Increased SignUp Bonus on the JetBlue Business Card (Up to 80,000 Miles)

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

Offer Ends: Expired

Barclays is improving the welcome offer for the JetBlue Business Card to 80,000 TrueBlue points, which is good news because business versions of airline cards don’t improve as often as consumer ones. Doctor of Credit was the first to notice this: 60,000 points after spending $2,000 + AF in 90 days, plus another 20,000 points after spending $6,000 total in the first year. The annual fee is still $99.

Let’s find out if this is really a good deal, how it compares to past promotions, and most importantly, what you can do with 80,000 JetBlue points so they don’t just sit there unused.

What the Current Offer is

The limited-time business offer is essentially 60k + 20k: you earn 60,000 TrueBlue points after a relatively modest early spend and paying the $99 fee, then another 20,000 points after you finish the longer first-year spend requirement. Total: 80,000 points. That’s exactly the same shape we’ve seen on the JetBlue Plus personal card.

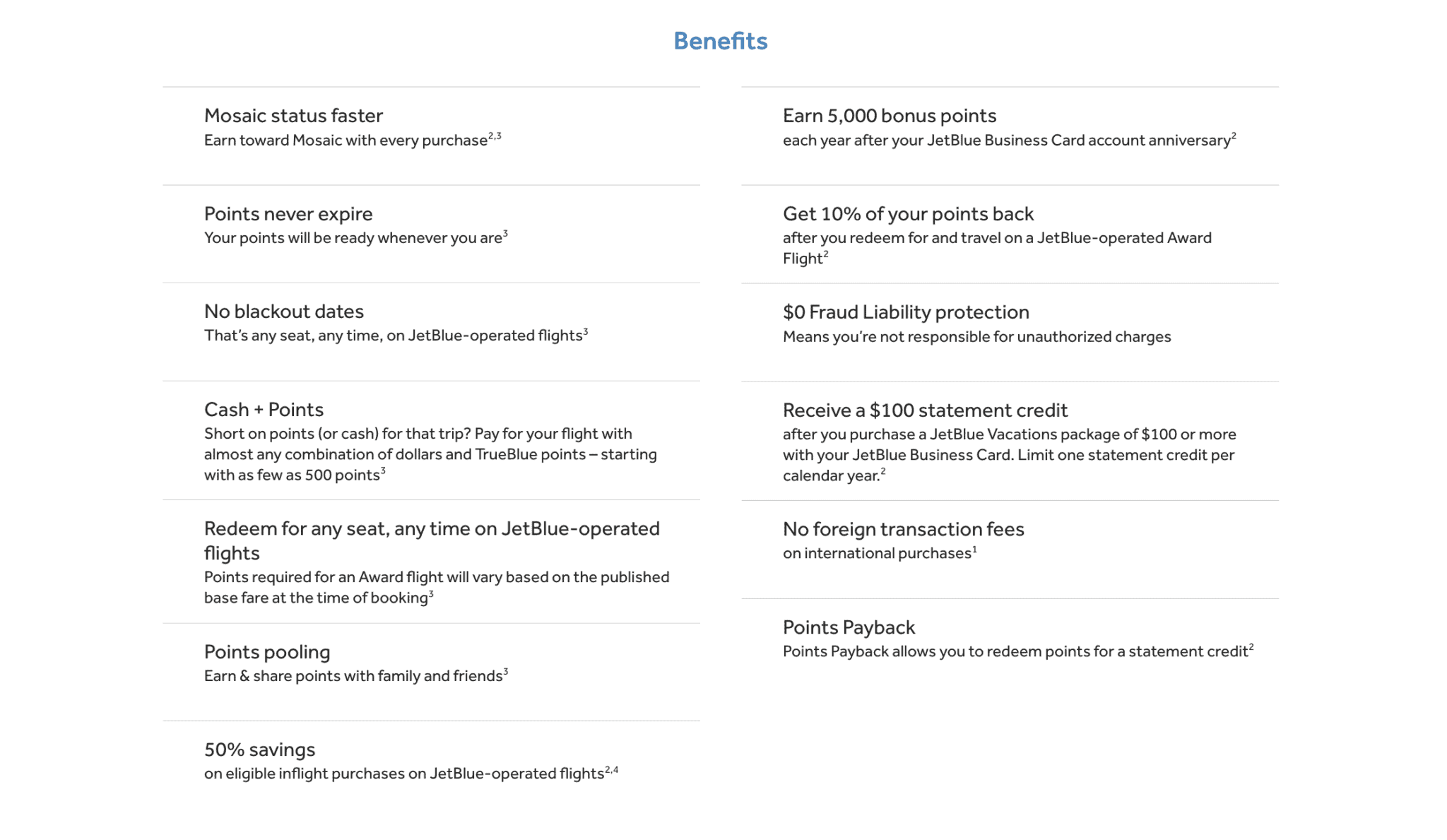

Earning structure (same as usual):

- 6× on JetBlue purchases

- 2× at restaurants and office supply stores (business twist vs. the personal Plus card’s groceries)

- 1× everywhere else

- 5,000 anniversary points every year

- Group A boarding on JetBlue-operated flights

- 10% of your points back after you redeem and fly a JetBlue award

- First checked bag for you + 3 companions on the same PNR

Historical Context

Most of the last couple of years the business card has sat around 50,000 points (sometimes 60,000) for $2,000–$4,000 in 90 days.

