Chase Sapphire Reserve vs. Capital One Venture X

PointsCrowd is a community-supported platform. When you apply for a credit card, make an order, or otherwise interact with the advertisers through the links on this page we may earn an affiliate commission. This helps us maintain and develop the platform further at no cost to you.

The Chase Sapphire Reserve and the Capital One Venture X are two of the most popular premium travel rewards credit cards on the market. Both offer lucrative travel perks like annual travel credits, airport lounge access, and points you can redeem for trips. However, they differ significantly in cost, complexity, and the type of traveler they best serve. In this comprehensive comparison, we’ll examine annual fees, benefits, rewards, application requirements, and more – including real user feedback from forums and social media – to help you decide which card is right for you.

At the end of the article, you can take a short quiz to determine which card is best for you.

Annual Fees & Key Credits

One of the biggest differences is the annual fee. The Sapphire Reserve recently increased its annual fee to $795 (up from $550), plus an additional $75-$195 fee per authorized user (AU). By contrast, the Venture X’s annual fee is $395, and authorized users are free (you can add up to four at no cost).

Both cards offer generous credits to offset these fees, but Chase’s package is far more extensive (and complex) than Capital One’s:

- Chase Sapphire Reserve ($795) – Comes with a $300 annual travel credit usable on any travel purchase (airlines, hotels, car rentals, etc.). On top of that, the refreshed Reserve is laden with multiple credits across different categories. For example, cardholders get up to $500 in “The Edit” luxury hotel credits (split into two $250 semiannual credits), a $300 annual dining credit (for exclusive Chase dining experiences via partner restaurants), and a $300 annual event ticket credit for StubHub/Viagogo. It also provides monthly or annual credits for services: e.g. DoorDash (up to $25 in credits each month), Lyft (up to $10/month), Apple subscriptions (up to $250/year), Peloton (up to $120/year), and a Global Entry/TSA PreCheck fee credit (up to $100 every four years). These perks can add significant value if you use them all, effectively offsetting much of the fee – but they require effort. A number of cardholders have criticized this “coupon book” approach, saying many credits are niche or hard to use. For a complete list of credits and terms, see the review article Chase Sapphire Reserve Revamp: 100K Bonus, New Perks, and a $795 Fee – What It Means for Travelers.

- Capital One Venture X ($395) – Offers a $300 annual travel credit as well, but only for bookings made through the Capital One Travel portal. This is a bit more restrictive, but many users find it easy to use for routine flights or hotel bookings. Venture X also gives 10,000 anniversary bonus miles each year (worth $100 towards travel). These two perks alone can fully offset the $395 fee (or even slightly exceed it) if utilized, which is why the net cost is often considered $0 or better. Unlike Chase, Capital One keeps it simple – aside from a Global Entry/TSA PreCheck credit (up to $100 every four years), Venture X doesn’t bundle a dozen smaller coupons. Many appreciate this simplicity.

| Feature | Chase Sapphire Reserve | Capital One Venture X |

|---|---|---|

| Annual fee | $795 | $395 |

| Primary travel credit | $300/yr usable on any travel purchase (airlines, hotels, car rentals, etc.). | $300/yr travel credit usable only via Capital One Travel portal. |

| Additional recurring credits | • The Edit luxury hotels: $500/yr (2×$250 semiannual) • Dining (exclusive experiences): $300/yr • Event tickets (StubHub/Viagogo): $300/yr • DoorDash: up to $25/mo • Lyft: up to $10/mo • Apple subscriptions: up to $250/yr • Peloton: up to $120/yr • Global Entry/TSA PreCheck: up to $100 every 4 years | • 10,000 anniversary miles/yr (≈ $100 toward travel) • Global Entry/TSA PreCheck: up to $100 every 4 years • No bundle of smaller monthly coupons |

| How the value feels | “Coupon-book” style bundle can offset much of the fee if you actively use the many credits. | Simple set of perks; $300 portal credit + 10k miles can fully offset (or slightly exceed) the fee for many users. |

Authorized Users (AU)

Authorized users work with these two cards differently.

