Chase Sapphire Reserve Revamp: 100K Bonus, New Perks, and a $795 Fee – What It Means for Travelers

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

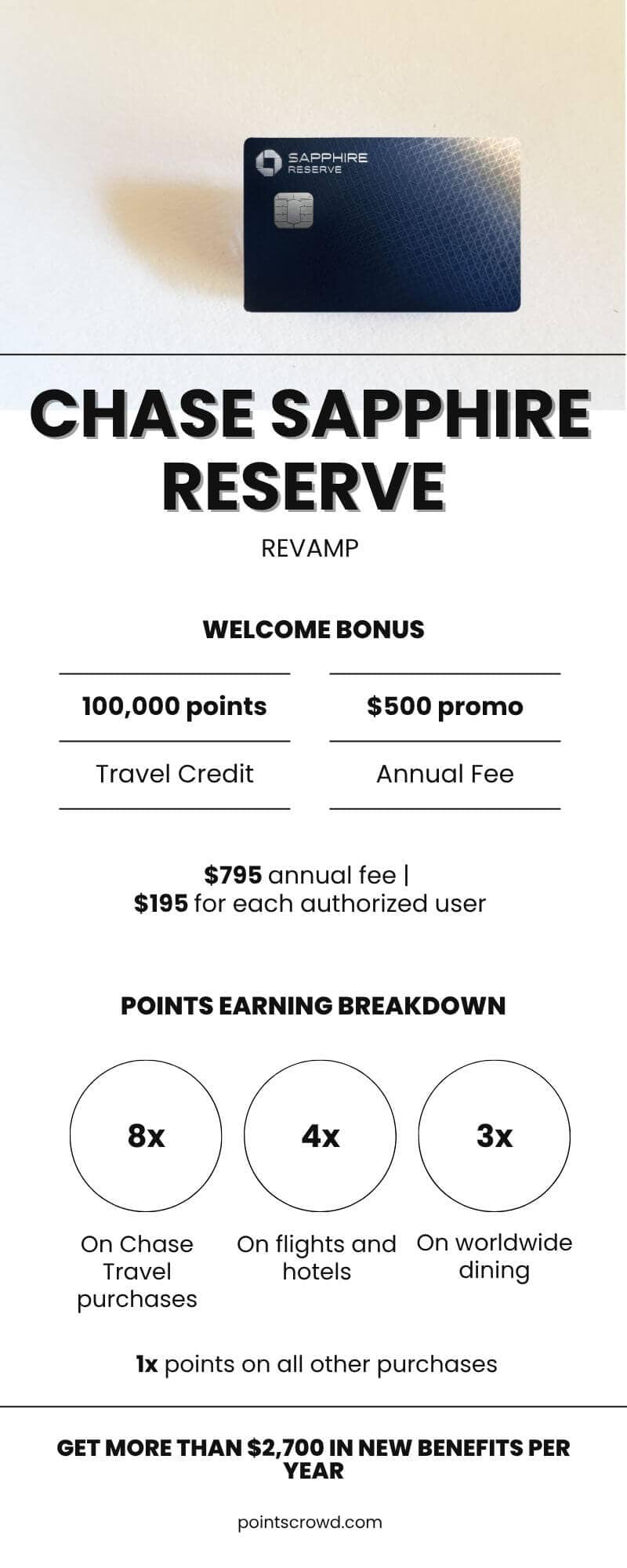

Chase has radically revamped its Sapphire Reserve credit card, introducing new rewards and privileges, as well as significantly increasing the annual fee. For frequent flyers and bonus point collectors, this change is big news. The card now offers the highest sign-up bonus (100,000 points + $500 in travel credit) and a range of new account credits from restaurants to hotels, but also an increase in the annual fee from $550 to $795.

Let’s take a look at what’s new and who will benefit most from the updated Sapphire Reserve.

Key Changes

Record Sign-Up Bonus: New cardholders can earn 100,000 bonus points plus a $500 Chase Travel credit after spending $5,000 in the first 3 months. This is the highest bonus ever for the Sapphire Reserve, and Chase values this welcome offer at over $2,000 in travel (when points are redeemed well).

Annual Fee Hike: The annual fee jumps from $550 to $795, making the Sapphire Reserve one of the most expensive travel cards on the market. (Authorized user fees also rise steeply, from $75 to $195 each.) Existing cardmembers won’t pay the higher fee until their first renewal after October 26, 2025.

