Mastering Southwest Credit Cards: Which Card Fits Your Travel Style in 2025? (Update)

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

Offer Ends: Expired

This article includes changes made on July 24, 2025.

Introduction to Southwest Credit Cards

Southwest Airlines fans are sure to realize the value that co-branded credit cards can offer. Southwest Airlines has partnered with Chase to offer a suite of credit cards designed to enhance the travel experience for its customers. These cards offer a variety of benefits, including the ability to earn Rapid Rewards points, anniversary bonuses, and travel credits. Which.

In this article, we’ll explore the available Southwest Rapid Rewards credit cards, their privileges, application nuances, and analyze the ideal user profile for each card.

Overview of Southwest Rapid Rewards Credit Cards

Southwest offers both personal and business credit cards to cater to a wide range of travelers.

The current welcome offer for new Southwest Rapid Rewards Plus, Premier, and Priority Consumer Credit Cardmembers will end at 9:00 a.m. ET on September 17, 2025.

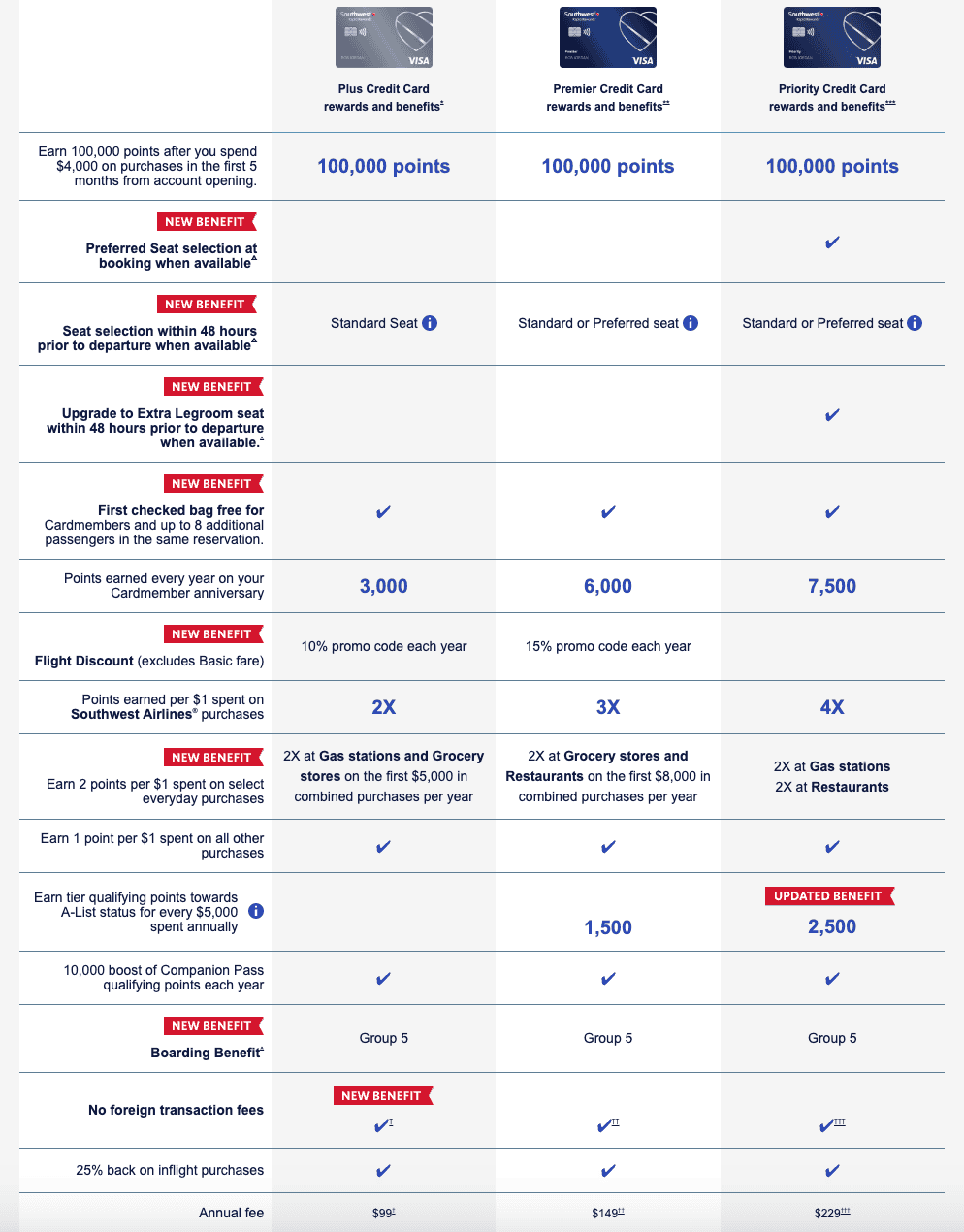

Personal Southwest Сredit Сards

Southwest Rapid Rewards Plus Credit Card

- Annual Fee: $99

- Sign-Up Bonus (through September 17, 2025):

Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.Earn 100,000 points after you spend $4,000 in the first 5 months from account opening + first checked bag free. - Earning Rates:

- 2X points on Southwest purchases,

- (New) 2X points on first $5,000 in combined spend at gas stations and grocery stores each anniversary year,

- 1X points on all other purchases.

- Anniversary Bonus: 3,000 points each year.

- (New) Foreign Transaction Fees: None

- Additional Benefits: 25% back on in-flight purchases.

- (New)Cardmembers and up to 8 additional passengers in the same reservation can check their first bag at no additional cost. For a group of 4 this would be a savings of up to $280 roundtrip ($35 per bag per trip).

- (New) Standard seat selection within 48 hours prior to departure, when available, for the Cardmember and up to eight passengers traveling on the same reservation (for flights operating in 2026)

