Citi Points Transfer Partners: Best Ways to Redeem 2026

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

Citi ThankYou Points are Citi’s flexible rewards currency. Unlike airline-specific miles or hotel points, you’re not locked into a single loyalty program. Instead, you can:

- Redeem for travel, gift cards, or statement credits (typically at ~1¢ per point).

- Or — the real value play — transfer to airline and hotel partners for outsized travel rewards.

That flexibility is what makes Citi one of the “big four” transferable points programs (alongside Amex Membership Rewards, Chase Ultimate Rewards, and Capital One Miles).

Citi’s transfer partners open the door to some of the best award flights and hotel deals in the game. But here’s the catch — figuring out which partners are worth it (and which are not) can be confusing.

This guide walks you through everything you need to know: the full list of Citi transfer partners, how to actually transfer, real-world redemption examples, and answers to common questions like. Stick around until the end for a “pro move” that’ll help you squeeze extra value out of your points.

Why Citi Transfer Partners Matter

Here’s the thingv—vwhen you redeem Citi points directly for gift cards or statement credits, you’ll usually get a weak return (often just 1 cent per point or less). But when you transfer to an airline or hotel partner, that same stash of points can unlock premium flights, luxury hotel stays, or even multiple economy trips.

- Proof example: 60,000 Citi points → transferred to Virgin Atlantic → round-trip ANA business class ticket from the US to Tokyo (worth $5,000+ cash). That’s a redemption value of 8¢ per point instead of 1¢.

Transfer partners are where the magic happens.

Let’s go through which cards earn universal Citi points?

Which Citi Cards Earn ThankYou Points?

Not all Citi cards earn transferable ThankYou points — only the premium travel cards do. Here are the main ones to know:

| Card | Annual Fee | Welcome Bonus (typical) | Points Earning | Notes |

|---|---|---|---|---|

| Citi Strata Elite | $595 | 80,000 ThankYou points after $4,000 spend in 3 months | 12x hotels, car rentals & attractions via CitiTravel.com; 6x air via CitiTravel.com; 6x restaurants on Citi Nights (Fri–Sat, 6pm–6am ET); 3x restaurants other times; 1.5x all other purchases | Premium card; unlocks 1:1 transfers (incl. AAdvantage) when using ThankYou; $75 per AU |

| Citi Strata Premier | $95 | Varies (often ~60,000 points after $4,000 spend) | 10x hotels, car rentals & attractions via CitiTravel.com; 3x air travel & other hotel purchases, restaurants, supermarkets, gas & EV charging; 1x all else | Best mid-tier; full 1:1 transfer access to airline/hotel partners (incl. AAdvantage) |

| Citi Prestige (discontinued) | $495 | N/A | 5x air travel & dining; 3x hotels & cruises | Not open to new applicants; existing cardholders retain benefits |

| Citi Double Cash | $0 | None | 2% back (1% when you buy + 1% when you pay) | Can be pooled into a Strata Premier/Elite account to enable 1:1 transfers; otherwise earns “limited” ThankYou points |

| Citi Rewards+ / “Strata” (no-AF) | $0 | Varies (e.g., ~20,000 points) | 2x supermarkets & gas (up to $6k/yr), 1x all else; rounds up to nearest 10 pts | 10% points back on first 100k redeemed per year (legacy benefit; sunset timelines may apply to newer accounts) |

| Citi Custom Cash | $0 | 20,000 points | 5% back (up to $500/mo) in your top eligible category; 1% all else | Pool with Strata Premier/Elite to unlock 1:1 transfers (otherwise “limited” points) |

*Welcome offers fluctuate. Always confirm current terms on Citi before applying.

Why this matters:

- To unlock all Citi transfer partners at the full 1:1 ratio (including AAdvantage), you need either the Strata Elite or the Strata Premier (or a legacy Prestige).

- The no-annual-fee cards (Double Cash, Rewards+, Custom Cash) become much more powerful when you pool points into a Strata Premier/Elite account.

