Smart Ways to Use Citi ThankYou Points Today

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

If you’ve been racking up Citi points, you’re probably wondering how to redeem them for the best possible value. There are many ways to use Citi ThankYou points, and the difference between decent and excellent use can easily be two to three times in value. This guide is for anyone looking to turn those hard-earned points into real travel savings, luxury experiences, or even cash—without falling for common traps. We’ll break down which redemption paths are worth your time, which partners deliver the most value, and how to avoid costly mistakes.

What Are Your Redemption Paths—And Which Are Worth It?

Citi gives you multiple ways to redeem ThankYou Points: cash-like uses, gift cards, the Citi Travel portal, and transfers to airline/hotel partners.

Not all are created equal.

Cash or statement credit

Available in selected forms (e.g., via Shop with Points at online retailers or selected statement credits when offered). Citi explicitly allows linking retailer accounts and covering part or all of a purchase, often crediting as a statement adjustment. Expect weak value around 0.5–1.0 cents per point (cpp), with some routes historically at 0.8 cpp or less.

Gift cards

Usually, land near 1.0 cpp, sometimes lower during off‑promotions. Simple but rarely optimal if you can travel.

Citi Travel portal

You can use points to book flights, hotels, car rentals, and attractions directly through Citi. Value often clocks in near 1.0 cpp (and sometimes as low as 0.8 cpp depending on card/offer), which is easy but not exciting.

Transfers to Airline and Hotel Partners

This is a case where excessive buyouts are common. Citi supports transfers—often 1:1—to a broad slate including Aeromexico, Avianca LifeMiles, Air France/KLM (Flying Blue), JetBlue, Qatar, Singapore Airlines, Virgin Atlantic, Wyndham, and more.

With the right partner and route, 1.6–2.0+ cpp is common; 3+ cpp is possible on premium long-haul when you find saver space.

Here’s the thing—value isn’t just a number; it’s the friction to get there. Before you chase a theoretical 4 cpp redemption, weigh these pitfalls:

- Devaluations and dynamic pricing: Award charts shift; many programs price dynamically. Saver space today can disappear tomorrow. A route that’s 60k miles now could be 80k next month.

- Surcharges and fees: Great mileage prices can be undercut by high carrier-imposed surcharges (e.g., some transatlantic flights), plus airport taxes, especially ex-UK.

- Scarce availability: The best awards (like premium cabins to Europe or Asia) often release limited seats. Flexibility is key.

- Complexity and time cost: Some partners require phone bookings, mixed-cabin quirks, or clunky websites. Transfers are irreversible, and not all are instant.

Do Citi ThankYou Points Expire?

For most people with active Citi Strata Premier, Strata Elite, or legacy Prestige cards, points don’t expire as long as the account is open and in good standing. But there are three important exceptions:

- Closing a Card

If you close your ThankYou-earning card without first moving the points into another active ThankYou account, those points are forfeited immediately. - Shared or Gifted Points

Points transferred to another Citi ThankYou member expire in 90 days, no matter what. This rule applies even if both accounts remain open. - Special Rules on Certain Cards

Some older or co-branded ThankYou cards (like AT&T Access or discontinued retail versions) apply their own expiration timelines if you don’t have a premium card linked. Always double-check.

To be safe, log in to thankyou.com and click “My Points Summary” to see exact expiration dates tied to your account.

Transfer Partners That Commonly Deliver Value

Below are partners frequently yielding above-average value. Each includes a “why it’s good” and a caveat so you’re clear on trade-offs.

Avianca LifeMiles (Star Alliance)

Why it’s good: Competitive award pricing and no fuel surcharges on most partners; think U.S.–Europe in economy around 20k and business around 60k one-way on some routes when saver space appears. LifeMiles also runs transfer bonuses occasionally, amplifying value.

Caveat: IT can be quirky; mixed-cabin itineraries sometimes price oddly; schedule changes require patience. Award space still depends on partner releases.

Air France/KLM Flying Blue (SkyTeam)

Why it’s good: Monthly Promo Rewards can drop Europe prices meaningfully; wide partner network, good to/from secondary European cities. Transfers are typically fast, and availability is decent relative to peers.

