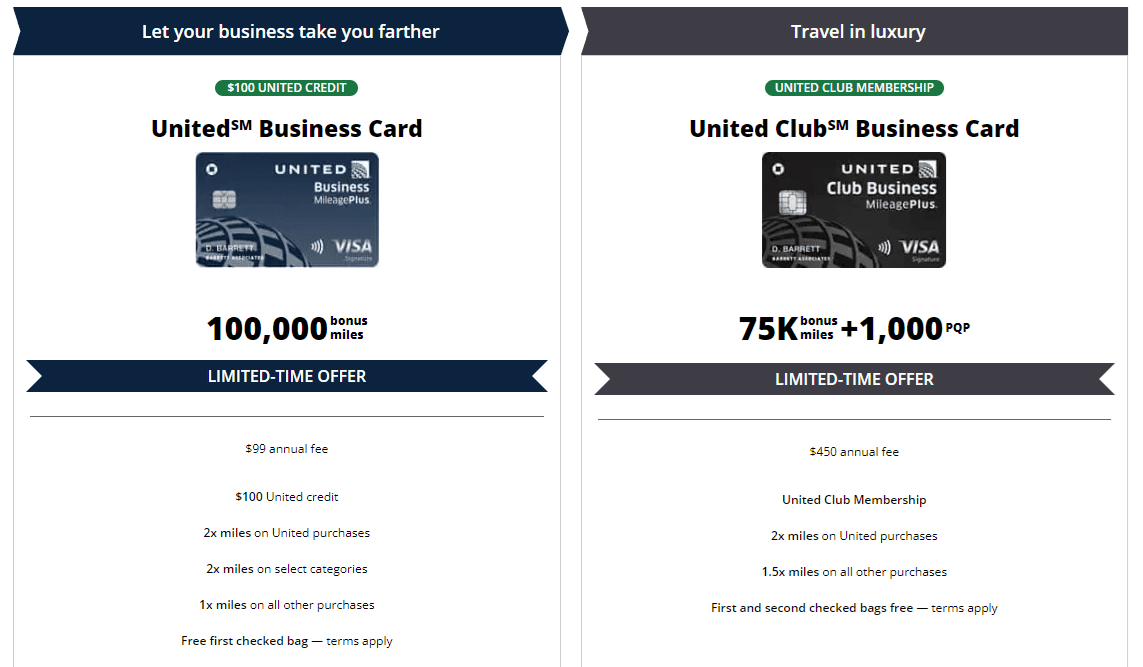

Introductory Offer for New Cardholders

For a limited time, the United Business Card offers an attractive 100,000 bonus miles when you make purchases worth $5,000 within the initial three months. With the latest valuation pegging United miles at about 1.1 cents each, this bonus translates to an estimated value of $825.

However, some restrictions apply: If you’re a current or previous cardholder who’s availed the new member bonus in the past two years, you won’t qualify for this offer.

Remember, Chase perceives the United Business Card as distinct from other United-branded business cards. So if you’ve owned one of the other United cards, you’re still in the race for this bonus.

Moreover, Chase’s unpublicized 5/24 rule might impact your application. If you’ve activated five or more credit cards within the previous 24 months, your approval might be on the line.

Key Features and United Business Credit Card Benefits

Designed with small business proprietors in mind, the United Business Card comes packed with exclusive perks, especially if you don’t already have elite status with United or the Star Alliance network. Some highlighted features include:

Streamlined Travel with United (Free First Checked Bag and Priority Boarding)

When flying United, both you and a travel buddy can check your first bags for free, provided you book with your United Business Card. And with priority boarding, evade the hassles of basic economy.

United Club Access

Regardless of your travel frequency, access to United Club lounges can be a lifesaver, especially during flight disruptions. A list of all United Club locations and United Polaris lounges can be found here.

Additional incentives of the United Business Card

From a $100 credit after seven eligible United transactions to a “Better Together” bonus and extended award availability, this card ensures that the perks keep rolling.

- One can obtain a $100 travel credit with United following certain flight acquisitions.

- A collective 5,000 bonus miles are awarded on the anniversary if an individual possesses both the UnitedSM Business Card and a personal United credit card.

- For each $12,000 spent using the United Business Card, an individual can accumulate 500 Premier qualifying points, with a maximum limit of 1,000 PQP annually. These points contribute to achieving Premier status, up to the Premier 1K® level.