Overhauled Earning Rates: The card’s travel earning structure is revamped. You’ll now earn 8X points on travel booked through Chase (flights, hotels, car rentals, etc.), 4X on flights and hotels booked directly, but only 1X on other travel purchases like cruises, trains, or Airbnb. (Dining remains 3X, and specialty partners like Lyft and Peloton still earn elevated rates.) This boosts rewards for airfare and hotels, but cuts the old 3X rate on broad travel not booked through Chase.

New “Points Boost” Redemptions: Chase replaced the card’s flat 1.5¢ per point travel redemption rate with a tiered “Points Boost” system. With Points Boost, Sapphire Reserve cardholders can get up to 2.0¢ per point value on select travel redemptions (certain flights and hotels in the Chase Travel portal). Non-boosted redemptions will continue to be paid at only 1.0 cent per point, which is a significant devaluation compared to the previous minimum of 1.25-1.5 cents. (Cardholders who have accumulated points before October 26, 2025, will have a two-year grace period, but in the long term, the 1.25-1.5X option will disappear).

Important: You can still transfer points 1:1 to airline and hotel partners as before, preserving the value of Chase’s travel transfer partnerships.

Loads of New Credits & Perks: To justify the fee, Chase is adding over $2,700 worth of annual credits across travel, dining, and lifestyle categories.

Highlights include:

- $300 Annual Travel Credit – unchanged and ultra-flexible, automatically erasing any $300 in travel purchases each year. (This effectively lowers the net cost of the card.)

- $500 Annual Hotel Credit (The Edit by Chase) – split into two $250 credits per year for prepaid bookings through Chase’s new luxury hotel collection, The Edit (requires 2-night minimum). These bookings also come with VIP benefits like a $100 property credit, daily breakfast, and room upgrades at select hotels.

- $300 Dining Credit (Exclusive Tables) – split into two $150 semiannual credits, usable for reservations at participating Sapphire Reserve Exclusive Tables restaurants (a curated list via Chase’s partner platform). This essentially rebates up to $300 yearly on dining at select high-end restaurants.

- $300 Annual Event Ticket Credit (StubHub/Viagogo) – split into two $150 credits (Jan–Jun and Jul–Dec) for concert, sports, or show tickets via StubHub or viagogo (activation may be required). Great for frequent concert-goers or sports fans.

- $300 in DoorDash Credits – delivered as up to $25 in credits every month through 2027 (a $5 credit for restaurants + two $10 credits for grocery/retail orders each month). Plus, a free DashPass membership for at least 12 months (worth ~$120) is included.

- $250 Annual Apple Entertainment Credit – covers Apple TV+ and Apple Music subscriptions (complimentary through June 2027, totaling ~$250/year). Essentially, cardholders get these streaming services free for the next couple of years.

- $120 Annual Peloton Membership Credit – $10 per month toward Peloton App or All-Access membership, through 2027. Cardholders also earn 10X points on Peloton equipment purchases over $150 (through 2027) as an added perk.

- $120 Annual Lyft Credit – $10 in Lyft ride credits each month until Sept 2027, plus continued 5X points on Lyft rides.

Complimentary Elite Status: IHG One Rewards Platinum Elite status comes free with the card (through Dec 2027), offering perks at IHG hotels. The Priority Pass™ Select lounge membership also continues (worth $469/year) for unlimited airport lounge access (including Chase’s own Sapphire Lounges and select Air Canada Maple Leaf lounges). And of course, the card still provides a Global Entry/TSA PreCheck or NEXUS fee credit (up to $100-$120 every four years)

Big-Spender “Milestone” Rewards: Chase is introducing new perks for ultra-heavy spenders. If you charge $75,000 or more in a calendar year on the Sapphire Reserve, you’ll unlock top-tier elite statuses and extra credits: namely IHG Diamond Elite status (upgrade from Platinum), Southwest Airlines A-List status (priority boarding, free checked bags, etc.), a $500 Southwest travel credit (when booking Southwest flights through Chase), and a $250 “Shops at Chase” credit for luxury retail purchases. These are decent bonuses, though $75K spend in one year is a high bar that many cardholders may not hit.

As you can see, the Sapphire Reserve’s revamp is extensive. Next, we’ll dive deeper into what these changes mean – which are genuinely valuable and which might be more of a mixed bag for frequent travelers and points hobbyists.

Higher fees, bigger bonus – first-year offer

The increase in the annual fee to $795 is striking, as it is $245 more than before. This makes Sapphire Reserve even more expensive than Amex Platinum and puts it among the most expensive cards on the market.

However, Chase has tried to soften the blow, especially for new customers, by combining the update with a welcome offer. The new sign-up bonus of 100,000 Ultimate Rewards points + $500 in travel credit is unprecedented for this card.