Caveat: Dynamic pricing can swing wildly; expect moderate surcharges, especially ex-Europe. Hot dates price high.

Turkish Airlines Miles&Smiles (Star Alliance)

Why it’s good: One of the best domestic sweet spots—United-operated domestic awards at 7.5k economy / 12.5k business one-way, including flights to Hawaii, when space exists.

Caveat: Booking can require patience (website and office interactions), and finding saver inventory on United can be the gating factor.

Virgin Atlantic Flying Club (non-alliance; partners include Delta, ANA, Air France/KLM)

Why it’s good: Historically excellent partner awards (e.g., ANA first/business from the U.S. to Japan), and competitive pricing for select Delta and transatlantic routes; Upper Class can be fun for East Coast–UK.

Caveat: Surcharges can be steep on Virgin Atlantic metal and some partners; UK Air Passenger Duty adds pain. Recent chart changes have narrowed some sweet spots.

Singapore Airlines KrisFlyer (Star Alliance)

Why it’s good: Access to Singapore premium cabins like Suites on the A380 (often not bookable via partners) and solid Asia connectivity.

Caveat: Premium-cabin availability is limited; devaluations happen; surcharges and dynamic elements mean deals vary.

Qatar Airways Privilege Club (oneworld, Avios)

Why it’s good: Qsuite is a bucket-list business product on many U.S.–Doha routes with onward connections. Using Avios can open transfers across IAG programs.

Caveat: Variable pricing, surcharges on some itineraries, and competition for popular routes. Routing through Doha may add taxes.

JetBlue TrueBlue (U.S. domestic and Caribbean)

Why it’s good: Simple revenue-based redemptions average around 1.5 cpp in many cases—great for short-haul, last-minute domestic, and when you just want an easy button.

Caveat: No magical sweet spots; premium Mint awards can price high. If cash fares are low, portals or paying cash can be better.

Wyndham Rewards (hotels, plus Vacasa vacation rentals)

Why it’s good: Transfers enable hotel stays when airfare isn’t your goal; Vacasa redemptions can be strong for families in high-cash-cost markets.

Caveat: Property quality varies; award availability can be limited during peak periods. Run the math against cash prices.

When Transfers Make Sense

Think of transfers as your secret lever — the one you pull when the numbers swing dramatically in your favor. The sweet spot is when award pricing in partner miles crushes what you’d pay in the Citi Travel portal or in cash. That’s when Citi points stop being “just another rewards currency” and start acting like a backstage pass.

The most obvious wins show up on big-ticket trips. Business class to Europe might sell for $3,000 cash, but through a partner program you’ll see the same seat for 60,000 miles. That turns your Citi points into 3–4 cents of value each, instead of the one cent you’d get booking through Citi Travel.

Sometimes the deal is hiding in plain sight — like Turkish domestic awards on United metal for 7,500 miles, or a Flying Blue Promo Reward that slashes the cost of a transatlantic hop. And if a transfer bonus is live, those already-good prices get even sweeter.

But there’s a flip side.

Transfers are a one-way street — once your points move, they’re locked. If a cash fare is already cheap, or dynamic pricing inflates award costs, you could come out behind.

Don’t forget about taxes and surcharges either: European departures and some carriers (like Virgin Atlantic) tack on hefty extras that eat into your cents-per-point value. Always check award space first, run the math, and only transfer when you know the numbers tilt in your favor.

Real-World Scenarios

| Scenario | What to Do | Why It Works / Caveat |

|---|---|---|

| Last-minute domestic fare jumps to $350+ one-way | Check Turkish Miles&Smiles for United space; failing that, JetBlue TrueBlue or pay cash | Turkish domestic awards at 7.5k/12.5k are unbeatable if saver space exists; JetBlue averages ~1.5 cpp; if no space, cash may be simplest. |

| Economy to Europe in shoulder season | Search Flying Blue (Promo Rewards) and LifeMiles; consider transfer bonus | Flying Blue often shows decent space with moderate surcharges; LifeMiles avoids fuel surcharges; a 25% bonus can push value >2 cpp. |