- (New) Earlier boarding – the Cardmember, and up to eight additional passengers traveling on the same reservation, can board in Group 5

- (New) One promotional code for a 10% flight discount each anniversary year (except Basic fare)

Southwest Rapid Rewards Premier Credit Card

- Annual Fee: $149

- Sign-Up Bonus (through September 17, 2025):

Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.Earn 100,000 points after you spend $4,000 in the first 5 months from account opening + first checked bag free. - Earning Rates:

- 3X points on Southwest purchases,

- (New) 2X points on first $8,000 in combined spend at grocery stores and restaurants each anniversary year,

- 1X points on all other purchases.

- Anniversary Bonus: 6,000 points each year.

- Foreign Transaction Fees: None.

- Additional Benefits: 25% back on in-flight purchases.

- (New) Cardmembers and up to 8 additional passengers in the same reservation can check their first bag at no additional cost. For a group of 4 this would be a savings of up to $280 roundtrip ($35 per bag per trip).

- (New) Standard or Preferred seat selection within 48 hours prior to departure, when available, for the Cardmember and up to eight passengers traveling on the same reservation (for flights operating in 2026)

- (New) Earlier boarding – the Cardmember, and up to eight additional passengers traveling on the same reservation, can board in Group 5

- (New) One promotional code for a 15% flight discount each anniversary year (except Basic fare)

Southwest Rapid Rewards Priority Credit Card

- Annual Fee: $229

- Sign-Up Bonus (through September 17, 2025):

Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.Earn 100,000 points after you spend $4,000 in the first 5 months from account opening + first checked bag free. - Earning Rates:

- (New) 4X points on Southwest Airlines eligible purchases (previously 3X points),

- (New) 2X points at gas stations and restaurants, with no annual cap,

- 1X points on all other purchases.

- Anniversary Bonus: 7,500 points each year.

- Foreign Transaction Fees: None.