For new cardholders, this first-year windfall can easily offset the fee. The Chase Travel $500 promo credit is essentially a voucher for bookings on the Chase Travel portal. It is one-time use (must be used in a single transaction within 12 months) and automatically applies to any flights, hotels, car rentals, etc. booked through Chase.

In addition, 100,000 points can be extremely valuable, for example, if you redeem them at ~2 cents per point through transfers to partner airlines or Points Boost, they will be worth about $2,000.

In total, a new cardholder can earn over $2,000 in travel during the first year, which more than covers the $795 fee.

However, after the first year, the ongoing benefits will depend on how much you use the card’s rich benefits compared to the high annual cost.

For existing Sapphire Reserve cardholders (who do not receive the additional bonus), the calculation would be: can you get at least $795 each year from the credits, rewards, and travel perks that this card offers? The answer will be different for each person — let’s take a closer look at the new earning structure and benefits to help answer that question.

Revamped Earning Rates: More for Airfare/Hotels, Less for Other Travel

Chase significantly reshuffled the Sapphire Reserve’s bonus categories for spending on travel. The goal was clearly to reward traditional travel purchases (flights and hotels) even more, while cutting back on points for other travel forms.

Here’s the new structure:

- 8X points on travel booked via Chase Travel – This covers flights, hotels, rental cars, cruises, activities and more booked through the Chase Travel portal. Previously, Chase offered 10X on hotels/car rentals and 5X on flights via its portal. So portal flights actually get a boost (from 5X to 8X), while portal hotels drop slightly (10X down to 8X).

- 4X points on flights & hotels booked directly – If you buy airfare directly from an airline or book a hotel from the hotel website/desk, you earn 4X Ultimate Rewards points per dollar. This is an improvement from the old 3X rate on travel.

- 1X point on other travel purchases – Here’s the painful part: any travel that doesn’t fall under the above (or isn’t booked through Chase) now earns just 1X. Chase removed the 3X broad travel category, which used to award triple points on everything from taxis and parking to train tickets, Airbnb rentals, cruises, tours, etc. Those purchases will now only get the base 1 point per dollar – a big downgrade for travelers with lots of spend in these non-airline, non-hotel areas. For example, someone who frequently uses ride-shares, pays for rail passes, or rents vacation homes will see their Sapphire Reserve earning rate plummet on those transactions (from 3% in points to about 1%).

What About Dining And Other Categories?

The card continues to earn 3X points on dining worldwide, unchanged from before. You also still get 5X points on Lyft rides (through Sept 2027) and 10X points on Peloton equipment purchases (through end of 2027) as ongoing partner promotions.

All other spending (non-bonused) remains 1X.

In short, the big changes in earning apply to travel spend: better rewards for airfare and hotels, worse for everything else. For many frequent flyers who primarily spend on flights and hotels, this is a net win. But if a lot of your travel spend is in the “other” bucket (say, you’re a road tripper, cruiser, or Airbnb devotee), you’ll earn far fewer points unless you shift more bookings through the Chase portal.

“Points Boost”: New Redemption Value (Up to 2¢ per Point)

We have already written about Chase’s “Points Boost” feature, so let’s take a quick look at it here.

Previously, Sapphire Reserve members could redeem points for travel through Chase at a fixed rate of 1.5 cents per point (50% more than the base value). Chase is now phasing out the 1.5x multiplier and replacing it with “Points Boost” offers for redeeming points for travel.

Here’s how it works:

When you book a trip through the Chase Ultimate Rewards portal, certain options (especially select flights and hotels) will be marked as eligible for Points Boost. For these, you can redeem points at up to 2.0 cents per point, which is effectively double the normal value.

For example, a $500 flight could cost just 25,000 points (2 cents per point) if it meets the maximum Points Boost multiplier. Bookings through the new Chase The Edit program for luxury hotels always cost 2 cents per point, and some airline tickets cost between 1.25 and 2 cents per point, depending on the airline, class, and demand.

However, all other travel redemptions (not marked with Points Boost) will now be redeemed at a fixed rate of 1.0 cent per point. In other words, if you want to use your points for travel that is not eligible for the boost (or if you are simply using Pay Yourself Back-style redemptions for travel), you will only receive the base value. This is a significant devaluation compared to the guaranteed value of 1.5 cents previously offered by Reserve.

If you already had a Sapphire Reserve card before these changes, Chase is not canceling it immediately. Points earned before October 26, 2025, can be redeemed at 1.5 cents through the portal for several more years (until the end of 2027).

New applicants (as of June 23, 2025) will not receive the 1.5X option at all — they will receive the Points Boost (1 or 2 cents) right from the start.