Chase Sapphire Reserve

With Chase Sapphire Reserve, each additional card costs an extra $195 — it’s like paying a separate annual fee for each additional person. In return, the authorized user receives:

- ctheir own Priority Pass membership and can also visit Sapphire Lounges, usually with several guests, if they use Priority Pass.

- Global Entry/TSA PreCheck reimbursement by transferring the application fee to the account, although this credit is shared at the account level and is only renewed once every four years.

- travel protection, such as trip delay coverage or basic rental car insurance (the key point is that the relevant expenses are charged to the Reserve account; if your authorized user books a trip using the card, these protections generally extend to them as well).

Capital One Venture X

Capital One Venture X is popular because you can now add up to four (4) authorized users for free, and each one gets their own Priority Pass and access to Capital One Lounges, as well as the ability to activate Global Entry/TSA PreCheck credit on the joint account

It’s simple and convenient for families: give the card to your spouse or adult child, and they can enjoy the lounges just like you, with travel protection applying when their eligible trips are paid for with the Venture X account.

But on February 1, 2026, there will be one important change for Venture X. Authorized users will no longer receive complimentary lounge access by default.

If you want your authorized users to retain their lounge privileges after that date, you will be able to pay an annual lounge access fee of $125 per AU/year, and guest access will become more limited and partially paid, with a set fee for each guest of $35 for Priority Pass and $45 for Capital One Lounges (or $25 for individuals under the age of 17). Capital One will offer an exception for customers with very high spending: if the account reaches the $75,000 annual spending threshold in a calendar year, some complimentary guest benefits will be retained for the primary user and authorized users.

Until January 31, 2026, the current generous lounge system for authorized users remains in effect.

Practically speaking, if you travel with family or friends today, Venture X is an easier and cheaper way to share lounge access and protection among several people. After the changes in 2026, you will have to calculate how often your additional users actually visit lounges and whether it makes sense to pay extra for lounge access for additional users — or whether the Reserve model with payment for additional users and permanent Priority Pass access is better suited to your group, despite the higher cost of additional users (AU).

Rewards Earning & Welcome Bonuses

Both cards offer large sign-up bonuses and ongoing rewards on spending, though there are differences in how their points systems work:

Current Welcome Bonus

Chase Sapphire Reserve

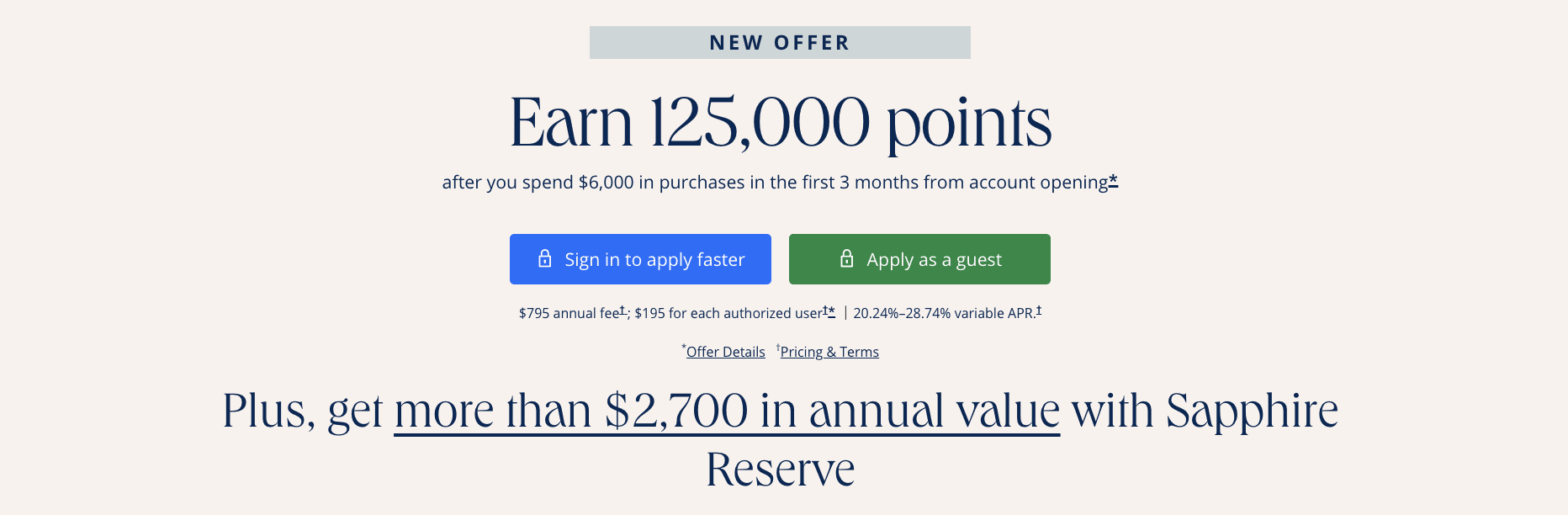

As of 2025, Chase is offering a hefty 125,000 Chase Ultimate Rewards points bonus on the Sapphire Reserve (after $6,000 spend in 3 months).

Capital One Venture X

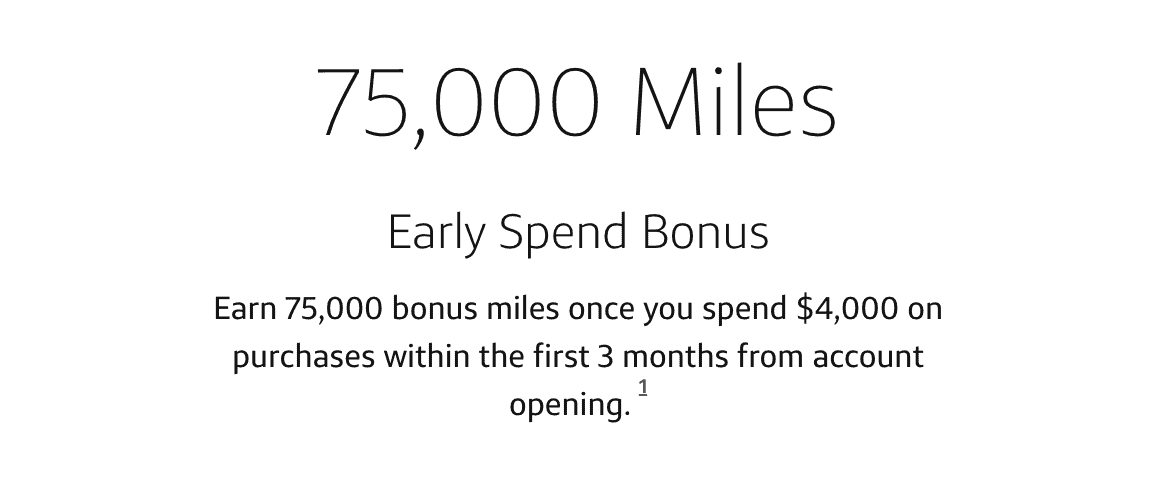

Capital One’s offer is 75,000 Venture miles on the Venture X (after $4,000 spend in 3 months).

In pure points, Chase’s bonus is larger – and because Chase points are valued a bit higher, it can be worth around $2,500+ in travel by some estimates. The Venture X’s 75k miles are worth about $750 toward travel if used at a penny per mile, or more if transferred to airlines (TPG’s valuation is ~$1,388 at ~1.85¢ per mile).

Keep in mind these bonuses can change, but historically the Reserve tends to have the bigger upfront offer – befitting its higher fee – while Venture X’s bonus, though smaller, is still very strong.

Earning Rates

The Sapphire Reserve and Venture X take different approaches.

Chase Sapphire Reserve

Chase Sapphire Reserve now has a tiered rewards structure with elevated rates in many categories.

You earn:

- 10X points on hotels, car rentals, and other travel bookings made through Chase Travel

- 5X on flights through Chase Travel (these portal rates apply after you’ve used up your $300 travel credit)

- 4X points for travel booked directly with airlines or hotels

- 3X for other travel and dining/restaurants

- 10X for Chase Dining booked through their platform

- 1X for all other purchases.