A few years back Barclays ran a 100,000-point JetBlue card offer (pandemic/2020 era), and later we saw 80k + $99 statement credit flavors come and go. That 100k was the outlier; 80k has shown up several times since 2022 on both the personal Plus and the Business card, usually for a short window.

So the way to rate the current offer:

- vs. everyday offer (50k–60k): very good

- vs. recent best (80k): ties the best

- vs. all-time unicorn (100k in 2020): second best

That’s enough for us to call it “apply-if-you-can” territory — especially if you’re over 5/24 and don’t see many Barclays cards you want later.

What are 80,000 JetBlue Points Worth?

JetBlue’s award prices usually follow the cash price, so you won’t find crazy deals where your points are worth a ton. But the value is pretty steady. Right now, most places say TrueBlue points are worth around 1.3–1.5 cents each. Let’s split the difference and say each point is worth 1.4 cents.

- 80,000 points × 1.4 cents = $1,120 in flights

- When you use your points, JetBlue gives you 10% back. Now you have 8,000 points again, which at 1.4 cents each is about $110 more.

- If you keep the card, you also get 5,000 points each year, which is like getting another $70.

You only pay $99 in the first year.

You can debate how much each point is worth, but it’s clear that you’re getting a lot of value. You can easily get over $1,100 in flight value from a $99 card in the first year. Plus, you still get the free bag and the 10% points back. For an airline card, that’s a great deal.

Real Ways to Use 80K

Okay, so here’s the deal with this offer and where it actually makes sense:

If you’re living where JetBlue is popular—think Boston, New York (all airports), Fort Lauderdale, Orlando, San Juan, or even LA—those 80,000 points can disappear super quick. Flying from the Northeast to Florida or the Caribbean when everyone else is? Yeah, those flights can easily cost 12,000–16,000 points each way. So, for a family of three taking four trips, that bonus is gone even before you get that 10% back. It’s like, those 80,000 points aren’t just a number, they’re your next vacation.

If you’re always flying across the country (like JFK/BOS to LAX/SFO), you can often find fares for 15,000–20,000 points. When the cash price is $230–$300, that’s pretty good. Getting five of those flights from the bonus? Awesome. And if you see a sale, which happens now and then, you could spend most of those 80,000 points on a fancy flight. Then, you get 8,000 points back to use later. If you’re into points, it’s a way to try out the fancy seats once and then let the 10% rebate help you get more points.

JetBlue now flies to London, Paris, Amsterdam, and Edinburgh, which is good for this bonus. Flights in the main cabin to those places are often around 25,000–35,000 points. Those 80,000 points could get you two or three one-way tickets or a round trip plus a connecting flight. Is it as cool as transferring Amex points to Air France with a bonus? Maybe not. But if you already use JetBlue, it’s way easier.

Who Can Open the JetBlue Business Card?

You don’t need a giant company or payroll to get it. Barclays (like Amex, Chase, Citi) is fine with small and very small businesses:

- sole proprietors (you + your laptop),

- freelancers/consultants,

- Airbnb/VRBO hosts,

- resellers (eBay, Etsy, FB Marketplace),

- content/IG/TikTok creators who get paid,

- people who do 1099 work on the side.

If you make money in a repeatable way, that’s a business. On the app, you can choose “sole proprietorship,” use your own name as the business name, use your SSN instead of an EIN, and enter your actual annual revenue (it can be small). Barclays sometimes asks for a little extra (proof of biz or LLC docs), but people report getting approved as sole props just fine.

So the “owner” can absolutely be you, as long as you have a real income activity and you’re going to use the card for business expenses (office supplies, ads, software, travel). You don’t have to be incorporated.

Who Should Actually Grab This

This offer is best for someone who

- flies JetBlue at least a couple of times a year,

- can meet the $2k/$6k split without acrobatics

- values the card’s permanent perks — especially free checked bag for you and 3 companions 10% back on awards.

That last one matters because it’s a built-in devaluation shield: every time JetBlue nudges prices up, you’re getting a little of it back.

Conclusion

This is a good public business offer that we have seen in recent years. If you fly JetBlue often enough to use your points quickly, then this is an easy choice.