| Business class to Europe for a honeymoon | Prioritize LifeMiles, Flying Blue, or Virgin on partner airlines | LifeMiles often hits 60k biz class; Flying Blue off-peak can be fair; Virgin offers luxury but beware high surcharges. |

| Family of four to Hawaii | Try Turkish on United metal; if no space, weigh Citi Travel portal vs. cash | 7.5k each way is a unicorn-level deal; but availability is limited, and portal bookings at ~1 cpp can be a fallback. |

| Amazon checkout tempts you to “Shop with Points” | Skip it; save points for transfers | “Shop with Points” is usually <1 cpp — far below the 1.5–3 cpp travel value. |

| Hotel-heavy trip with vacation rentals | Consider Wyndham transfers for Vacasa stays | Families can score excellent value in high-cash markets; but availability is spotty and redemptions are fixed at 15k points per bedroom per night. |

Quick decisions beat analysis paralysis. Use this cheat sheet to pick a path.

A Quick Word On the Citi Travel Portal

Citi explicitly supports booking flights, hotels, and more via Citi Travel. But portal redemption rates on many cards hover around 0.8–1.0 cpp, and user sentiment on the experience is mixed to negative. If a portal fare equals a direct-cash price and you won’t earn elite benefits anyway, it can be fine. Otherwise, either transfer to partners for outsized value or pay cash and save points for a better opportunity.

Strategy: Squeezing Value Without Wasting Time

Points can stretch far, but the trick is knowing when it’s worth the effort—and when to just book and move on. Here’s a simple framework to guide you.

Set Your Value Benchmarks

Think in terms of a floor and a ceiling:

- Floor: Gift cards, portal bookings, or other cash-like redemptions usually yield 0.8–1.0 cents per point (cpp). If a transfer won’t beat that—after factoring in taxes, fees, and time—skip it.

- Ceiling: Transfers to partners can be much stronger. A realistic goal: 1.6–2.0 cpp for economy and 2.0–4.0 cpp for premium cabins.

This way, you have a baseline for whether the move makes sense.

Always Check Cash vs. Award

Start by pricing the trip in cash. If it’s cheap, save your points. If cash fares are high, then it’s worth checking award options.

Use Smart Search Tools

You don’t need to dig through every airline site manually. A few tools make it faster:

- PointsCrowd (pointscrowd.com): Quickly surfaces partner availability and prices.

- ExpertFlyer: Seat maps, fare buckets, and alerts.

- AwardWallet: Tracks balances and expirations.

- Seats.aero: Fast award searches on popular routes.

Pick the combo that fits your workflow.