Why the Strata Elite or Strata Premier Are the Keys to Transfer Partners

Here’s the thing: not every Citi card gives you full access to airline and hotel transfer partners. The no-annual-fee cards (Double Cash, Rewards+, Custom Cash) can earn ThankYou points, but those points are “base-level” — you can’t send them directly to airlines unless you also hold a Strata Premier or Strata Elite.

That’s where Citi’s two travel cards come in.

Citi Strata Premier — The Affordable Transfer Unlock

- Annual fee: $95

- Why it’s strong: At this price point, it’s one of the cheapest ways across any bank to unlock 1:1 airline and hotel transfers.

- Earning power: 10x points per dollar spent on Hotels, Car Rentals and Attractions booked on cititravel.com; 3x points on air travel, hotels, supermarkets, gas stations, and restaurants.

- Best for: Travelers who want full access to Citi transfer partners without paying premium-card fees.

Example in action:

Spend $1,000 at restaurants → earn 3,000 Citi points.

Pool in 2,000 from a Citi Double Cash.

Now you’ve got 5,000 points in your Strata Premier account → transfer to Air France Flying Blue → book a promo reward one-way to Europe for as little as 15,000 points.

Citi Strata Elite — The Premium Powerhouse

- Annual fee: $595

- Why it’s strong: Adds luxury travel benefits like 12x points on Hotels, Car Rentals, and Attractions booked on cititravel.com; 6x points on Air Travel booked on cititravel.com., at Restaurants including Restaurant Delivery Services, every Friday and Saturday from 6 p.m. to 6 a.m. ET and 3x points any other time; 1.5x points on All Other Purchases. — while also unlocking all 1:1 transfer partners.

- Earning power: Turbo-charged for frequent travelers who spend heavily on airfare, dining, and hotels.

- Best for: Road warriors and luxury flyers who value premium perks on top of transfer flexibility.

Example in action:

Book a $3,000 international business class ticket via Citi Travel → earn 30,000 points (10x).

Transfer 30,000 points to Virgin Atlantic → book ANA First Class Tokyo → US West Coast (normally $10,000+ cash).

If you want Citi points to act like “real” airline miles, you need a Strata card. The Premier is the low-cost unlock, while the Elite piles on travel perks and higher earning rates for frequent flyers.

Full List of Citi Points Transfer Partners

Here’s a snapshot of Citi’s airline and hotel partners. All transfers are generally at a 1:1 ratio, unless noted otherwise.

| Partner | Transfer Ratio | Notes |

|---|---|---|

| Avianca LifeMiles | 1:1 | Great for Star Alliance redemptions, no fuel surcharges. |

| American Airlines AAdvantage | 1:1 | New partner, high-value currency with rich partner options like Qantas, JAL, and Qatar |

| Singapore Airlines KrisFlyer | 1:1 | Access to premium cabins like Suites. |

| Virgin Atlantic Flying Club | 1:1 | Sweet spots for ANA & Delta awards. |

| Air France/KLM Flying Blue | 1:1 | Monthly promo rewards. |

| Emirates Skywards | 1:1 | Flex for business/first redemptions. |

| Qatar Airways Privilege Club | 1:1 | Qsuites with Avios transfers. |

| British Airways Executive Club | 1:1 | Good for short-haul Oneworld flights. |

| Etihad Guest | 1:1 | Unique partner redemptions (e.g., Royal Air Maroc). |

| Turkish Airlines Miles&Smiles | 1:1 | US–Europe biz class for 45k miles. |

| EVA Air Infinity MileageLands | 1:1 | Fewer sweet spots, but option. |

| Cathay Pacific Asia Miles | 1:1 | Great for Oneworld multi-carrier awards. |

| Qantas Frequent Flyer | 1:1 | Best for Australia domestic flights. |

| JetBlue TrueBlue | 1:1 | Fixed-value, but no blackout dates. |

| Thai Airways Royal Orchid Plus | 1:1 | Limited use. |

| Aeromexico Club Premier (as of January 25, 2026, it will no longer be a ThankYou partner) | 1:1 | SkyTeam partner, but watch surcharges. |

