Karta Visa Infinite by Interactive Brokers: Who It’s For, and the Stand-Out Perks

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

From what is known, Interactive Brokers (IBKR) has partnered with Karta to issue a Karta Visa Infinite Credit Card designed for globally mobile clients who keep assets at IBKR. The card carries a $300 annual fee, no foreign transaction fees, and hooks directly into your IBKR brokerage for monthly payment — so you can spend worldwide without shuffling cash between bank accounts first.

Fees, eligibility & availability

- Annual fee: $300.

- FX fees: None.

- Up to $200K limit, with limits linked to U.S. assets;

- Karta also states a minimum $50,000 balance at a U.S. financial institution—IBKR’s page likewise requires $50k+ in IBKR assets. Citizens of China, Russia, and Venezuela are ineligible for this U.S. card.

How to apply for a Karta Visa Infinite Credit Card? If you’re already an IBKR client, apply via the Karta application portal from the IBKR page; if not, open an IBKR account first.

We will keep an eye out for new details if IBKR/Karta refine eligibility wording or publish additional underwriting criteria.

Key takeaways (from what is known)

- Premium Visa Infinite credit card built for IBKR clients; annual fee $300.

- No foreign transaction fees and instant virtual card issuance (Apple/Google Wallet) while your 17g metal card ships.

- Priority Pass Select airport lounge access (IBKR cites 1,300+ lounges). (Visit allowances/guesting aren’t specified on IBKR’s page.)

- Karta Points on every purchase with redemptions handled via WhatsApp (e.g., toward preferred airlines or hotels). IBKR does not publish an earn rate on its page. (Karta’s site references redeeming points for preferred airlines or hotels, but neither IBKR nor Karta publish a public earn rate for the IBKR-issued card—confirm in your cardholder materials.)