Capital One Venture X

Capital One Venture X makes everything easier, you get:

- 10X miles on hotels and car rentals booked through Capital One Travel,

- 5X on flights booked through the Capital One portal

- 2X miles on everything else.

If you prefer simplicity, Venture X wins – you can make any purchase and earn 2 miles for every dollar spent, as well as occasionally use the portal to get a 5–10x bonus on travel. With Sapphire Reserve, you’ll only earn 1 point per $1 on general purchases (not related to travel and dining), which is a relatively low return for a high-end card. Chase seems to assume that Reserve users will combine it with other Chase cards for everyday spending (such as Freedom Unlimited for 1.5X on everything). On the other hand, if you spend a lot on travel and dining, the Reserve’s 3-4X earnings in those categories may outweigh the Venture X’s 2X earnings.

For example, someone who travels frequently (outside of the portal) and dines out a lot may accumulate points faster with the Reserve’s bonuses.

Without loyalty to specific travel brands, Venture X wins with its fixed earnings, but if you value specific partner programs, such as Hyatt or Southwest (to which Chase points can be transferred), Reserve may pay off despite its complexity.

Point Redemption & Value

Earning points is only half the story – how you redeem them matters. Chase and Capital One both allow flexible point redemption, but with some differences.

With Sapphire Reserve, your points are worth 1.5 cents each on Chase Travel, and select Points Boost offers can increase their value to ~2.0 cents.

So, 50,000 points can cover $750 in travel (and sometimes $1,000 with a Boost offer).

Venture X miles are worth 1.0 cent each on Capital One Travel — 50,000 miles = $500 — but you can also cancel any travel purchase on your statement at the same 1.0 cent rate, so you’re not tied to the portal.

Chase can provide greater value within its system; Capital One offers simple and flexible options for using points anywhere.

Transfer partners

Chase has an advantage for many US travelers: it transfers points at a 1:1 ratio to United, Southwest, JetBlue, and, most importantly, Hyatt, where points are often worth more than 2 cents per point.

Capital One also has strong partners (e.g., Air Canada Aeroplan, Flying Blue, British Airways, Singapore, Emirates, Etihad, Turkish), as well as Wyndham and Choice for hotels, but it is weaker in major US brands and has no equivalent to Hyatt.

If you stay at Hyatt or fly United/Southwest frequently, Chase usually wins; Capital One can still be a great option for niche airlines (e.g., Turkish or Avios) with a little more strategy.

Ecosystem and Pooling

Chase allows you to pool points from your own cards (and your family members’ cards) and then redeem them through Reserve at 1.5× or transfer them to partners — this makes the Freedom/Reserve combination particularly powerful.

Capital One also allows you to transfer miles between certain cards and even to other people in limited circumstances, but since most transfers cost 1.0¢, pooling offers fewer additional benefits. For experienced users, the Chase ecosystem is generally more versatile.

Travel Benefits & Lounge Access

Both cards include Priority Pass Select for access to over 1,300 lounges.

With Sapphire Reserve, Priority Pass also works at participating airport restaurants for a small food credit ($28 credit at certain airport eateries).

| Chase Sapphire Reserve (CSR) | Capital One Venture X (VX) | |

|---|---|---|

| Priority Pass | Included; also works at participating airport restaurants (dining credit). | Included; generally no restaurant credit advertised. |

| Issuer lounge network | Chase Sapphire Lounges (small network so far: BOS, LGA, AUS terrace). Also Maple Leaf Lounge access in some cases when flying Air Canada/Star Alliance. | Capital One Lounges at DFW, DEN, IAD (expanding). Widely praised for food, drinks, showers, even fitness areas. |

| Lounge entry & guests | Priority Pass is the main value; practical for most airports. | Unlimited entry for cardholder + 2 guests at Cap One Lounges; great if you often pass a Cap One location. |