| Malaysia Airlines Enrich | 1:1 | Niche routes in Asia. |

| Virgin Australia Velocity | 1:1 | Useful for Oceania travel. |

| Accor Live Limitless (Hotels) | 2:1 | Only hotel partner, low value. |

| Choice Privileges | 1:2 for full access cards (Strata Premier/Elite/Prestige); ~1:1.5 (2:3) for no‑fee cards | Exceptional for Japan & Nordic hotels; even suites. |

| Preferred Hotels (I Prefer Hotel Rewards) | 1:4 via full‑access cards; reduced ~1:2.8 for no‑fee cards | Boutique luxury; spotty availability, variable value. |

| The Leading Hotels of the World Leaders Club (LHW) | 5:1 | High-end properties; small luxury footprint. |

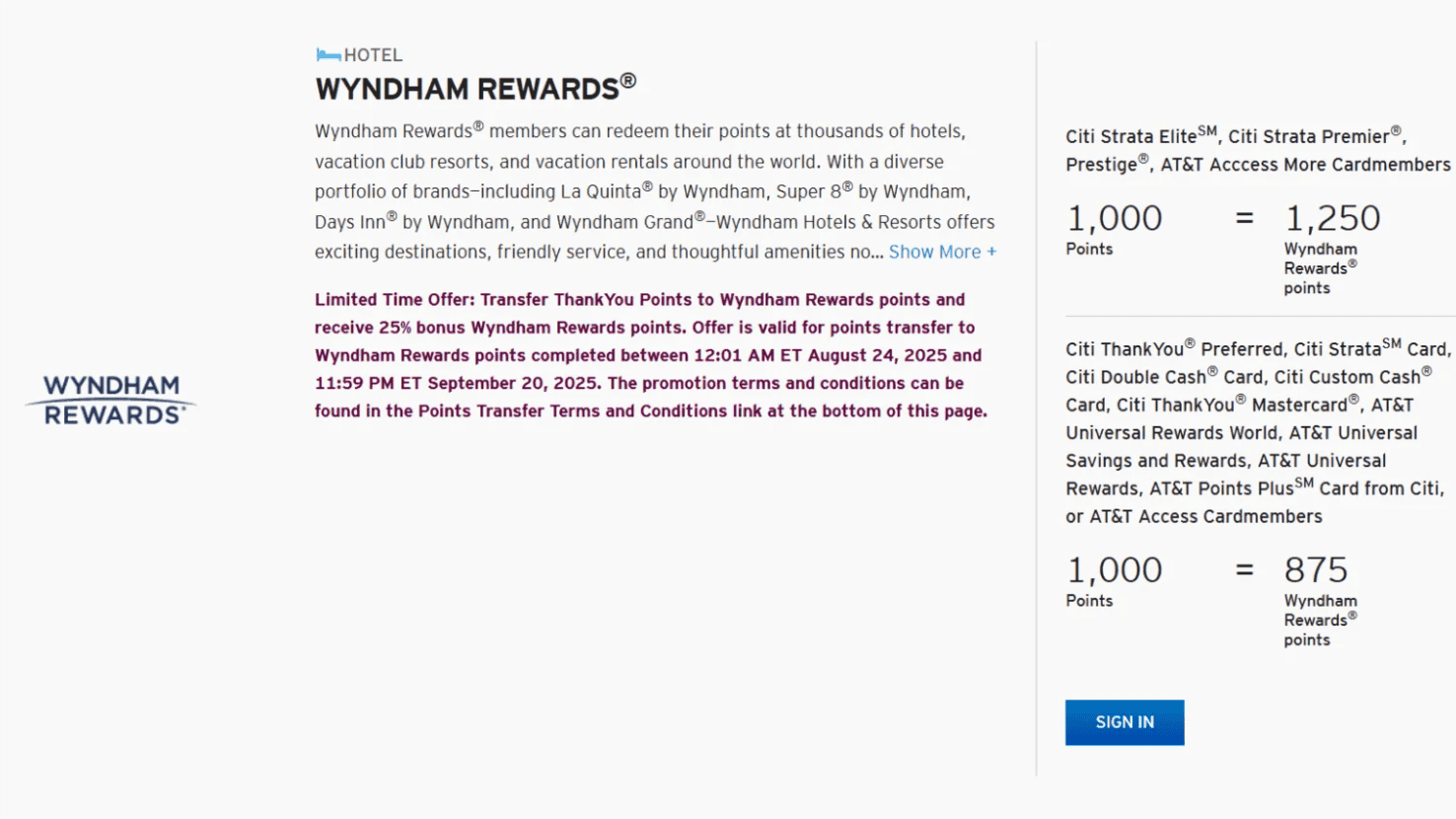

| Wyndham Rewards | 1:1 for full-access cards; reduced for no‑fee cards | Useful for affordable stays worldwide; often fixed-tier pricing. |

How to Transfer Citi Points

So how do you actually move points into one of these programs?

- Log into your Citi account → “Rewards” → “ThankYou Points.”

- Choose Transfer Points.

- Select your airline/hotel partner.

- Enter your frequent flyer number and the number of points.

- Confirm the transfer (note: transfers are irreversible).

Some transfers are instant (JetBlue, Flying Blue), while others (like Singapore Airlines) can take 24–48 hours. Always search for award space first.

Citi ThankYou + AAdvantage: Now a Permanent 1:1 Transfer Partner

Citi ThankYou Rewards has officially reintroduced American Airlines AAdvantage as a permanent transfer partner, effective July 27, 2025. Now, paying your everyday bills could turn into destination-worthy travel—with more flexibility than ever (details here).

Who Gets the Full 1:1 Ratio?

To transfer at the ideal 1:1 rate (1,000 Citi points = 1,000 AA miles), you need one of these premium Citi cards:

- Citi Strata Elite

- Citi Strata Premier

- Citi Prestige (also eligible, but not open to new applicants)