- Additional Benefits: $75 annual Southwest travel credit, 4 upgraded boardings per year (when available), and 25% back on in-flight purchases.

- (New) Cardmembers and up to 8 additional passengers in the same reservation can check their first bag at no additional cost. For a group of 4 this would be a savings of up to $280 roundtrip ($35 per bag per trip).

- (New) Standard or Preferred seat selection at booking, when available for the Cardmember and up to eight passengers traveling on the same reservation (for flights operating in 2026)

- (New) Unlimited upgrades to Extra Legroom seats within 48 hours prior to departure, when available and at no additional charge, for the Cardmember and up to eight additional passengers traveling on the same reservation

- (New) Earlier boarding – the Cardmember, and up to eight additional passengers traveling on the same reservation, can board in Group 5

- (New) 2,500 Tier Qualifying Points (TQPs) towards A-List status for every $5,000 spent annually, previously 1,500 TQPs

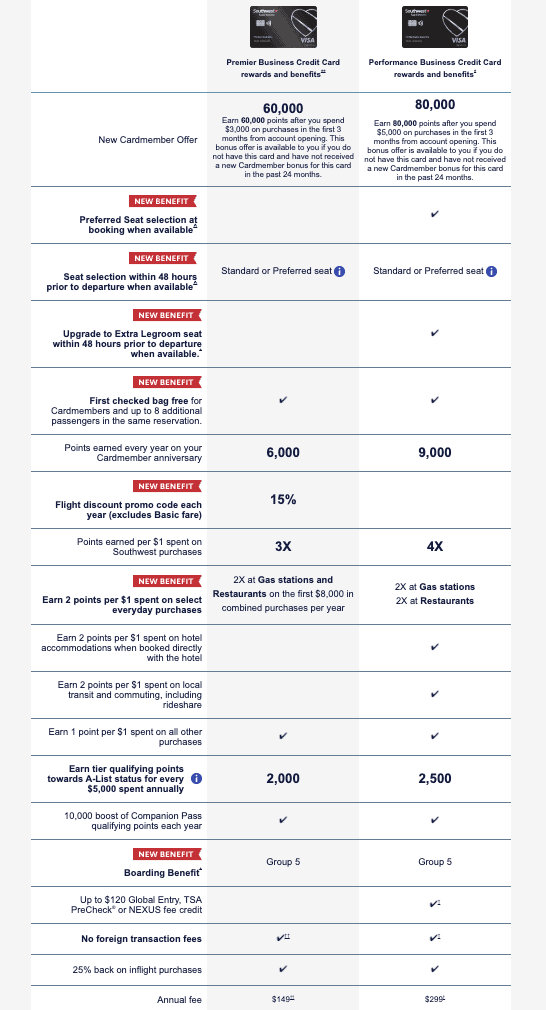

Business Southwest Сredit Сards

Southwest Rapid Rewards Premier Business Credit Card

- Annual Fee: $149

- Sign-Up Bonus: Earn 60,000 points after spending $3,000 on purchases in the first 3 months from account opening + first checked bag free.

- Earning Rates:

- 3X points on Southwest purchases,

- 2X points on local transit and commuting,

- 2X points on first $8,000 in combined spend at gas stations and restaurants each anniversary year,

- 1X points on all other purchases.

- Anniversary Bonus: 6,000 points each year.

- Foreign Transaction Fees: None.

- Additional Benefits: 25% back on in-flight purchases.

- (New) Cardmembers and up to 8 additional passengers in the same reservation can check their first bag at no additional cost. For a group of 4 this would be a savings of up to $280 roundtrip ($35 per bag per trip).

