AA Transfer Partners & Earning Strategies

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

The American Airlines AAdvantage loyalty program (AA), like many others, allows you to increase your mileage balance by transferring points from your credit card program, converting hotel bonuses, or using other methods. In this article, we will review all current mileage AA transfer partners, how the process works, which transfers are the most profitable, and which ones are best to skip so that you can get the most out of every mile and turn your points into unforgettable trips.

| Transfer Partner Categories | Partner / Option | Transfer/Earning Details |

|---|---|---|

| Credit Card Transfers | Citi ThankYou | 1:1, reinstated Jul 27, 2025; selected cards only |

| Hotel Transfers | Marriott Bonvoy / Hyatt | Poor ratios; only for unused points |

| AAdvantage → Other | Other AAdvantage member | 1k-mile increments, ~$5 fee |

| Partner Airline Redemptions | Oneworld & codeshare airlines | Wide network, check availability first |

| Booking via Portals | Chase, Capital One, etc. | Cash-price redemption fallback |

Credit Card Transfer Partners

Citi ThankYou Rewards

Citi ThankYou Rewards is now the only official transfer partner for AAdvantage miles, reinstated on July 27, 2025. Transfers are at a 1:1 ratio, in 1,000‑mile increments, and typically require having one of these cards: Citi Strata Elite, Citi Strata Premier, or the former Citi Prestige—though the latter is no longer open to new applicants.

Steps For Transfer

- Log in to your Citi account and go to Rewards → Transfer Points.

- Select American Airlines AAdvantage as your partner.

- Enter your AAdvantage number and choose the transfer amount (min. 1,000 points).

- Confirm — transfers are instant in most cases.

Example:

You find a Qatar Airways Qsuite ticket from JFK–DOH for 70,000 AA miles. You have 50,000 AAdvantage miles + 20,000 Citi ThankYou points. Transfer 20,000 from Citi to AA, book instantly.

Other Credit Programs

Other major credit programs like Chase Ultimate Rewards or Amex Membership Rewards do not transfer directly to AAdvantage. However, you can still use those points to book AA flights via travel portals or transfer to other airline partners—like British Airways or Qantas—that then allow you to redeem for AA flights.

Indirect Transfers via Oneworld Partner Programs

Even though Chase, Amex, and Capital One can’t send points directly to AA, you can transfer to a partner airline that’s also in Oneworld and then book AA flights as awards.

Example: Chase Ultimate Rewards → British Airways Avios → Book AA

- Log in to Chase → Transfer to Travel Partners → select British Airways Executive Club (1:1 ratio).

- Transfer points (min. 1,000).

- Log in to BA’s site → Search for AA flights (note: BA shows only certain routes).

- Book using Avios; you’ll fly AA but pay in Avios.

When it makes sense:

- Short-haul domestic AA flights, especially under 1,151 miles, often price at 7,500–9,000 Avios vs. 12,500 AA miles.

Example: Amex Membership Rewards → Qatar Privilege Club → Book AA

- Transfer Amex points to Qatar Privilege Club at 1:1.

- Search for AA flights via Qatar’s site.

- Book using Avios — Qatar uses the same Avios pool as BA, but sometimes shows more availability.

Using Credit Card Travel Portals to Book AA Flights

When award seats aren’t available, booking through a portal can still “convert” your points into an AA ticket.

Example: Chase Ultimate Rewards Portal

- AA flights are available at cash rates in the Chase Travel portal.

- With the Chase Sapphire Reserve, each point is worth 1.5¢; a $300 AA ticket costs 20,000 points.

- You’ll still earn AAdvantage miles and Loyalty Points for these bookings.

Hotel Program Transfers

You can convert hotel loyalty points into AAdvantage miles—but the ratios are generally poor value

| Hotel Program | Transfer Ratio | Minimum Transfer | Notes / Best Use |

|---|---|---|---|

| Marriott Bonvoy | 3:1 | 3,000 points | 60,000 Marriott Bonvoy → 20,000 AA miles, No bonus. |

| World of Hyatt | 2.5:1 | 5,000 points | Transfers in 1,250-point blocks (5,000 Hyatt → 2,000 AA miles). Great for small top-offs but poor value for large transfers. |

| IHG One Rewards | 5:1 | 10,000 points | Very low value — only use if you need a small amount to complete an award booking. |

| Best Western Rewards | 5:1 | 5,000 points | Very poor conversion rate; rarely makes sense. |

| Wyndham Rewards | 5:1 | 6,000 points | Low value; use only for topping off your balance. |

| Choice Privileges | 5:1 | 5,000 points | Same low-value problem; best avoided unless points are expiring. |

Practical Example: Marriott Bonvoy → AA Miles

- 60,000 Marriott Bonvoy → 20,000 AAdvantage miles (3:1), no bonus.

- transfer in multiples of 3,000 points (min 3,000; up to 240,000/day).

Unlike most partners—and unlike United’s 10k bonus—American AAdvantage doesn’t receive the 5k bonus on 60k-point Marriott transfers.

These options are best used only if you have excess hotel points you can’t use otherwise.

Transferring AAdvantage Miles Directly

You cannot transfer AAdvantage miles to other airlines or credit card programs.

Transfer Miles to Other AAdvantage Members

American Airlines lets you move miles from your account to another AAdvantage member’s account — but it’s not free. American cut its transfer fee in 2024. As of today, the price to transfer AAdvantage miles to another member is $5 per 1,000 miles (0.5¢/mile), in 1,000-mile increments, with no extra transaction fee.

Key details:

- Cost: $5 per 1,000 miles; example costs—10k = $50, 20k = $100, 50k = $250. AA’s own fees page shows “$0.005 per mile.”