If you hold one of these cards, you unlock full value when transferring—boom, instant AA miles at face value.

What About No-Fee Citi Cards?

Good news for no‑annual‑fee cardholders: Citi has now enabled transfers to AAdvantage from select no‑fee ThankYou‑earning cards — but at a reduced ratio:

These cards can transfer at 1,000 Citi points → 700 AA miles.

Quick Comparison Table

| Citi Card Type | Transfer Ratio to AAdvantage | Who It’s Good For |

|---|---|---|

| Citi Strata Elite / Premier / Prestige | 1:1 (1,000 → 1,000 miles) | Max‑value redemptions; premium travel flexibility |

| No‑Fee Cards (Double Cash, etc.) | 1:0.7 (1,000 → 700 miles) | Good for occasional top‑off or no‑fee earners |

Why It Matters

Here’s the thing — AAdvantage is a high-value currency with rich partner options like Qantas, JAL, and Qatar — and now Citi users have direct access to it. This means you can turn everyday spending into memorable trips, and even ddpear instantly to your AAdvantage balance in many cases.

Real-World Redemption Scenarios

Here’s the real magic of Citi ThankYou transfers: turning points into first-class memories. Here’s how things are looking right now:

1. ANA Business Class via Virgin Atlantic

Premium double-suite luxury — often one of the best Citi redemptions.

- Cost: West Coast → Tokyo one-way: 45,000 Virgin miles + ~$150 taxes

- Thanksgiving example: round-trip business for 90K total Citi points (if transferred both ways)

2. AA AAdvantage Business/First Class Asia

Now a Citi transfer partner — great for Asia comfort.

- 60,000 AA miles one-way for business-class U.S. → Japan (e.g., ORD → HND), plus $5.60 in fees

- 80,000 AA miles one-way for JAL first-class between the U.S. and Tokyo, offering 10¢+ per mile value on high-cash fares

3. AA AAdvantage Domestic Value

Fast, efficient, and often undervalued way to use miles.