- (New) Standard or Preferred Seat Selection within 48 hours prior to departure, when available, for the Cardmember and up to eight passengers traveling on the same reservation (for flights operating in 2026)

- (New) Earlier boarding – the Cardmember, and up to eight additional passengers traveling on the same reservations, can board in Group 5

- (New) 2,000 Tier Qualifying Points (TQPs) towards A-List status for every $5,000 spent annually, previously 1,500 TQPs

- (New) Promotional code for a 15% flight discount each anniversary year (except Basic fare)

Southwest Rapid Rewards Performance Business Credit Card

- Annual Fee: $299

- Sign-Up Bonus: Earn 80,000 points after spending $5,000 on purchases in the first 3 months from account opening + first checked bag free.

- Earning Rates:

- Earn 2 points for every $1 you spend at gas stations and restaurants.

- 4X points on Southwest purchases,

- (New) 2X points on spend at gas stations and restaurants, with no annual cap

- (New) 2X points on all hotel purchases

- 2X points on local transit, rideshare and commuting

- (New) Cardmembers and up to 8 additional passengers in the same reservation can check their first bag at no additional cost. For a group of 4 this would be a savings of up to $280 roundtrip ($35 per bag per trip).

- (New) Standard or Preferred Seat Selection at booking, when available, for the Cardmember and up to eight passengers traveling on the same reservation (for flights operating in 2026)

- (New) Unlimited upgrades to Extra Legroom seats within 48 hours prior to departure, when available and at no additional charge, for the Cardmember and up to eight additional passengers traveling on the same reservation

- (New) Earlier boarding – the Cardmember, and up to eight additional passengers traveling on the same reservation, can board in Group 5

- (New) 2,500 Tier Qualifying Points (TQPs) towards A-List status for every $5,000 spent annually, previously 1,500 TQPs

Southwest Credit Card Updates and Expanded Benefits

Image source – Southwest Media

On July 24, 2025, Chase and Southwest Airlines introduced new and expanded benefits for Southwest Rapid Rewards credit cards.

New benefits include free first checked bag, pre-flight seat selection, and an upgrade to a seat with extra legroom in any fare class, as well as early boarding.

Cardholders can also earn more points in new everyday spending categories, including gas, grocery stores, and participating restaurants.

New Southwest Rapid Rewards Priority, Premier, or Plus credit cardholders can earn 100,000 bonus points when they spend $4,000 within the first 5 months of account opening.

Cardholders continue to receive all the same benefits as before, including anniversary bonus points, accelerated point earning on Southwest flights, and a one-time 10,000 Companion Pass bonus per calendar year, 25% off in-flight purchases.

Some cards also continue to earn points toward tier status, and Priority and Performance cards now earn 2,500 points toward A-List status for every $5,000 spent annually, up from 1,500 points previously.

Here is a description of what each card offers:

1. Rapid Rewards Points

1. Rapid Rewards Points

All Southwest credit cards let you earn Rapid Rewards points on your purchases:

- Southwest Purchases: Previously 2X–4X points per dollar; now for Priority & Performance Business, it’s 4X points. For Premier, it’s 3X, and for Plus, 2X.

- Everyday Spending:

- Priority & Performance Business: 2X points at gas stations and restaurants, uncapped.

- Premier: 2X points at grocery stores and restaurants on the first $8,000/year.

- Plus: 2X points at gas stations and grocery stores on the first $5,000/year.

You can redeem these points for flights, hotels, car rentals and more in the Rapid Rewards program.

2. Anniversary Bonus Points

Each Southwest credit card grants annual bonus points on your cardmember anniversary:

- Plus Card: 3,000 points

- Premier Card: 6,000 points

- Priority Card: 7,500 points

- Premier Business: 6,000 points

- Performance Business: 9,000 points

These points are added to your Rapid Rewards account automatically each year.

3. Annual Travel Credits

- Priority Card: $75 Southwest travel credit (unchanged).

- Performance Business Card: $100 Global Entry or TSA PreCheck credit.