| Global Entry / TSA PreCheck | Reimburses up to $100 every 4 years; one card can cover multiple family applications (credit is per account, per 4-year period). | Same: up to $100 every 4 years; can charge different family members’ fees to trigger the credit. |

| Rental car status | National Emerald Club Executive (plus perks with Avis/Silvercar; National discount). | Hertz President’s Circle for the primary cardholder. |

| Primary rental car insurance (CDW) | Yes—primary coverage when you pay with CSR. | Yes—primary coverage when you pay with VX. |

| Trip delay coverage | Up to $500 per person for 6+ hour (or overnight) delays. | Up to $500 per person for 6+ hour (or overnight) delays. |

| Trip cancellation / interruption | Up to $10,000 per person ($20,000 per trip) on prepaid, nonrefundable costs. | Up to $2,000 per person (lower ceiling than CSR). |

| Emergency medical evacuation | Up to $100,000—strong safety net for international/remote travel. | Not advertised as a comparable benefit. |

| Luggage & purchase protections | Robust Visa Infinite-level protections (lost/delayed baggage, purchase protection, extended warranty). | Similar robust protections (Visa Infinite). |

| Cell phone insurance | No built-in cell phone coverage. | Yes—up to $800/claim (with deductible) when you pay your phone bill with VX. |

| Foreign transaction fees | None | None |

| Authorized users & sharing perks | AUs cost extra; they get Priority Pass but don’t duplicate the primary’s statement credits. | Up to 4 AUs free; each AU gets their own lounge access and can help use the GE/PreCheck credit (terms can evolve). |

Each issuer also has its own lounges:

- Chase has a small but growing network of Sapphire Lounges (e.g., BOS, LGA, AUS terrace) and even Maple Leaf Lounges if you fly Air Canada or Star Alliance.

- Capital One lounges, currently located at DFW, DEN, and IAD airports, receive high marks for food, drinks, and amenities, and Venture X cardholders can visit them an unlimited number of times and bring two guests.

Global Entry / TSA PreCheck

Each card reimburses the application fee (up to $100 every four years). That’s standard at this tier and handy if you haven’t enrolled yet. One card per household is usually enough, since you can charge different family members’ application fees to trigger the credit.

Rental cars and on-the-ground perks

Sapphire Reserve includes National Emerald Club Executive status and perks with other rental brands, while Venture X confers Hertz President’s Circle for the primary cardholder. Both cards provide primary rental car collision coverage when you pay with the card, so you can skip the agency’s policy in most cases.

Travel protections and insurance

For delays, both cover reasonable expenses after a significant holdup (typically $500 per person for 6+ hours or an overnight). The big split is trip cancellation/interruption: Sapphire Reserve covers up to $10,000 per person ($20,000 per trip) on prepaid, nonrefundable costs, while Venture X is capped around $2,000 per person. Reserve also includes up to $100,000 in emergency medical evacuation coverage—a rare and valuable safety net for international or remote travel. Venture X doesn’t advertise a similar evac benefit but does add built-in cell phone insurance if you pay your monthly bill with the card. For most routine trips, both cards have you covered; for pricey itineraries or worst-case scenarios, Reserve’s protections can be worth far more.

Application Requirements & Approval Odds

Premium cards can be hard to get. Chase and Capital One each have specific rules and criteria for approvals:

- Credit rating and profile: Both cards require an excellent credit rating. In practice, this means that it is recommended to have a FICO score of at least 700 (many approved applicants have scores between 740 and 800+). Some experts indicate that you need to have an excellent credit history of at least two (2) years.

- Chase’s 5/24 rule: Chase will not approve most applications if you have opened 5 or more new credit cards in the last 24 months (Chase uses to decide includes personal cards from other banks too). Capital One does not have a published rule such as 5/24, but there is unofficial data that they also prefer fewer recent accounts.

- One Sapphire Rule & 48-Month Bonus Rule (Chase): Previously, Chase’s policy was to not have more than one Sapphire card at a time. However, this rule was abolished in June 2025, along with the 48-month bonus rule, and replaced with a lifetime bonus rule (i.e., you can have multiple Sapphire cards, but you can only claim the welcome bonus for each specific card once in your lifetime).