Importantly, the ability to transfer points at a 1:1 ratio to 14 airline partners and hotel programs remains unchanged, so points enthusiasts can still use strategies such as transferring points to United, Hyatt, Southwest, and more to earn potentially high rewards.

Lots of New Credits: Great Value or Coupon Book Headache?

Chase has loaded the Sapphire Reserve with a long list of new credits and discounts to justify the $795 price tag.

On paper, these benefits add up to over $2,700 per year if fully utilized. But each cardholder must honestly assess which of these benefits align with their spending. Let’s summarize the main benefits and their appeal to travel enthusiasts:

$300 in general travel spending

This benefit remains unchanged and is still one of the card’s best features. Each year, every cardholder automatically receives a refund of the first $300 spent on any travel (from airline tickets to taxis and road tolls). This benefit is essentially “cash back” for anyone who travels even a little. This effectively reduces your annual fee to ~$495, as most cardholders will use this credit without even trying.

$500 hotel credit (The Edit by Chase)

This is a new perk for luxury hotels: a $250 credit every six months for bookings made through The Edit (Chase’s curated hotel program). The Edit hotels are typically high-end hotels and resorts carefully selected by Chase. To take advantage of the credit, you must book at least 2 nights through the Edit section of the Chase Travel portal and pay for the reservation with your Reserve card. You’ll get up to $250 back for that reservation (twice a year, up to $500 per year).

Pros: If you love high-end hotels, this is a fantastic perk — essentially a $500 subsidy on luxury accommodations. Plus, Edit bookings come with VIP perks (similar to Amex’s Fine Hotels & Resorts), such as a $100 hotel credit, free breakfast, late checkout, and possible room upgrades, adding even more value.

Cons: This is only useful if you actually book hotels through Chase. If you prefer to use hotel points or book through discount sites, you’ll have to change your habits to take advantage of The Edit. In addition, the two-period split means you’ll have to plan at least two hotel stays (one in January-June, one in July-December) to fully utilize the $500 — something to consider if you take one big trip per year.

$300 dining credit (Exclusive Tables)

This is a $150 credit each year in January-June and another $150 in July-December for dining at Sapphire Reserve Exclusive Tables restaurants. These are select restaurants (bookable via a special OpenTable link) that are often located in major cities and popular with foodies. If you book a table through the app and pay with your Reserve card, the credit will automatically be applied to your statement (up to $150 per period).

Pros: For cardholders in cities such as New York, Los Angeles, Miami, etc., who enjoy fine dining, this is a nice bonus — essentially two free meals worth $150 per year (or several smaller outings). It also includes access to “prime time” table reservations, which is a nice VIP bonus.

Cons: It depends a lot on where you live — if you don’t live near one of the cities with participating restaurants or don’t travel there, this credit may go unused. You also need to book a table through the Exclusive Tables app (you can’t just eat anywhere and get $150 back).

$300 for entertainment per year (StubHub/Viagogo)

This benefit is also distributed over six months: $150 in the first half of the year and $150 in the second half of the year on the StubHub and viagogo ticket exchanges. You must use your credit to purchase eligible tickets (e.g., sporting events, concerts, theater), and you will be reimbursed up to $150 per period.

Pros: Great for event lovers — essentially, you can attend $300 worth of shows or games each year on Chase. This is a great feature that other cards don’t have, which appeals to entertainment lovers.

Cons: Requires use of StubHub/viagogo (which often have built-in fees). If you rarely attend events that require tickets, this credit won’t be very useful.

DoorDash credits ($300 + DashPass)

Chase has extended and expanded its partnership with DoorDash. With Sapphire Reserve, you get up to $25 in DoorDash credits every month through December 2027. Each month’s credits are actually made up of three parts: $5 for restaurant orders and two $10 credits for grocery or retail orders through DoorDash. They are not transferable, so you must use them each month or they will be lost. In addition, you get 12 months of free DashPass membership (with no delivery fees at restaurants with $0 delivery), which is worth about $120 per year.

Pros: If you already regularly order food delivery or essential goods, that’s $25 per month — a significant annual benefit of $300, making Reserve similar to a restaurant and takeout card.

Cons: It’s a bit fragmented — some joke that it’s like “coupons” because you have to manage three separate credits each month. You can’t, say, use all $25 at once; you have to remember to use $5 and $10 in the appropriate categories. It requires some organization to get the most out of the benefits (set reminders in your calendar!). If you don’t use DoorDash or prefer other delivery services, this benefit may go unused.