New promo code benefits (anniversary year):

- Plus Card: 10% off one flight promo code (Basic fare excluded)

- Premier Card: 15% off one flight offer (Basic fare excluded)

4. Seating and Boarding Benefits

Starting July 29, 2025, Southwest introduces assigned seating (standard, preferred, extra legroom) for flights operating January 27, 2026 and beyond. Cardholders gain priority access and boarding upgrades:

Group 5 boarding for up to nine in your reservation.

Priority & Performance Business Cards:

- Choose a Preferred or Standard seat when booking (if available), for you and up to eight companions.

- Unlimited Extra Legroom seat upgrades starting 48 hours before departure on the same reservation (if available).

- Boarding Group 5 for you and up to eight travelers in your party.

Premier & Premier Business:

- Preferred or Standard seat selection within 48 hours prior to departure.

- Group 5 boarding for you and up to eight others.

Plus & Plus Business:

- Standard seat selection within 48 hours prior to departure.

5. Checked Bag Benefit

All cards now include the first checked bag free for the cardmember and up to eight passengers on the same reservation—a return of a key benefit given Southwest’s removal of general free checked bag policies.

6. In‑Flight & Other Ongoing Perks

- Inflight Discounts: 25% back on inflight purchases (drinks, Wi‑Fi) for all cards, plus performance/business cards offer inflight Wi‑Fi credits.

- EarlyBird Check‑In (still available for Plus and Premier in 2025).

- Anniversary Companion Pass Qualifying Points: +10,000 CPQs per year on every consumer card.

- No Foreign Transaction Fees: Applies to Plus, Premier, Priority, Premier Business and Performance Business cards.e.

7. Tier Qualifying Points (TQPs)

New accelerated earn structure starting July 24, 2025:

- Priority & Performance Business Cards: 2,500 TQPs per $5,000 spent (formerly 1,500 per $10,000).

- Premier Card: now earns 1,500 TQPs per $5,000.

- Premier Business: 2,000 TQPs per $5,000.

- Plus and Plus Business: No TQP benefit.

8. Companion Pass Qualification

All points earned via these cards—including anniversary bonuses and welcome offers—count toward the Companion Pass, letting you fly with one person free (excluding taxes and fees) when you redeem or purchase Southwest flights.

9. Limited-Time Welcome Offer (July 24–September 17, 2025)

New cardholders of Priority, Premier, or Plus consumer cards can earn 100,000 bonus Rapid Rewards points after spending $4,000 within the first five months of account opening—the best offer of the year.

Each Southwest credit card has its own set of benefits to fit different travel styles and spending habits. Choose the card that works for you and maximize your rewards and travel experience.

Comparative Analysis: Business vs. Personal Southwest Cards

1. Annual Fee vs. Value

- Business cards, especially the Performance Business Card, now carry a higher annual fee ($299) compared to the equivalent Priority consumer card ($229).

- However, the added benefits—higher bonus categories, expedited status, more generous seat upgrades—justify the premium for businesses that travel often.

2. Bonus Earning Rates

- Business cards reward broader categories:

- Performance Business offers 2X points on hotels, gas, restaurants, transit, rideshare, and Southwest purchases.

- Personal Priority card caps at 2X for gas & dining, and 4X on Southwest flights.

- These richer categories on business cards enable faster accumulation for heavy operational spending.

3. Travel and Seat Benefits

- Both families of cards now include:

- First checked bag free for the cardholder plus up to eight companions.

- Boarding in Group 5, ahead of most passengers.

- Business cards—especially Performance—go further:

- Preferred or standard seat selection at booking (where available).

- Unlimited upgrades to Extra Legroom within 48 hours of departure for cardholder plus companions.

- Priority consumer card offers similar upgrades, while Premier consumer cards only get preferred/standard choice shortly before departure.

4. Elite Qualification (TQPs)

- Performance Business and Priority Consumer cardholders now earn 2,500 Tier Qualifying Points per $5,000 spent—doubling the previous rate.

- Premier Business earns 2,000 TQPs per $5,000, faster than most personal cards.