- Starting at just 7,500 miles each way for short U.S. flights — sweet if you want flexibility for under $100 tickets

- Near-instant value: 5,000 miles + $5.60 for IAD → MCO economy; cash equivalent fares often ~$134

4. Turkish Miles & Smiles Short-Haul Steal

Fantastic domestic sweet spot.

- U.S. domestic routes via United (mainland to Hawaii/Alaska) for just 10,000 miles economy or 15,000 miles biz one-way

Citi points are flexible, but the real wins come when you pay attention to partner sweet spots. Whether you’re craving first-class comfort or insane domestic value, the right transfer partner can make all the difference.

Can I book hotels with Citi transfer partners?

How fast are transfers?

Is there a cap on how many points I can transfer?

Can I use transferred points right away?

Citi Hotel Transfer Partners

According to Citi’s official site and trusted sources, these are the hotel loyalty programs that Citi ThankYou Points can transfer to:

- Accor Live Limitless (ALL) —Standard ratio: 2:1 (i.e., 1,000 Citi → 500 ALL)

(Recent short‑term bonus 1:1 example existed in 2025 but has since reverted to 2:1.) - Choice Privileges — 1:2 for full access cards (Strata Premier/Elite/Prestige); ~1:1.5 (2:3) for no‑fee cards

- Preferred Hotels & Resorts (I Prefer Hotel Rewards) – 1:4 (1,000 Citi → 4,000 I Prefer) via full‑access cards; reduced ~1:2.8 for no‑fee cards

- The Leading Hotels of the World Leaders Club (LHW) — 5:1 (1,000 Citi → 200 LHW points)

- Wyndham Rewards — 1:1 for full-access cards; reduced for no‑fee cards

Transfer ratios differ between full-access Citi cards (Strata Elite, Strata Premier, legacy Prestige) and no-fee ThankYou cards — always good to check your card’s level before transferring.

Transfer to I Prefer Hotel Rewards (Preferred Hotels & Resorts)

Citi ThankYou added I Prefer Hotel Rewards (Preferred Hotels & Resorts) as a transfer partner in late October 2024.

Transfer ratio: 1,000 Citi points → 4,000 I Prefer points (1:4).

Who’s eligible: Full 1:4 transfers are available to premium ThankYou accounts (e.g., Citi Strata Elite, Citi Strata Premier, and legacy Citi Prestige). Some non-annual-fee ThankYou cards may only get a reduced ratio (e.g., 1,000 → 2,800) per AwardWallet’s tracker.

How good is the value?

Hundreds of properties now show points availability, with example rates from 30,000 I Prefer points per night (that’s 7,500 Citi points after the 1:4 transfer). Always compare against cash prices.

Quick math check (rule of thumb): I Prefer points often net around ~0.2¢ each on many redemptions. At a 1:4 ratio, that’s roughly ~0.8¢ per Citi point—worse than typical airline sweet spots, but workable for specific hotels or top-offs when cash rates are high. Validate value on a case-by-case basis.

How to search & book

- Confirm award space on iprefer.com or the Preferred Hotels website (both have been finicky—try both).

- Only then transfer from Citi (irreversible).

- Complete the booking with I Prefer.

Citi Transfer Bonuses: How to Supercharge Your Points

Here’s the thing — Citi occasionally runs limited-time promotions that give you extra miles or points when you transfer ThankYou Points to select partners. These promos can turn a “good” redemption into an unbeatable one.

How It Works

- During a promo, Citi might offer 10%–30% more miles when you transfer to a specific airline or hotel partner.

- The bonus is automatic at the time of transfer — no extra registration required.

- You’ll see the promo highlighted in your Citi ThankYou transfer portal with the exact end date.

As an example, the latest promotion offers a 25% bonus when transferring Citi ThankYou points to Wyndham Rewards, valid until September 20, 2025.

Conclusion

Citi ThankYou points are some of the most flexible in the game, thanks to a deep bench of transfer partners. The real value lies in knowing which partners unlock outsized deals — like ANA business via Virgin Atlantic or short-haul AA flights via Avios. With a little planning and the right tools, your Citi points can easily be worth 2–5x more than cash back.