$250 Apple Digital Credit

This benefit covers the cost of Apple TV+ and Apple Music (both) until June 2027. Essentially, if you sign up through Chase, you won’t be charged for these services — Chase will reimburse your monthly payments (up to $250 per year). Pros: If you use the Apple ecosystem, you get two popular entertainment services for free — that’s $20.75 per month (Apple TV+ ~$7 and Apple Music ~$10.99 for individual users). Over a year, that’s actually close to $216, and Chase effectively rounds that amount up to $250 in its estimate.

It’s relatively straightforward, but if you already have long-term subscriptions with other companies or a family plan, you may need to change them to take advantage of this offer. Additionally, this credit is limited to 2027; its future after that is unknown.

$120 Peloton credit

If you use Peloton, you’ll get up to $10 per month toward your membership fees (through the end of 2027). This fully covers the $12.99 per month Peloton app membership or provides a discount on the more expensive All-Access membership. Plus, any Peloton hardware purchase over $150 paid for with Reserve will earn 10× points (also through the end of 2027) — that could be a huge win if you’re buying a bike or treadmill.

Pros: For fitness enthusiasts, this is a nice bonus — effectively $120 off a year of workouts, plus the opportunity to earn a lot of points on a big Peloton purchase.

Cons: No value if you don’t use Peloton.

$120 in Lyft credits

$10 credit to use in the Lyft app every month (until September 2027). This works similarly to Amex credits for Uber — they appear in your Lyft account and you can use them for rides.

Pros: If you use ride-sharing services, this is a savings of up to $120 per year.

Cons: Lyft only, not Uber — but many cities have both services. Also, the monthly cadence means you can’t stack them, so use them each month or lose them.

In addition to all these new benefits, the core protection and other benefits of Sapphire Reserve remain unchanged. You still get one of the best travel insurance policies in the industry — trip cancellation/interruption coverage, trip delay coverage, basic rental car accident insurance, lost luggage reimbursement, emergency evacuation coverage, and more. These protections are a big reason why many frequent travelers love Reserve, and they remain unchanged.

In addition, you continue to get access to Priority Pass Select lounges for yourself and two guests, as well as access to the growing Chase Sapphire lounge network (now open in several airports) and even Air Canada Maple Leaf lounges when flying Air Canada. The credit toward Global Entry/TSA PreCheck or NEXUS (up to $100 every four years) also remains — in fact, Chase has increased it to $120 to fully cover whichever program you choose. And, as mentioned, IHG Platinum Elite status (the middle tier, which provides room upgrades, late check-out, etc.) is automatically granted through 2027, with the possibility of earning IHG Diamond status if you reach the $75,000 spending threshold.

Oh yes, that’s a lot of information! The bottom line is that if you take full or even significant advantage of these benefits, their value will far exceed the cost. For example, a traveler who uses $300 in travel credit, $250 in hotel credit, $300 in dining credit, $120 on DoorDash and Lyft, and $250 on Apple Music/TV (not to mention the rest) can easily get over $1,000 in real value each year.

Chase estimates that all of the new benefits “total over $2,700 per year.”

Even if you personally value some of the credits below their face value, you could earn $795 if you take advantage of many of them. However, not everyone will. The downside of this benefits buffet is its complexity. It’s a bit like a coupon book, where you have to activate different things, keep track of six-month periods and monthly credits, and spend money in specific places to realize their value.

If you’re willing to put in the effort, Reserve is easy to recoup, but if not, you might be better off with a card that has a simpler offer.

Final Thoughts: Is the New Sapphire Reserve Worth It?

The 2025 Chase Sapphire Reserve update is undoubtedly the biggest set of changes for this card since its debut in 2016. It’s a step toward the premium segment, offering a host of benefits for those who can take advantage of them, but at a significantly higher price.

For frequent travelers who love bonuses, it all comes down to this: are you willing to take full advantage of the numerous credits and improved points-earning system? If so, the Sapphire Reserve could be well worth the price — in fact, you could get much more than $795 per year out of it.

For travelers who have already considered purchasing a premium card, Chase’s “more benefits for more fees” compromise is actually on par with its competitors’ offerings and even surpasses them in some respects (the $500 hotel credit and 100,000 bonus points stand out in particular).

On the other hand, if you don’t like playing the rewards game, the changes to the Sapphire Reserve may not seem so good. The loss of the simple 1.5-cent redemption option and the reliance on specific merchants for credit redemption may make it less attractive to more casual users.

The Reserve can provide extraordinary rewards, but you have to jump through some hoops to get there (splitting credits, monthly offers, booking through the portal, etc.). If that’s more fun than work for you, then you’re the target audience for this card. If that sounds like a chore, you can avoid the headache and choose a simpler system. Ultimately, Chase has ensured that the Sapphire Reserve remains one of the best options for travelers, although it is now even more geared toward avid travelers and bonus point enthusiasts.