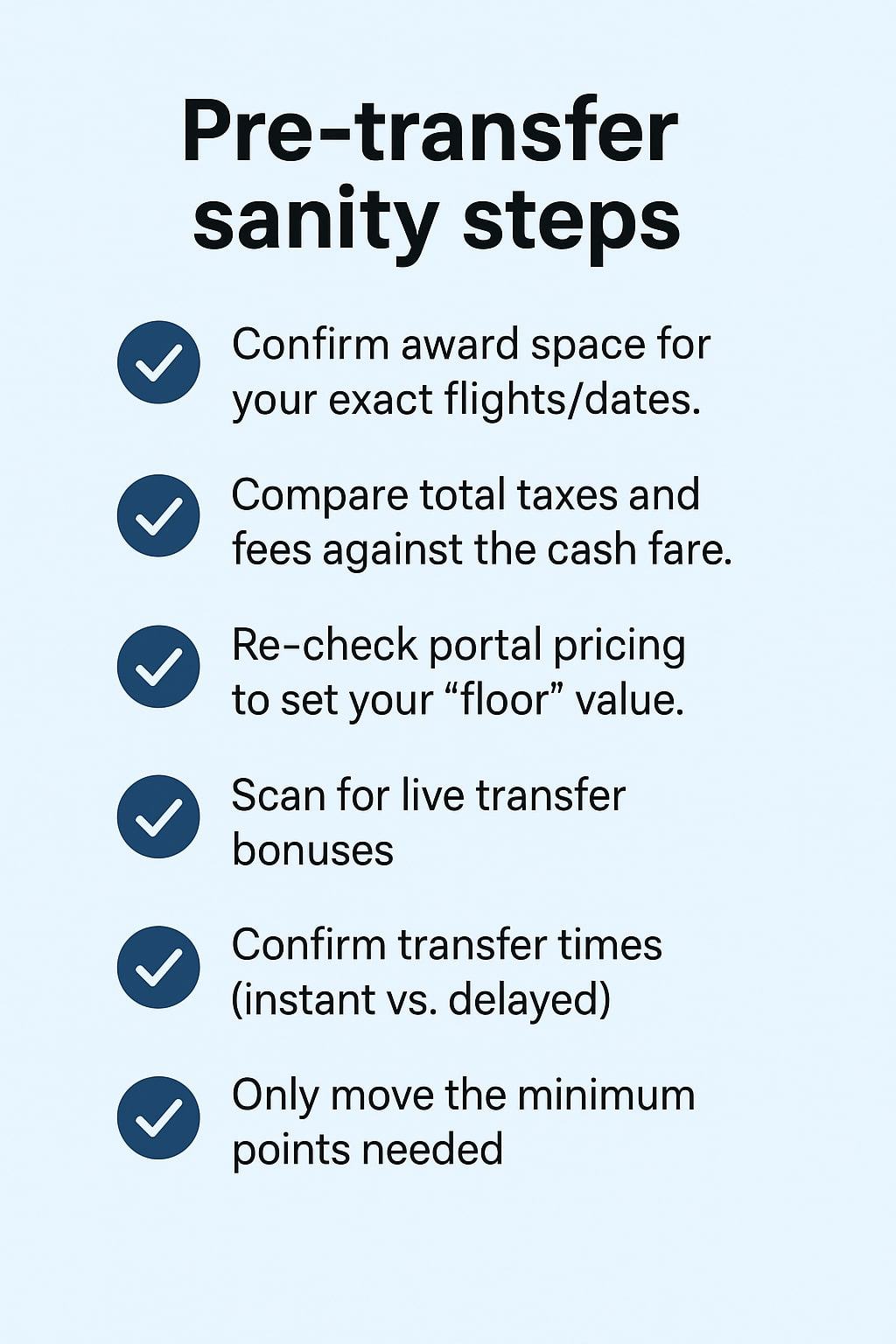

Confirm Before You Transfer

Never move points until you’ve confirmed award space. Check directly on the partner’s site, grab flight details, and re-check right before you hit transfer.

Transfer Bonuses: Helpful, Not Everything

Bonuses can make redemptions shine—like a 25% Citi → Avianca bonus that pushed real-world value to ~2.0 cpp on Europe flights. But don’t let the bonus lure you into a redemption that still loses against the cash fare.

Watch Out for Fees and Quirks

Different programs behave differently:

| Program | Quirks / Caveats |

|---|---|

| Flying Blue | Dynamic pricing, moderate surcharges; strong on Promo Rewards. |

| Virgin Atlantic | Great partner values, but surcharges (esp. UK APD) can sting. |

| LifeMiles | No fuel surcharges, but clunky site and odd mixed-cabin issues. |

| Turkish | Sweet-spot pricing, but booking process can be frustrating. |

The key: always check the final out-of-pocket costs before calling it a win.

Low-Value Cash Outs: Last Resort

Cashing out points for statement credits or loans often yields just 0.5–0.8 cpp. If you need cash, you’re usually better off with a true cashback card.

Don’t Forget Expiration Rules

Citi points can expire depending on the card and how they were earned. Always check your “My Points Summary” at thankyou.com. If you’re closing a card or risk inactivity, plan ahead: transfer to a partner you’ll actually use, or exit via gift cards.

A “60k miles to Europe in business” ticket isn’t automatically a win if you’re paying $400+ in surcharges. Always calculate net cpp after all costs.

What’s the best value use of Citi ThankYou Points?

Is the Citi travel portal a good option?

Are there any fees to transfer points?

Conclusions

Citi ThankYou Points offer a wide range of redemption options, but their value can vary significantly. If you are willing to put in a little work, transferring points to airline or hotel partner accounts can give you access to premium flights and unique hotels at a price significantly higher than the portal price or cash value.

With a little planning, you can turn your Citi ThankYou Points into an unforgettable trip without falling into the typical traps.