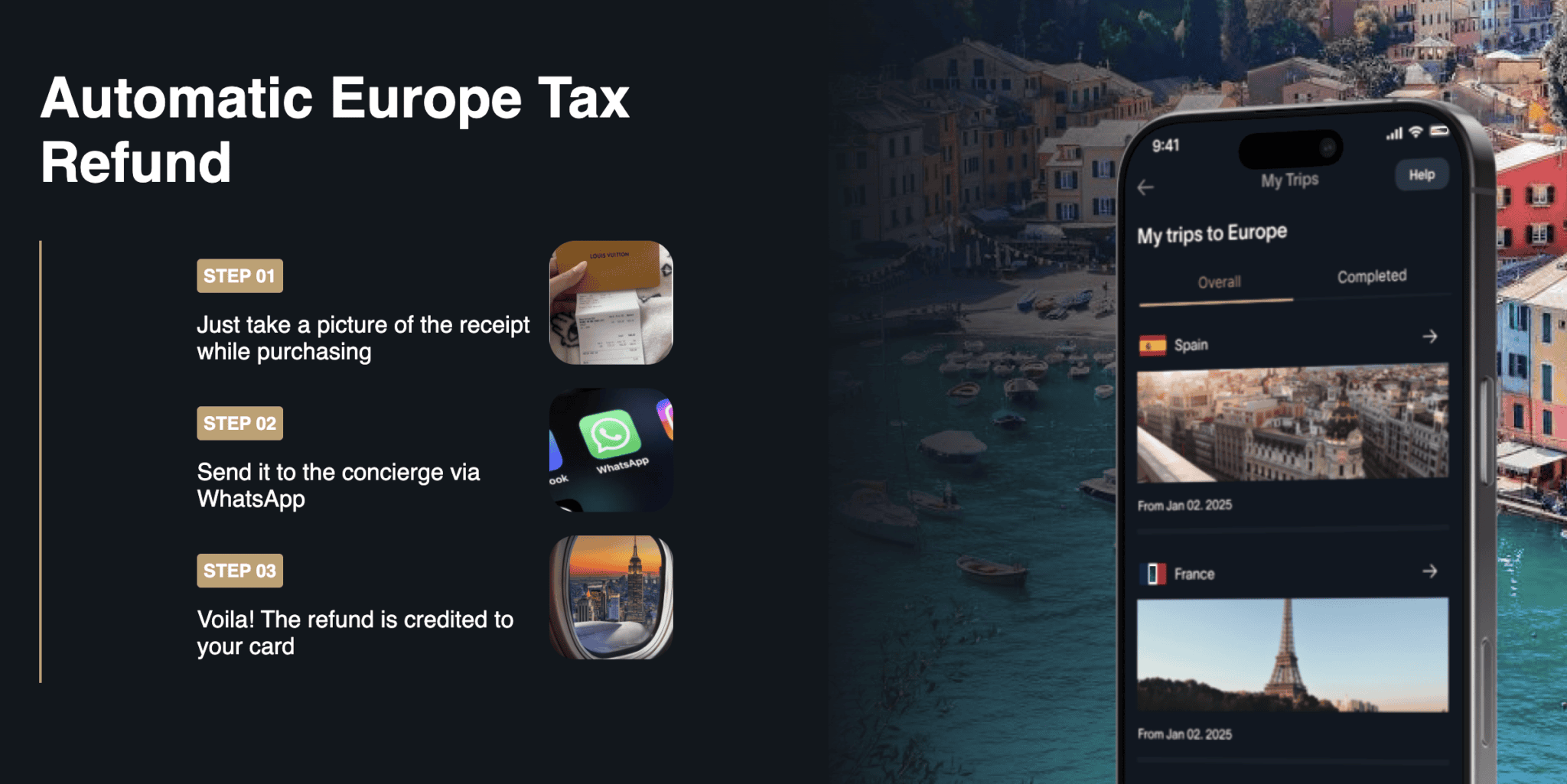

- WhatsApp concierge for spending, transfers, bill pay, real-time help, plus a global tax refund service.

- Eligibility: IBKR LLC clients with $50,000+ in assets in their brokerage account. Some citizenship exclusions apply (China, Russia, Venezuela).

Who is this card for?

If you’re already using Interactive Brokers and you like to travel or spend money in other countries, Karta lets you easily use your brokerage funds when you pay for purchases anywhere in the world without currency exchange fees. Plus, you get Visa Infinite perks like travel protection and access to airport lounges.

It’s also handy if you just want to keep all your money stuff – trading, borrowing, and spending – in one spot.

Here’s another thought: the card may be useful for those who have significant assets in the US but a less significant credit history in the US (the asset-based restrictions and WhatsApp customer service may be attractive in this case).

Benefits & Features

Below are all the currently known benefits of the Karta Visa Infinite Credit Card.

Unique feature: direct IBKR integration

Your card account ties into your IBKR setup; IBKR also advertises competitive interest on uninvested cash (up to 3.37% on the IBKR side) and low margin rates (as low as 4.37% for IBKR Pro)—contextual perks of the integrated account, not the card itself.

Visa Infinite protections & travel perks

- Price Protection: up to $4,000 per claim

- Baggage Delay: up to $600; Baggage Loss: up to $3,000

- Purchase Protection: up to $20,000

- Visa Luxury Hotel Collection privileges

- Global Auto Rental Insurance

- Up to USD 1.5 million in emergency medical coverage for international travel on the Karta Visa Infinite.

Important: These caps are advertised by Karta; the controlling limits/exclusions are those in your issuer’s Guide to Benefits delivered after approval. Coverage availability and amounts can vary by issuer/region and require paying with the card.

VIP Airport lounge access

Priority Pass Select access at 1,300+ lounges. (IBKR’s page doesn’t specify visit counts or guest policy—check your welcome materials.)

Digital-first experience

Instant virtual card + Apple/Google Wallet support; WhatsApp assistant for account tasks, redemptions, and global VAT refund submissions.

No FX fees

Spend globally with no surprise foreign transaction charges.

Additional cards for family/others

Additional cards for family/others are referenced in Karta materials. Availability and fees (if any) should be verified in the IBKR/Karta cardholder agreement.

You can actually find the same good stuff for less somewhere else…

If you just look at the basic travel perks – like no fees when you use your card in other countries, some protection when you travel or shop, and lounge access – lots of cards with lower yearly fees (or even no fee at all!) give you some of those things. Plus, some popular fancy cards have better lounge access and clear points systems. What makes this card stand out isn’t a big sign-up bonus or extra points on certain things (which they don’t tell you about anyway), but that it works with IBKR and your spending limit is tied to your investments.

Bottom line

Okay, so the Karta Visa Infinite card is probably best for you if:

- You have at least $50,000 sitting in an IBKR account.

- You want to spend money abroad without those pesky foreign transaction fees and still have credit card protection.

- You’d rather pay directly from your investment account instead of transferring cash beforehand.

If those things don’t sound like you, there are other cards out there with similar perks that might cost you less. This is especially true if you care about rewards rates, sign-up bonuses, or having access to more airport lounges.

We’re keeping our eyes peeled for more info, especially about how the points system works, what the deal is with Priority Pass (how many visits, how many guests), and if anything changes about who can get the card. We’ll let you know as soon as IBKR or Karta releases more details.

Who doesnt love a credit card that ties your investment portfolio directly to your ability to lounge in airport chairs? The Karta card sounds like a neat trick for IBKR users, turning dusty brokerage cash into jetsetter perks without the usual faff. No FX fees? Magic! Though, honestly, the idea of managing my finances through WhatsApp is about as appealing as parsing through my brokers earnings reports. Still, for those with serious assets parked at IBKR and a yen for global adventures (or just avoiding pesky currency fees), its a clever play. Just hope thePriority Pass access isnt like trying to get *into* Interactive Brokers – sometimes those doors are just *so* exclusive!

Yes, you are absolutely right! We will follow the official information, because many questions remain unanswered at this point.