- Plus and Premier Consumer cards continue to offer 1,500 TQPs per $5,000, or none in the case of Plus.

- For businesses that spend heavily, the accelerated path to A‑List status is a major advantage.

5. Anniversary and Promotional Perks

- Both card types include valuable annual bonuses:

- Performance Business: 9,000 anniversary points.

- Premier Business: 6,000 points.

- Personal cards have varying levels (3,000 to 7,500).

- Personal cards add flight discount promo codes (10% or 15%) each year—absent on Business cards.

6. Employee Cards & Management

- Business cards allow for free employee cards, with full earning capabilities on shared spending—a feature unique to the business lineup.

Which Card Fits You?

- Choose a Business card if you:

- Spend heavily on travel, lodging, dining, fuel, or commuting.

- Need seat flexibility (especially extra-legroom) and enjoy perks for team/group travel.

- Value faster elite status progression and workforce-wide point accumulation.

- Opt for a Personal card if you:

- Fly occasionally or travel primarily for leisure.

- Want lower annual fees for a decent perk package.

- Appreciate occasional seat selection, promo codes, and simpler family travel perks.

With Southwest’s new business model featuring assigned seating, baggage fees, and reward earning aligned to spending, the Performance Business Card emerges as the most robust choice for business travelers seeking maximum return. For more leisure-focused flyers, Priority or Premier Personal cards offer solid value without the busy‑traveler complexity.

| Benefit | Plus | Premier | Priority | Premier Business | Performance Business |

|---|---|---|---|---|---|

| Annual Fee | $99 (↑) | $149 (↑) | $229 (↑) | $149 (↑) | $299 (↑) |

| Anniversary Points | 3,000 | 6,000 | 7,500 | 6,000 | 9,000 |

| SW Air Spend | 2X | 3X | 4X | 3X | 4X |

| Everyday 2× Today | Gas & Grocery | Grocery & Dining | Gas & Dining | Grocery & Dining | Gas & Dining |

| Checked Bag Free | ✓ for you + 8 | ✓ for you + 8 | ✓ for you + 8 | ✓ for you + 8 | ✓ for you + 8 |

| Seat Selection | Std 48h | Pref/Std 48h | Pref/Std at booking + upgrades | Pref/Std 48h | Pref/Std at booking + upgrades |

| Group 5 Boarding | ✓ | ✓ | ✓ | ✓ | ✓ |

| TQPs per $5K | None | 1,500 | 2,500 | 2,000 | 2,500 |

| Flight Discount Code | 10% | 15% | — | — | — |

| Global Entry / TSA Credit | — | — | — | — | $100 |

| Companion Pass CPQs/year | +10,000 | +10,000 | +10,000 | +10,000 | +10,000 |

| Foreign Transaction Fee | No | No | No | No | No |

| Welcome Offer (bonus pts) | 100K | 100K | 100K | 60K | 80K |

Choosing the Right Card

Choosing the right Southwest credit card depends on your travel habits and spending:

- Casual Travelers: The Rapid Rewards Plus Credit Card has a lower annual fee and basic rewards for those who fly Southwest infrequently.

- Domestic Flyers: The Rapid Rewards Premier Credit Card has higher earning on Southwest purchases and no foreign transaction fees for regular domestic travelers.

- International Flyers: The Rapid Rewards Priority Credit Card has travel credits and upgraded boardings for those who travel internationally or want more perks.

- Small Business Owners: The Premier Business Credit Card is for businesses with moderate travel needs, with rewards on Southwest purchases and commuting expenses.

- Heavy Business Travelers: The Performance Business Credit Card is for businesses with heavy travel requirements, with higher earnings, in-flight Wi-Fi credits and more perks.

Each card has its benefits, so it’s up to you to assess your travel frequency, spending, and desired benefits to decide which one is best for you.