- Capital One’s Application Rules: Capital One usually pulls all three credit bureaus when you apply (so it’s a triple inquiry). Officially published restriction: existing or former cardholders are not eligible for the new cardholder bonus if they have received such a bonus within the last 48 months. We have also compiled a few unofficial rules reported by various travel experts. Here they are: Do not approve more than two personal cards at a time. Only one new card every 6 months — if you have recently received a Capital One card, you may have to wait at least six months. Preference is given to applicants with higher income and a credit history of at least several years (2–3+ years). Preference is given to customers who demonstrate that they have a balance in their account from time to time.

Before applying, make sure your credit reports are not blocked (Capital One almost always declines if it cannot obtain one of your reports). And if you are applying for Reserve, calculate your 5/24 status in advance (have you opened more than five new credit cards in the last two years?).

Which Card is Right for You?

Chase Sapphire Reserve and Capital One Venture X are two great travel cards, but they are designed for slightly different audiences and travel styles.

Choose Chase Sapphire Reserve If

You travel frequently or enjoy earning travel rewards, aren’t afraid to combine multiple benefits, and want access to the highest benefits. The Reserve is ideal for those who want to get the most out of their travel—you transfer points to frequent flyer programs, stay at Hyatt hotels, or use airline miles frequently, and you value premium protection. If you are someone who squeezes every last drop of value out of your travel, travels enough to visit different lounges, and will use the included credits, then this card is a true fit for your lifestyle. Another aspect: if you already have a set of Chase cards (Freedom, etc.), Reserve is the key that unlocks their full potential through point transfers and a 1.5x multiplier on the Chase portal.

Some users openly criticize Chase’s new benefits structure as “high-priced and coupon-book mentality,” which makes it seem like they’re trying to force their opinion on you. Don’t buy Reserve hoping you’ll change your habits to use the credits — buy it because it fits how you already travel and spend your money. And note: if you travel frequently with a companion or family, factor in the $195 AUD fee if you want them to enjoy all the benefits too; for some, this is a deal breaker.

Choose Capital One Venture X If

You want a premium travel card that is easy to use, requires no special maintenance, and provides solid value without high out-of-pocket costs. The net fee for Venture X is effectively $0 after all credits are used. It’s great for moderate travelers, families, or those who want to simplify their lives. If you travel several times a year, Venture X covers your lounge visits (for you and your family), provides $300 for travel (you’ll probably spend that amount on annual flights or hotels anyway), and rewards all your everyday purchases at 2x. It’s very loyal if you don’t want to optimize categories — you still get good reward for all your spending.

Venture X provides most of the important bonuses (lounge access, Global Entry credit, travel credit, solid earning rate) at half the price. Venture X is also great for those who fly from Capital One Lounge airports or value Priority Pass with family access. You can sign up for the Venture X card and forget about it, unlike the Reserve, where you have to remember to use various credits or you’ll lose some of the value. With Venture X, if you book a trip through the portal every year (to use the $300 credit) and keep the card to earn 10,000 miles annually, you’re winning. You feel less pressure to “get your money’s worth” every month.

Venture X is not as beneficial for those who optimize points. If you like to look for great ways to use your rewards, you may sometimes find Capital One’s reward system limiting. For example, if you primarily stay at Marriott or Hyatt hotels, your Venture miles cannot be transferred to those hotels (whereas Chase points give you the option to get free nights). Or if you value first-class flights on certain airlines, Chase has partners like United and Virgin Atlantic that Capital One does not. Therefore, frequent travelers with specific loyalty programs may prefer Reserve.

Assess how you travel: Do you see yourself staying at luxury hotels with The Edit, squeezing the most out of every partner point (Chase), or do you prefer practical rewards with automatic value and a simple plan of action (Capital One)?

The choice will become clear when you select a card that fits your lifestyle.

To quickly determine which credit card is best for you, we suggest you take the following survey and see the results.

Which card fits you better: Chase Sapphire Reserve or Capital One Venture X?

Choose option A or B for each question, then click “Show result.”