- Limits: You can send up to 200,000 miles per calendar year and a member can receive up to 200,000; transfers must be in 1,000-mile chunks.

How to Transfer

- Log into your AAdvantage account on aa.com.

- Go to Buy, Gift & Transfer Miles under the AAdvantage menu.

- Select Transfer Miles, enter the recipient’s name and AAdvantage number, and choose the amount.

- Review fees and confirm payment.

Often, instead of transferring, it’s cheaper for you to book the award ticket from your account in the other person’s name (American allows you to book for anyone). This avoids the transfer fee entirely.

Earning & Redeeming Through Partner Airlines

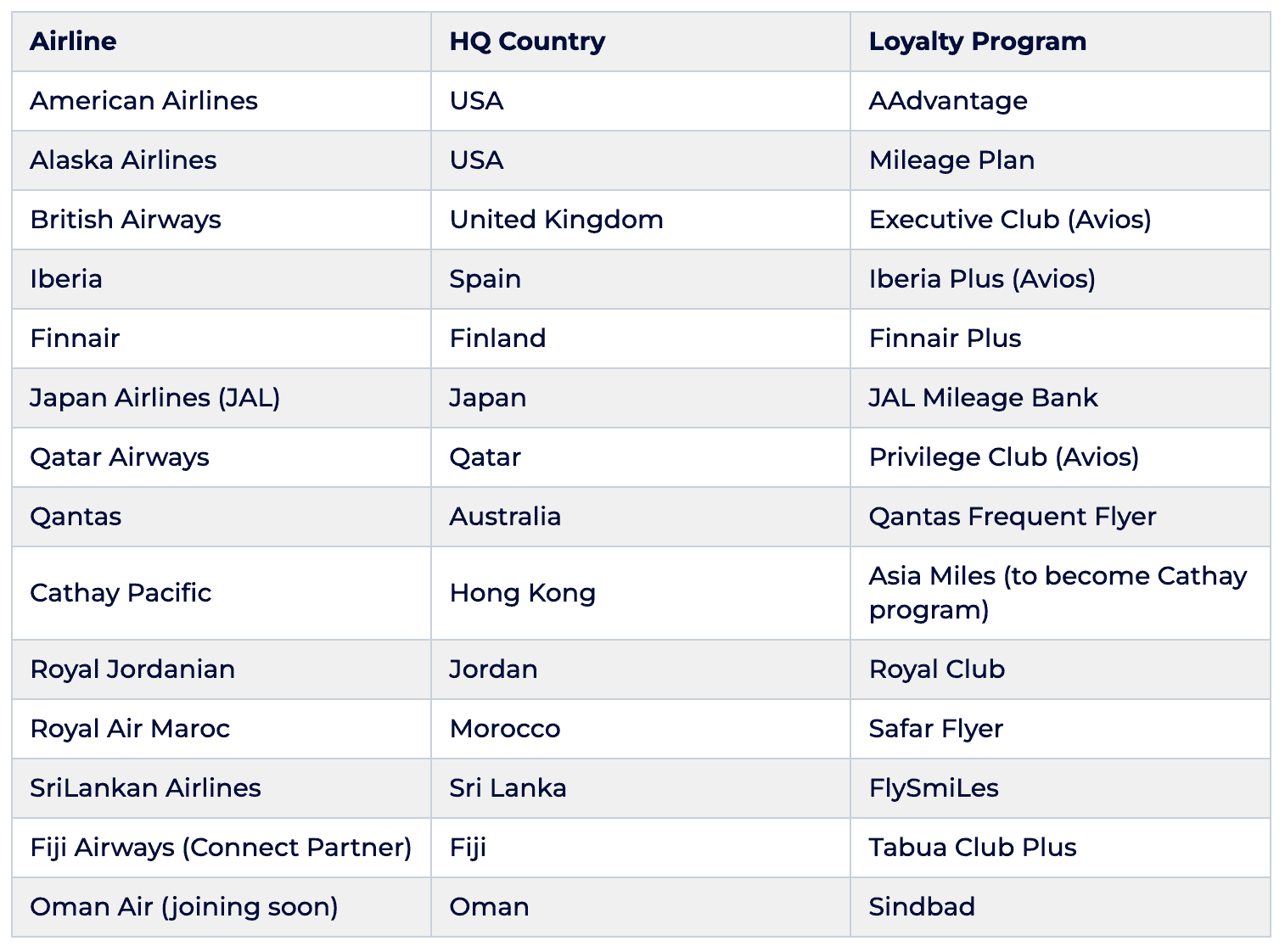

American Airlines is a member of the Oneworld alliance, which means AAdvantage miles can be used far beyond American’s own network. This opens up the ability to redeem miles for flights on well-regarded international carriers such as British Airways, Japan Airlines, Qatar Airways, Qantas, Cathay Pacific, and Finnair, as well as other partners like Alaska Airlines and Iberia. Availability varies by route and partner, so it’s always worth checking multiple booking channels to find the seats you want.

Earning points works the same way—when you fly with a Oneworld partner or select codeshare airlines, you can credit those flights to your AAdvantage account, provided the fare class meets the requirements. This is especially valuable for travelers who fly regularly with partner airlines but want to combine their rewards in one program.

By strategically using partner flights to both earn and redeem miles, you can increase the value of your miles and gain access to destinations not served by American.

Always verify award availability before transferring points—you can’t reverse credited transfers once they’re sent.

In Summary

To maximize AAdvantage miles, rely on Citi ThankYou as the primary transfer engine, but ignite your strategy with partner redemptions across Oneworld, and use flexible travel portal bookings when needed. Combine these with smart timing—always check award space before transferring and pool your miles carefully to unlock value.