Chase’s 5/24 Rule: What You Need to Know

If you’re applying for a Southwest credit card, you should know about Chase’s 5/24 rule. This unofficial rule means if you’ve opened 5 or more credit cards (from any bank) in the last 24 months, Chase will denied your application for a new card—including Southwest cards.

One thing to note is most business credit cards don’t count towards the 5-card limit, but there are some exceptions.

Being added as an authorized user on someone else’s personal credit card does count towards your 5 card total.

Can You Have More Than One Southwest Card?

If you like Southwest, you might be wondering if you can have multiple Southwest credit cards. Here’s how it works:

- You can only have one Southwest personal card at a time.

- You can have one personal and one business card at the same time.

- If you have a business, you’re allowed to have both Southwest business cards at the same time.

- You can’t have two of the same Southwest business card, even if for different businesses.

Southwest’s 24-Month Bonus Rule

Chase has a 24-month rule for Southwest credit card bonuses. This rule applies differently to personal and business cards:

Personal Cards

You can only earn a sign-up bonus on a Southwest personal card once every 24 months. This means if you’ve earned a bonus on any Southwest personal card in the last two years, you won’t be eligible for another one until that time has passed.

Note the 24-month clock starts when you receive the bonus, not when you open the card. If you’re not sure when you last earned a bonus, you can call Chase customer service and they’ll tell you.

Business Cards

The rules for business cards are a little more lenient. You can earn a sign-up bonus on a Southwest business card as long as you haven’t earned a bonus for that specific card in the last 24 months. But you can earn a bonus on a different Southwest business card within that timeframe.

Keep these rules in mind and you’ll plan your applications strategically and maximize your Southwest Rapid Rewards!

Now, Southwest is offering a limited-time offer for new personal credit card applicants to get the Companion Pass. To qualify, you need to apply for a personal Southwest credit card and spend $4,000 within the first 3 months. Once you meet this requirement, you’ll get 30,000 bonus points and the Companion Pass which allows you to pick one person to fly with you free (excluding taxes and fees from $5.60 one way), unlimited times whenever you buy or redeem points for a flight. Offer ends March 31, 2025.

The Companion Pass earned through this offer is good through February 28, 2026.

This offer is available on all three personal Southwest credit cards:

- Southwest Rapid Rewards Plus Credit Card

- Southwest Rapid Rewards Premier Credit Card

- Southwest Rapid Rewards Priority Credit Card

Each card has its own benefits and annual fee so be sure to review each to see which one fits your travel style and budget.

Business Southwest credit cards are not included in this offer.

For more info and to apply visit Southwest’s website or reputable financial news sites.

In Сonclusion

Explore the updated benefits of Southwest credit cards in 2025 to find the perfect fit for your travel habits.

The Southwest Rapid Rewards Premier Credit Card is ranked #1 and the Priority Credit Card is ranked #2 in their respective segments as the best co-branded airline credit cards in terms of customer satisfaction (according to J.D.Power).

Which Southwest Business Card is Best?

If you fly Southwest a few times a year and want to save on the annual fee, go with the Premier Business Card ($149). If you fly Southwest frequently and want travel perks like upgraded boarding and TSA PreCheck credit, the Performance Business Card ($299) is worth the extra cost.

Both cards help you earn points toward the Companion Pass, so if you're working toward that benefit, picking the right card can make a big difference!

Is a Southwest Credit Card Hard to Get?

If your credit score is above 700, you haven’t opened too many cards recently, and you meet Chase’s 5/24 rule, you have a good chance of getting approved.

Which Is the Best Southwest Credit Card?

- Best perks for the cost: Southwest Rapid Rewards Priority Card

- Best for Budget Travelers: Southwest Rapid Rewards Plus Card – Lowest annual fee

- Best for Business Travelers: Southwest Rapid Rewards Performance Business Card – Most travel perks

If you fly Southwest regularly, the Priority Card is the best value. If you’re looking for a business card, go with the Performance Business Card for premium perks.