- A 25% refund is given on United’s inflight and Club premium beverage expenses.

- Companies can obtain cards for their employees without any extra charge, and they have the capability to designate distinct spending caps on each of these employee cards.

- For the main cardholder, there’s an opportunity to witness an extended range of award availability when they utilize their miles to book flights operated by United.

- Whenever available, primary cardholders can enjoy the luxury of complimentary Premier upgrades on their United flights when they are using an award ticket.

- When reserving a stay with The Luxury Hotel & Resort Collection using the card, members can experience benefits that resemble those of elite status at selected establishments.

- For those unforeseen travel mishaps, the card provides numerous travel protections including, but not limited to, compensation for trip delays, insurance for trip cancellations and interruptions, coverage for baggage delays and lost luggage, waivers for auto rental collision damages, roadside help, and travel accident insurance.

- On the shopping front, cardholders enjoy safeguards such as purchase protection and an extended warranty cover.

- Lastly, the card does not charge any fees on foreign transactions.

Mileage Earnings and Redemption

For every dollar spent on various purchases like United services, gas stations, and restaurants, you receive 2 United miles. And for all other eligible transactions, you earn 1 mile per dollar.

When it’s time to redeem, using your miles for airline tickets usually yields the best value.

Other credit card offers for business from United

In addition to the United Business Card, United and Chase offer other business credit cards, such as the United Club Business Card. The United Club Business Card review highlights its premium benefits, including full United Club membership, providing unlimited access to United Club locations and participating Star Alliance affiliated lounges worldwide. This card, with a higher annual fee, is suited for those seeking luxury travel experiences and elevated benefits.

Comparison and Conclusion

Comparing United’s business credit cards, it’s clear that each card caters to different business travel needs and preferences. The United Business Card offers a balanced mix of benefits for a moderate annual fee, making it an excellent choice for small business entrepreneurs who fly United occasionally to frequently. Meanwhile, the United Club Business Card, with its comprehensive lounge access and premium benefits, is ideal for those who travel extensively and value comfort and convenience.

For small business individuals who frequently fly United, the suite of perks offered by United business credit cards, especially the Chase United Business Card, delivers substantial value. With benefits ranging from free checked bags and priority boarding to exceptional travel protections, choosing a United business credit card can significantly enhance your travel experience while providing valuable rewards for your business spending.

| Feature/Benefit | United Business Card | United Club Business Card |

|---|---|---|

| Annual Fee | $99 | $450 |

| Introductory Offer (LIMITED OFFER ENDS 4/3/2024) | 100,000 bonus miles after spending $5,000 in first 3 months | 75K bonus miles +1,000 PQP after you spend $5,000 on purchases in the first 3 months |

| Earning Rates | 2 miles per $1 on United purchases, restaurants, and gas stations, dining, local transit; 1 mile per $1 on all other purchases | 2 miles per $1 on United purchases; 1.5 miles per $1 on all other purchases |

| Get a bonus for each anniversary of using the card | 5,000 bonus miles | |

| United Club Access | 2 United Club one-time passes per year Over a $100 value | United Club membership Up to a $650 value per year |

| Back on food, beverage and Wi-Fi purchases onboard United and United Express-operated flights and United Club premium drink purchases | 25% | 25% |

| Free Checked Bag | First checked bag free for cardholder and one companion on United flights | First and second checked bags free for cardholder and one companion |

| Priority Boarding | Yes | Yes |

| Travel Credits and Bonuses | $100 credit after seven United flight purchases; anniversary bonus miles | N/A |

| Premier Access Travel Services | No | Yes |

| Foreign Transaction Fees | None | None |

| Travel and Purchase Protections | Comprehensive including trip delay insurance, lost luggage reimbursement, purchase protection, and extended warranty | More comprehensive protections and higher coverage limits |

| Premier Qualifying Points (PQP) Earning, for every $500 you spend on purchases, up to 1,000 PQP in a calendar year | Yes, up to 1,000 PQP annually with spending thresholds | Yes, with potentially higher earning rates and thresholds |

| Other Notable Benefits | employee cards at no extra cost; extended award availability; DoorDash; | enhanced rewards on spending; luxury hotel benefits; employee cards at no extra cost; Avis President’s Club; DoorDash; |